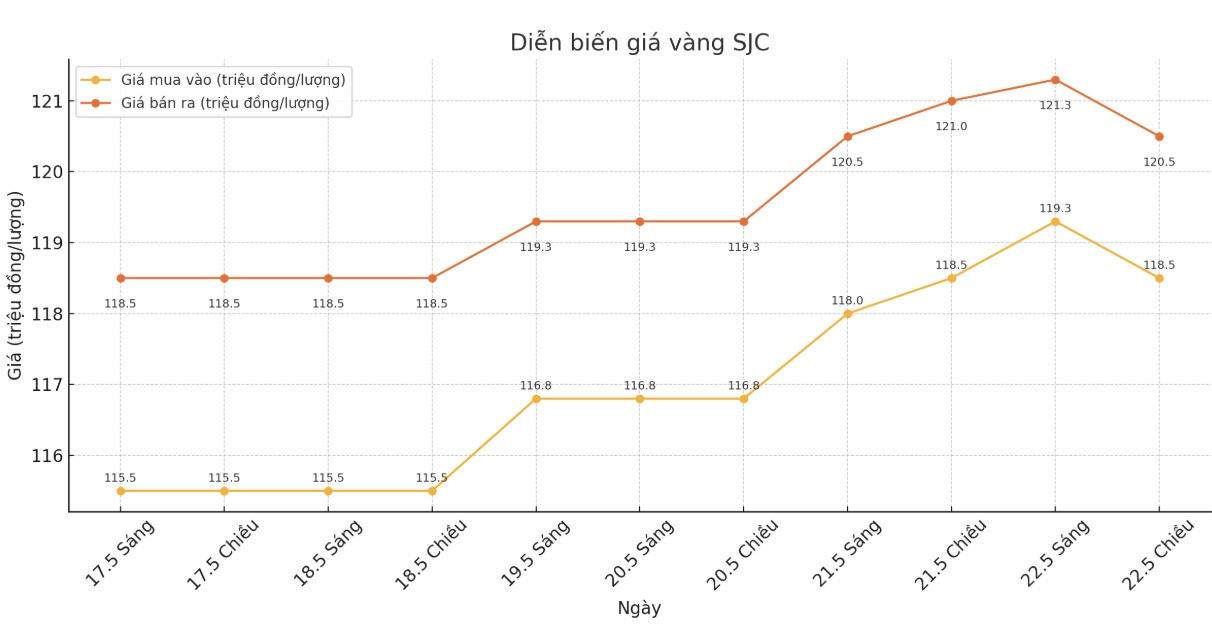

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), unchanged for buying and down VND 500,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy - sell), unchanged for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy - sell), keeping the same for buying and decreasing by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.8-120.8 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

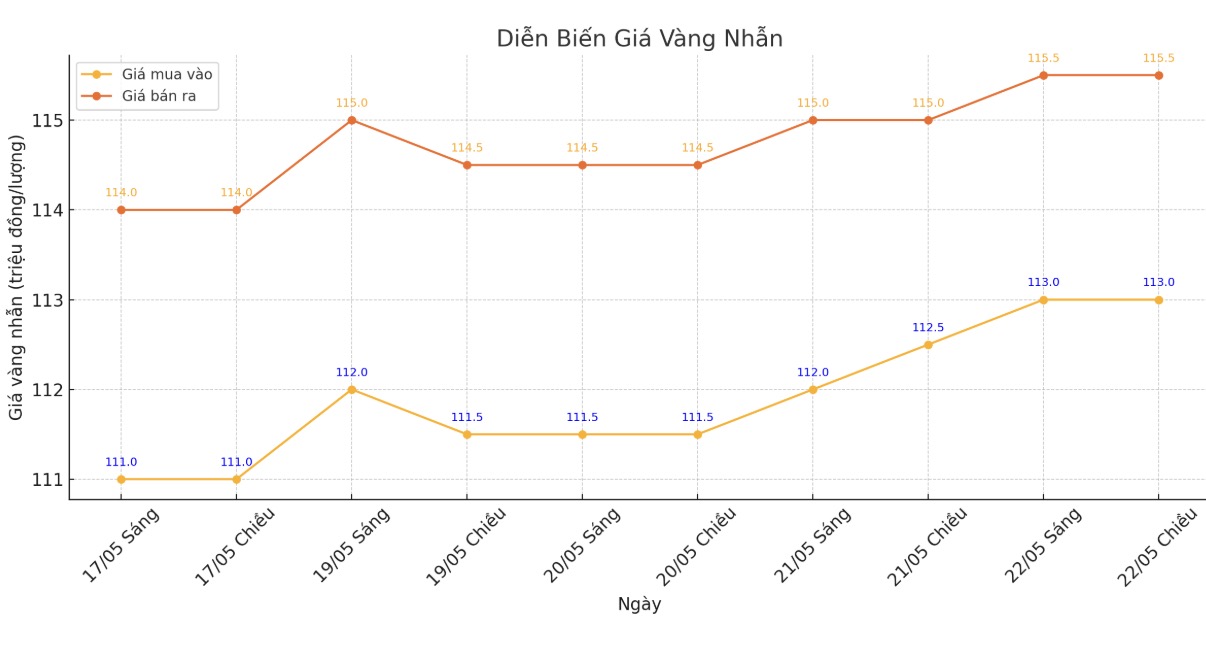

9999 round gold ring price

As of 6:15 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113-125.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.8-117.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

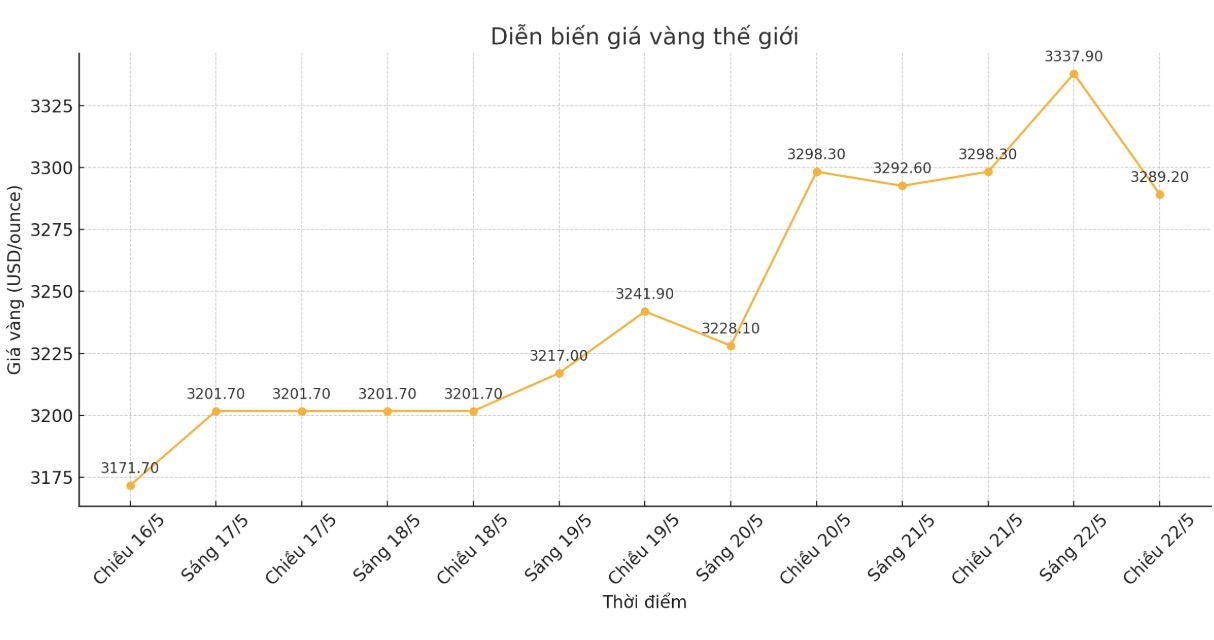

World gold price

At 6:15 p.m., the world gold price listed on Kitco was around 3,289.2 USD/ounce, down 9.1 USD/ounce.

Gold price forecast

According to Reuters, gold prices received support as concerns about the burden of public debt and the financial prospects of the US Government caused investors to seek this safe asset.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - commented: "Investors are concerned about the US public debt situation. The gold rally began last week after Moody's downgraded its credit rating and continues this week as we approach the decision on a major tax bill."

He also added that the stock market and the US dollar are both weak, making the gold price adjustment in the past few weeks almost over.

Last week, Moody's downgraded a US national credit rating due to concerns about debt to up to 36,000 billion USD.

In addition, the US Treasury Department's 20-year bond issuance session worth $16 billion on Wednesday faced weak demand from investors, reducing confidence in the Wall Street market.

In addition, concerns about the US public debt increasing by thousands of billions of USD if the Congress passes the tax cut bill proposed by President Donald Trump also put pressure on investor sentiment.

In the context of political and financial instability, gold is often considered a safe price holding channel.

The US dollar index is near a two-week low, making gold more attractive to investors holding other currencies.

Donald Trump's major tax and spending bill has taken a turn as the US House of Representatives voted on the side of the Party to open the debate, and a final decision is expected this morning.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...