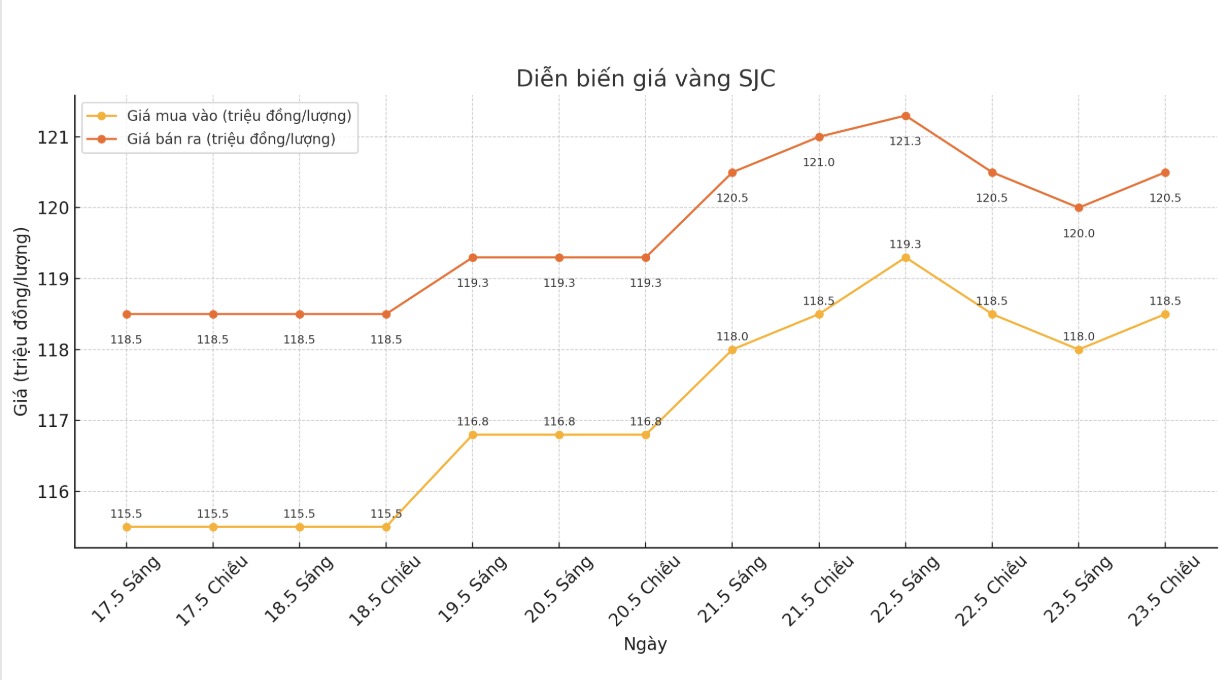

Updated SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.5-120.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

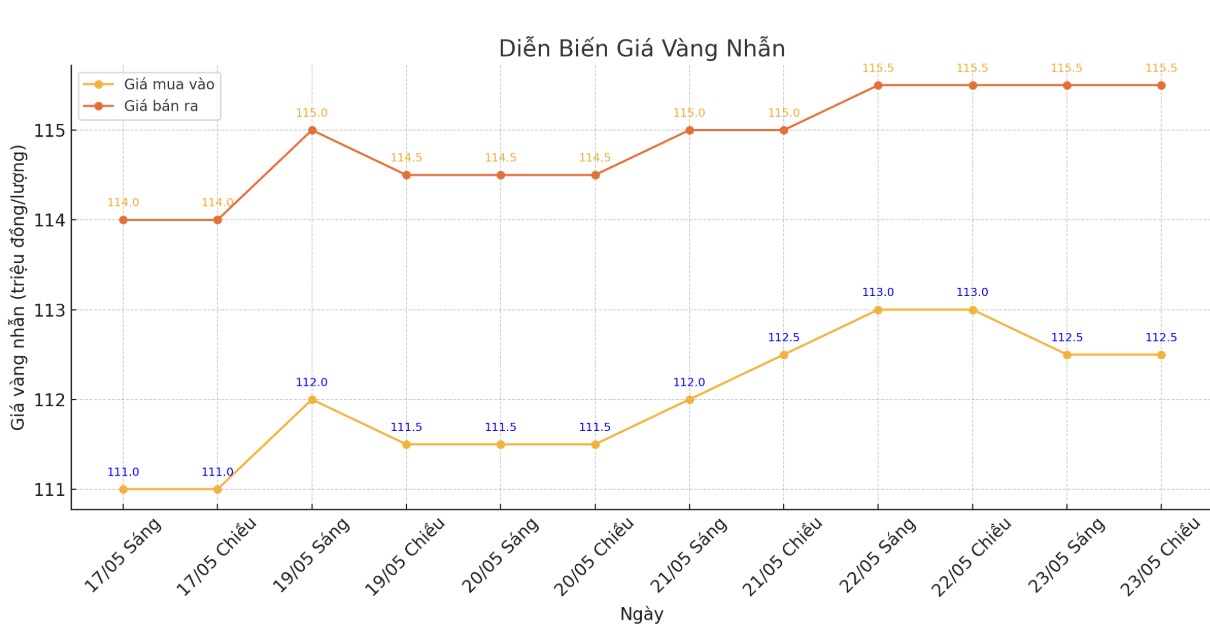

9999 round gold ring price

As of 7:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-125.5 million VND/tael (buy - sell), down 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

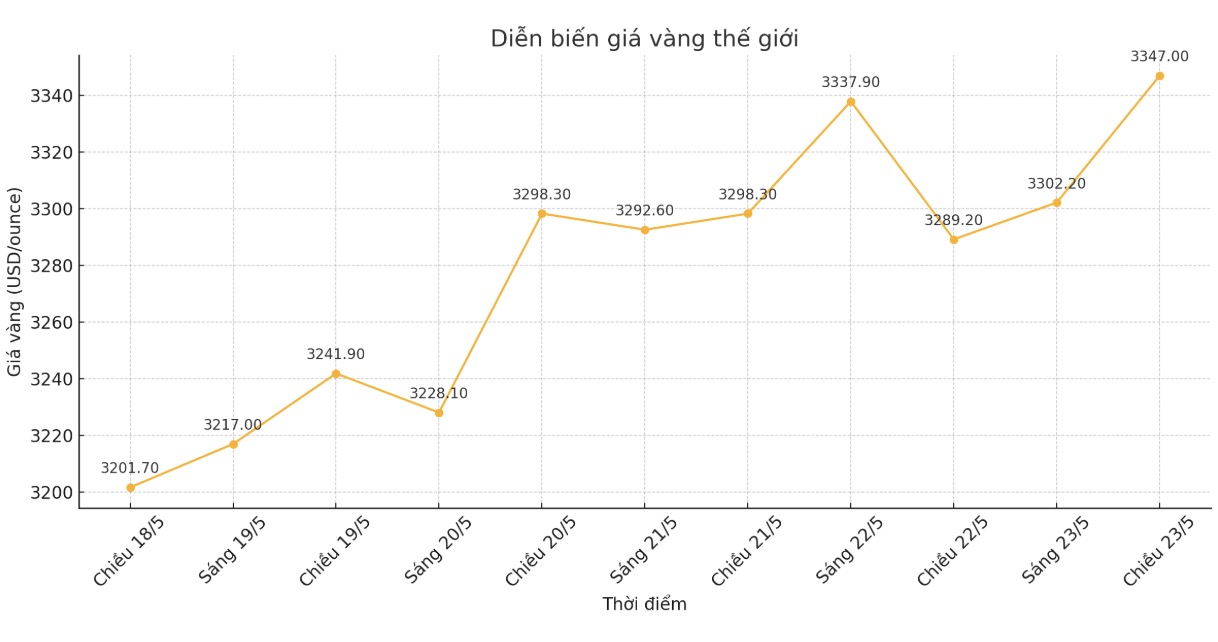

World gold price

At 6:15 p.m., the world gold price listed on Kitco was around 3,347 USD/ounce, up sharply by 57.8 USD/ounce.

Gold price forecast

Gold prices are receiving great support from Chinese investors. Demand from the continent is pushing the precious metal closer to its historical peak last month.

According to Kitco, China imported the highest amount of gold last month in nearly a year, despite gold prices reaching a record of 3,500 USD/ounce.

Total imported gold volumes reached 127.5 tons, the highest level in 11 months, up 73% compared to March, although gold prices were at a very high level at that time.

The import increase is partly due to the People's Bank of China (PBoC) granting additional import quotas to a number of commercial banks in April, in order to meet strong demand from institutional and individual investors in the context of peak US - China trade tensions.

The buying momentum shows no signs of slowing down. The Chinese gold market continued to support gold prices this month. After a few weeks of unusual weakness, it was Chinese investors who stood up to hoard gold when prices fell, pulling gold back to above 3,300 USD/ounce.

Stephen Innes - Head of Trading and Market Strategy at SPI Asset Management - said: "oldman's cash flow monitoring shows that the Shanghai night-time trading session has become bustling again, triggering a simultaneous purchase on COMEX".

Mr. Innes also emphasized that the number of open positions on the Shanghai exchange has reached a historical peak, with gold and silver prices both increasing sharply, respectively +3% and +4%. This shows a clear and strong consensus in the market.

He also commented on the steadfastness of domestic Chinese traders: Although gold prices have fallen 8% compared to the recent peak, they are still not selling off. This is not a trend but a solid trust. As the physical price difference between the Shanghai Gold Exchange (SGE) and the LBMA surges, global demand is activated again."

In a newly published report, Ms. Imaru Casanova - portfolio manager of VanEck Gold and Precious metals Fund said that in this new accumulation period, gold is building a solid foundation above $3,000/ounce. She also stressed that a slight decline from the record high of $3,500/ounce last month was normal and not a concern.

Regarding gold's upward momentum, commodity analysis group VanEck predicts prices could reach $4,000/ounce in 2025.

Gold is in a good position to continue its upward momentum, especially as more and more Western investors return to the market. tariffs, prolonged inflationary pressures and geopolitical risks will further strengthen gold's appeal as a hedge against market volatility risks," experts said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...