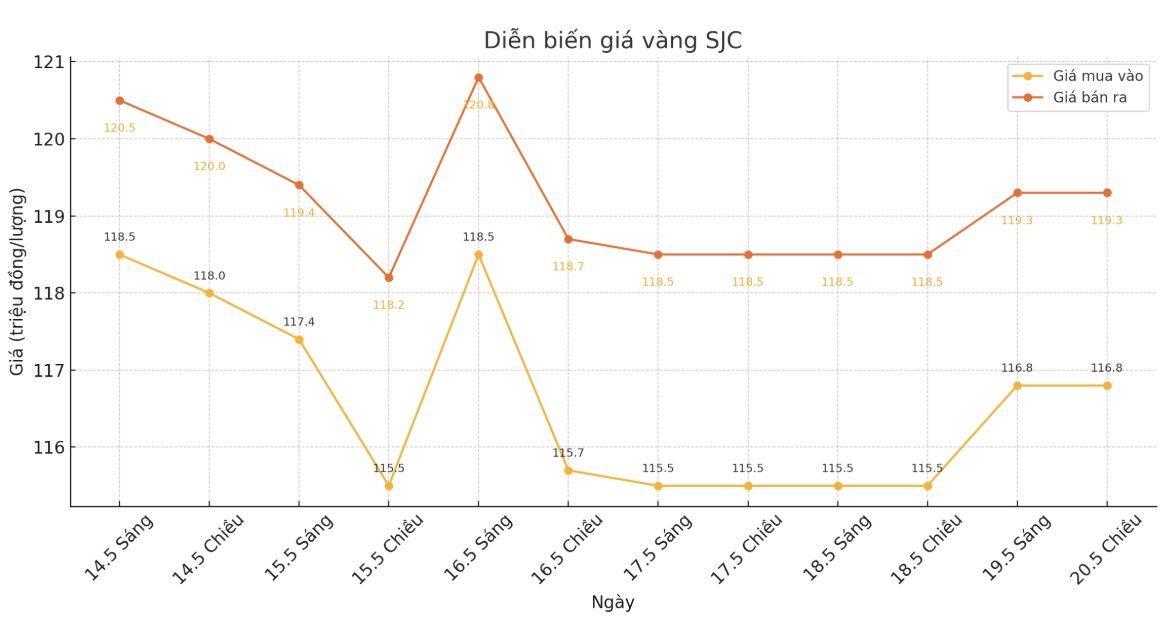

Updated SJC gold price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 116.8-19.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars listed by DOJI Group was at 116.8-119.000 VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 116.3-119.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

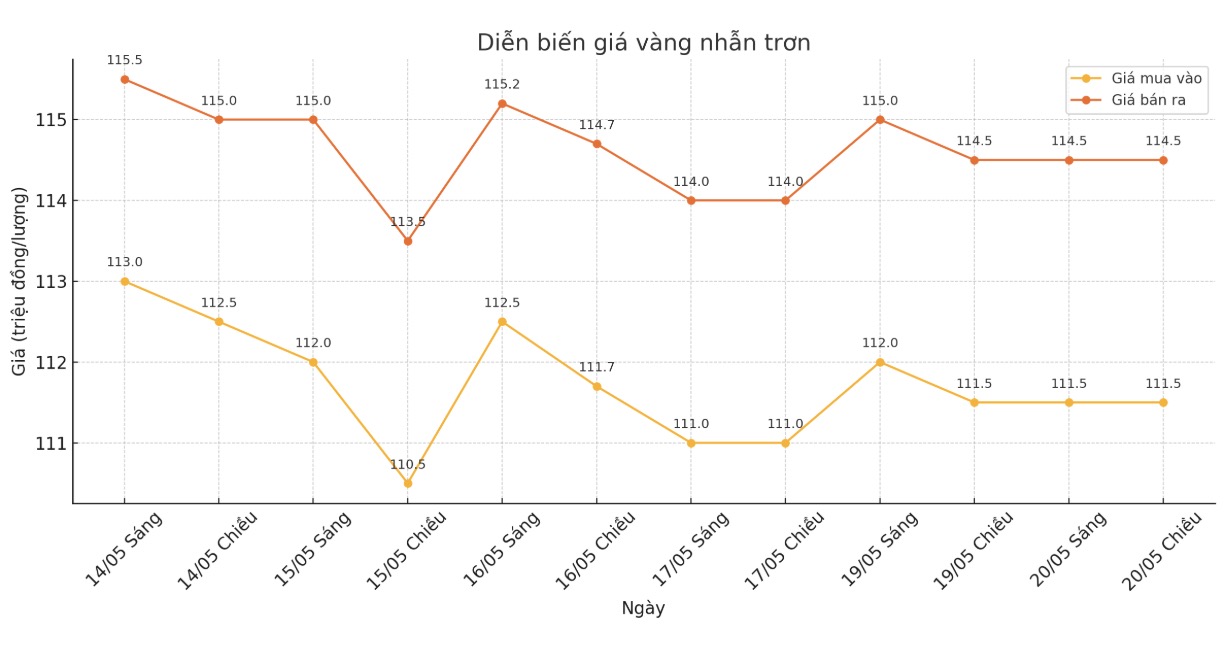

9999 round gold ring price

As of 6:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.8-116.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

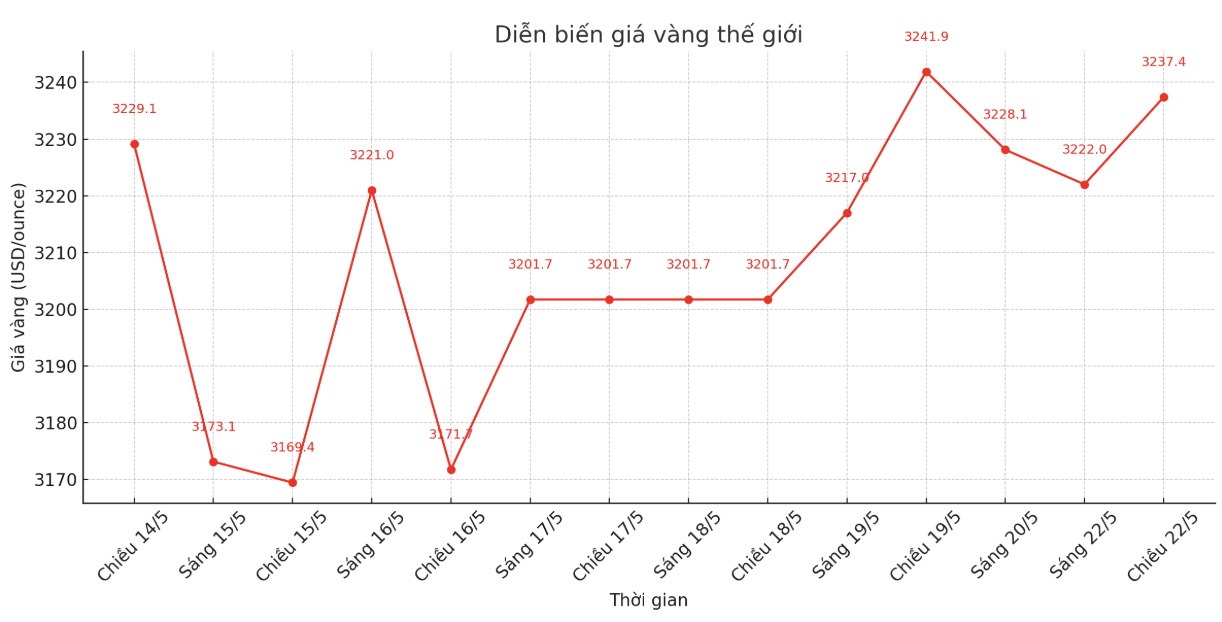

World gold price

At 6:05 p.m., the world gold price listed on Kitco was around 3,237.49 USD/ounce, down 4.5 USD/ounce.

Gold price forecast

According to Reuters, gold prices are under pressure as expectations of a ceasefire between Russia and Ukraine reduce safe-haven demand.

Capital.com's financial market analyst, Kyle Rodda, said: "We are seeing an immediate reaction to the decline in US credit rating, and at the same time, there is hope for a peace deal between Ukraine and Russia".

US President Donald Trump had a phone call with Russian President Vladimir Putin on Monday and said Russia and Ukraine would immediately begin talks towards a ceasefire.

Buyers began to show up as prices fell below $3,200 an ounce, Rodda added. However, I think gold could endure a bigger correction, especially as geopolitical risks ease and the pressure to increase yields from US fiscal policy increases.

The US Federal Reserve (FED) officials are assessing the impact of the US government's downgrading of the credit rating, in the context of the market continuing to face many economic uncertainties.

Many Fed officials are scheduled to speak today, possibly providing more information on the economic situation and monetary policy orientation.

On May 16, Moody's downgraded US credit rating from Aaa to Aa1, citing public debt and interest rates as much higher than in countries with equivalent credit.

In a recent note, Goldman Sachs maintained its gold price forecast at $3,700/ounce by the end of this year and $4,000/ounce by mid-2026, despite the Fed's delay in interest rate cuts and lower risks of economic recession in the US.

Meanwhile, senior market analyst Nikos Tzabouras of Tradu.com said that gold's appeal as a safe haven has rapidly increased due to concerns about US debt. Increased risk-off sentiment and a weak US dollar have helped gold recover after its worst week of the year, opening up the opportunity to hit a new record high, Tzabouras said.

In another development, gold purchasing power in India remained strong despite sharp price declines in May. Consumers are focusing more on gold bars, coins and investment gold products.

According to Kavita Chacko - Director of Indian Research at the World Gold Council (WGC), demand for gold in India in April was generally quite gloomy as the holiday season took place in opposite directions, accompanied by large withdrawals from ETF funds, but gold imports still maintained their resilience.

See more news related to gold prices HERE...