The US and China's agreement to sharply reduce tariffs and temporarily suspend trade tensions for 90 days has caused investors to turn to risky assets, reducing the attractiveness of gold - a traditional risk-off asset.

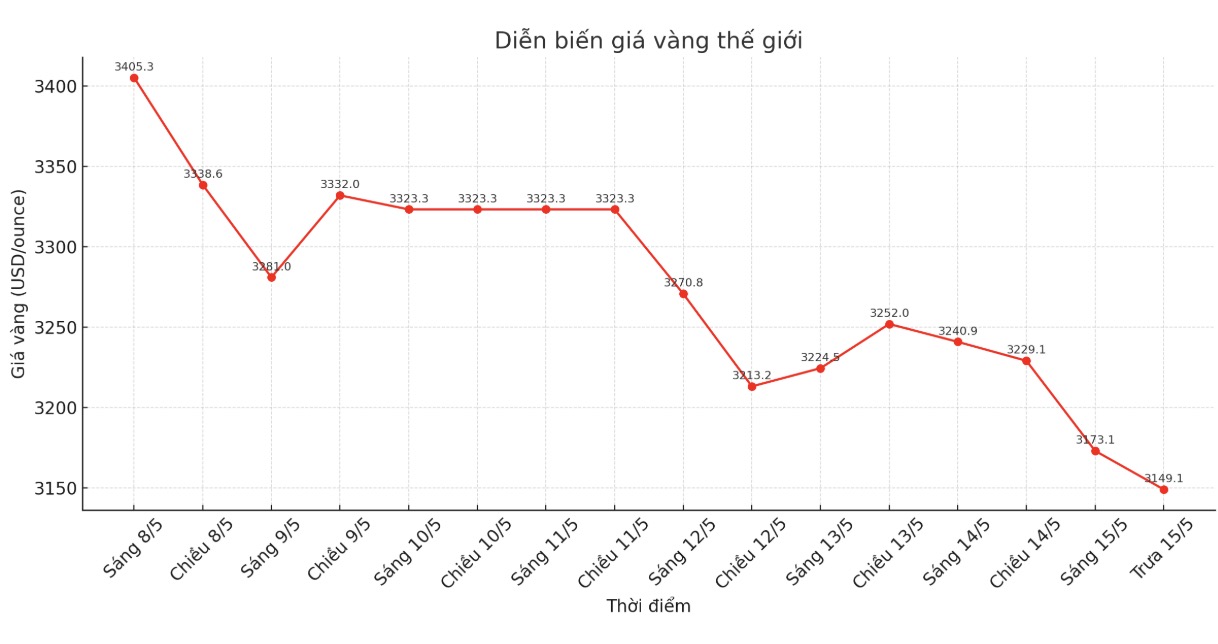

Brian Lan - CEO of GoldSilver Central in Singapore - commented: "The $3,150/ounce mark is the next important threshold, if this level cannot be maintained, the price could fall to $3,100/ounce".

Investors are also focusing on the day's speech of Federal Reserve Chairman Jerome Powell to find more signals about monetary policy.

The previously released CPI data was weaker than expected, leading the market to believe that the Fed could start cutting interest rates by 50 basis points from October, instead of July as previously forecast.

Gold often benefits in a low interest rate environment because it does not generate yields.

Currently, the market is paying attention to the US Producer Price Index (PPI) data, scheduled to be released at 7:30 p.m. (Vietnam time).

Meanwhile, silver prices fell 0.7% to 31.98 USD/ounce; platinum prices increased 0.5% to 980.35 USD/ounce and palladium prices increased slightly by 0.1% to 951.90 USD/ounce.