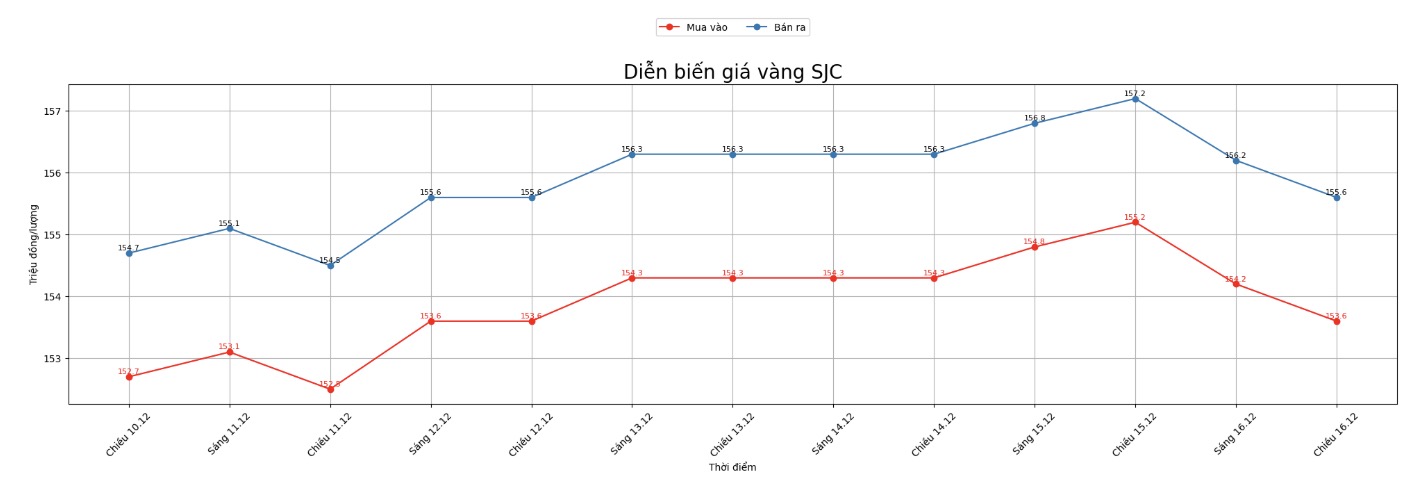

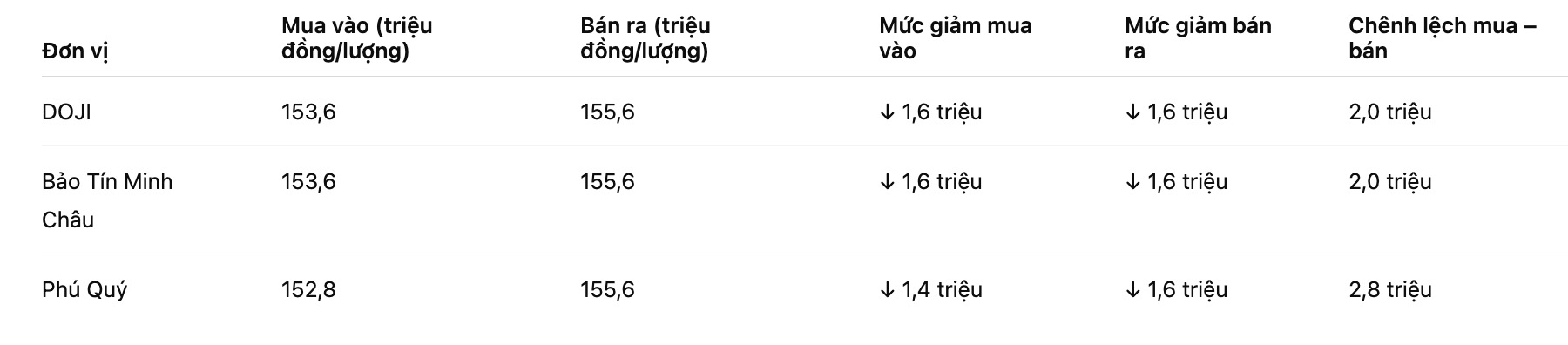

SJC gold bar price

As of 6:00 p.m., DOJI Group listed the price of SJC gold bars at 153.6-155.6 million VND/tael (buy in - sell out), down 1.6 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.6-155.6 million VND/tael (buy - sell), down 1.6 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 152.8-155.6 million VND/tael (buy - sell), down 1.4 million VND/tael for buying and down 1.6 million VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

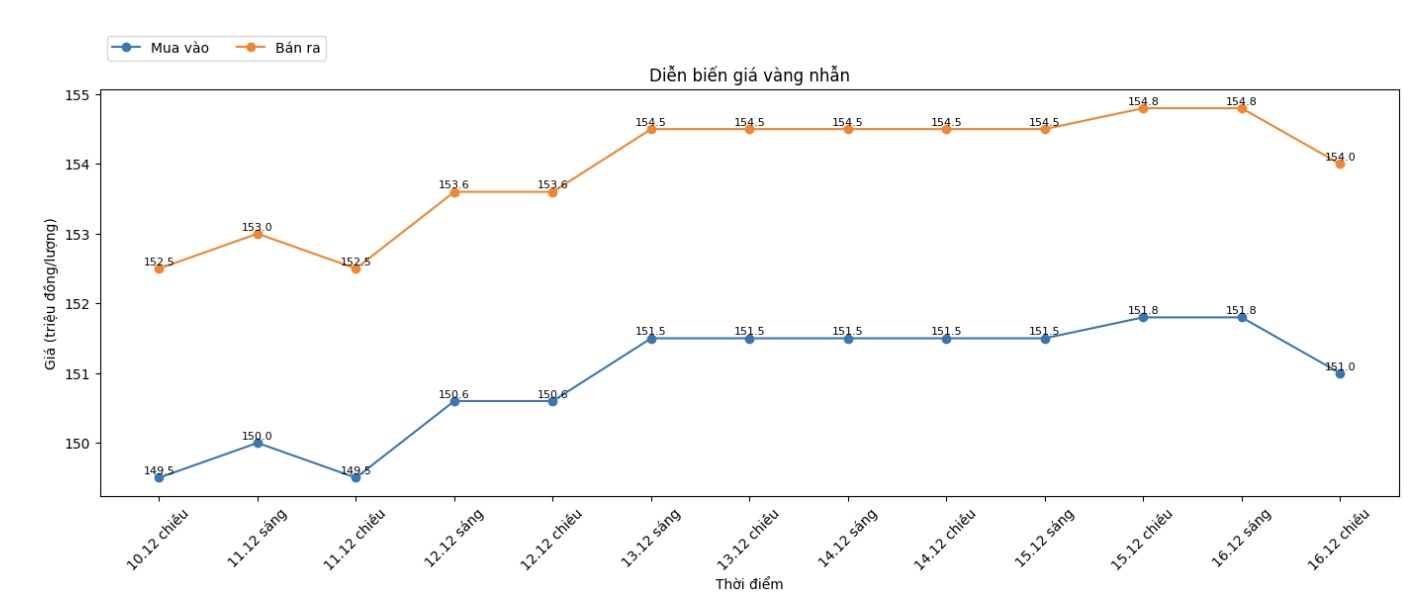

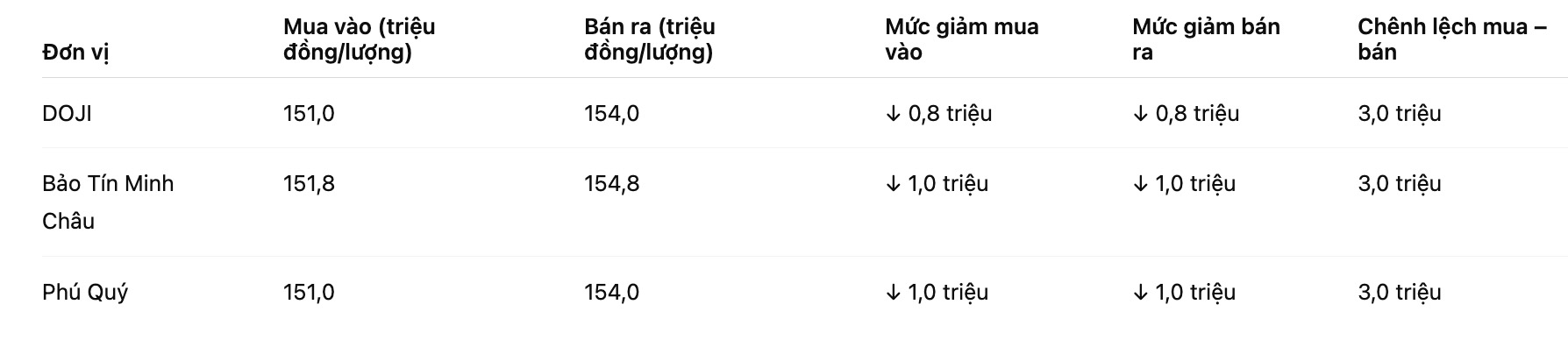

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.8-154.8 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

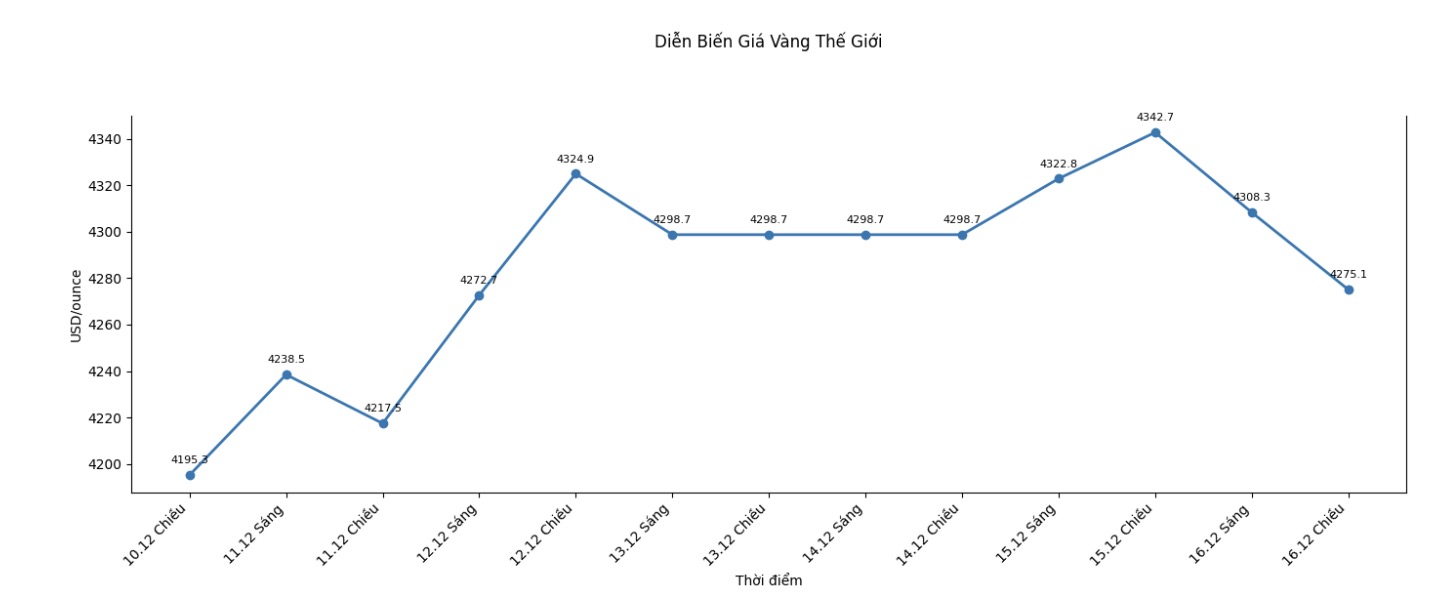

World gold price

The world gold price was listed at 6:07 p.m., at 4,275.1 USD/ounce, down 67.6 USD compared to a day ago.

Gold price forecast

Gold prices turned down due to profit-taking activities and short-term futures traders liquidating buying positions. Meanwhile, silver still maintained most of the strong gains achieved in the overnight session.

Some reports say that peace talks related to the Russia-Ukraine conflict may be making further progress, thereby reducing risk-off sentiment in the market in general and putting pressure on gold prices. Some sources said that the recent negotiations in Berlin have recorded new steps forward.

On the eve of the new year, analysts at Societe Generale (a French multinational banking and financial services group, one of the largest banks in Europe) said they continue to hold a 10% stake in the multi-asset portfolio.

The French bank kept its gold allocation unchanged as it reduced the share of US anti-inflation bonds to zero and cut the share of corporate bonds by half to 5%.

In a year when the fixed income market faced many difficulties and the weakness of the USD reduced the common currency yield of USD-denominated assets, the SGMAP portfolio still operated well thanks to balanced allocation.

The theme of expanding performance between our assets is clearly reflected in the developments of many stock markets as well as other assets such as gold. In the coming time, we expect this expansion trend to continue in the context of falling interest rates in the US" - analysts said in the latest report.

Analysts reiterate their forecast of gold prices reaching $5,000/ounce by the end of next year.

individuals continue to diversify their assets and increase their holdings of gold through gold bars, gold bars and ETFs.

We recommend buying when prices are adjusted, because un branched central banks will continue to diversify reserves, reduce their dependence on USD-denominated assets, and because gold provides effective protection against many risks (including the possibility of the Fed switching to a more dovish stance after a change in senior personnel)" - the report stated.

Company Generale maintains an optimistic view on gold as it expects the US Federal Reserve (Fed) to implement a strong monetary easing policy. The bank expects inflationary pressures to ease next year, but risks in the US labor market are rising.

See more news related to gold prices HERE...