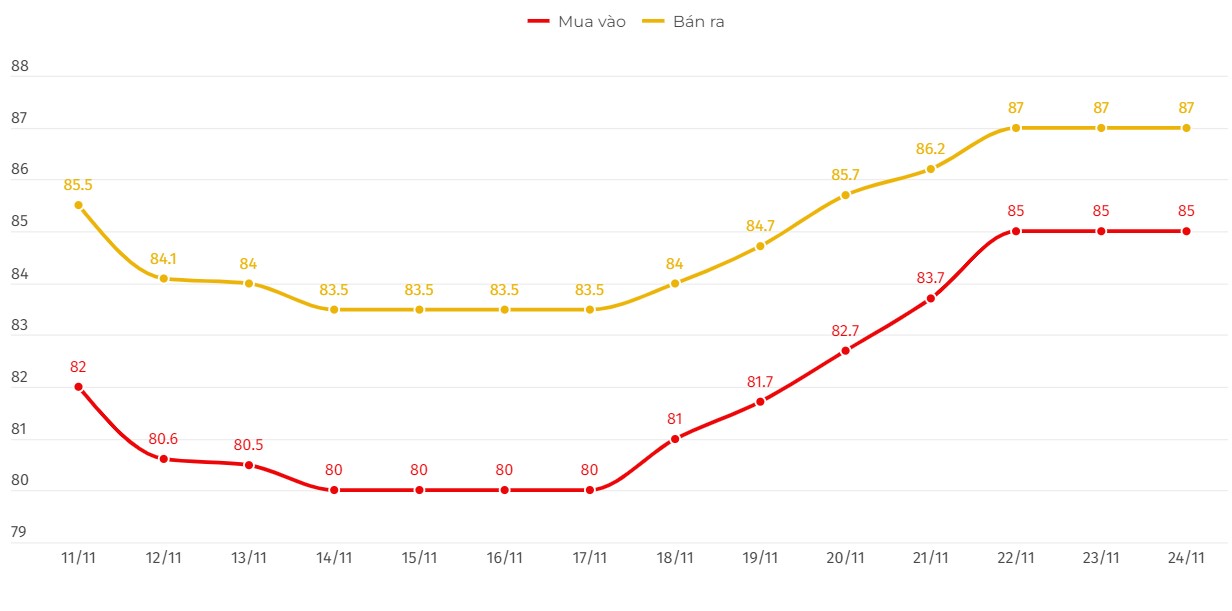

Update SJC gold price

At the end of the weekly trading session, DOJI Group listed the price of SJC gold bars at 85-87 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at DOJI increased by 5 million VND/tael for buying and increased by 3.5 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 85-87 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session, the price of SJC gold bars at Saigon Jewelry Company increased by VND5 million/tael for buying and VND3.5 million/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

If you buy SJC gold at DOJI Group on November 17 and sell it today (November 24), investors will earn 1.5 million VND/tael. Similarly, those who buy gold at Saigon SJC Jewelry Company will also earn 1.5 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say this difference is very high, causing investors to face the risk of losing money when investing in the short term.

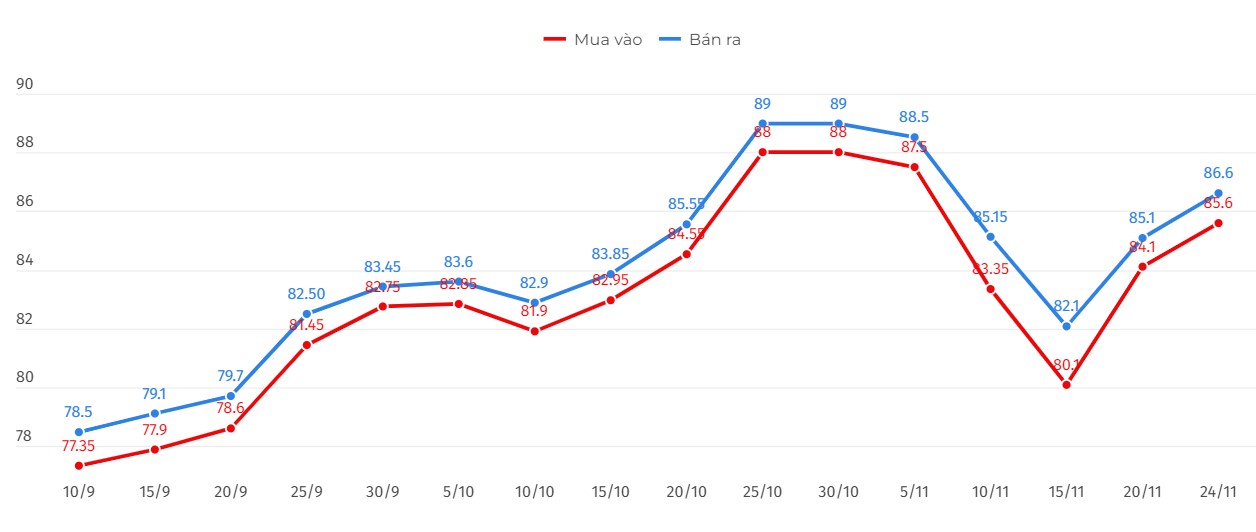

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.6-86.6 million VND/tael (buy - sell); an increase of 4.6 million VND/tael for buying and 3.9 million VND/tael for selling compared to the closing price of last week's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.63-86.58 million VND/tael (buy - sell); an increase of 4.6 million VND/tael for buying and 3.9 million VND/tael for selling compared to the closing price of last week's trading session.

After a week of strong increases, if investors buy gold rings in the session of November 17 and sell them in today's session (November 24), the profit investors will receive when buying at DOJI and Bao Tin Minh Chau is 2.9 million VND/tael and 2.95 million VND/tael, respectively.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

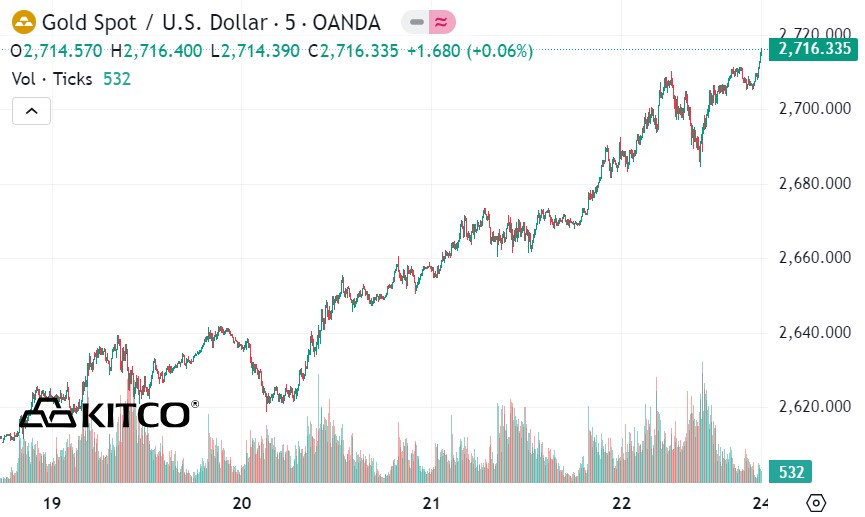

World gold price

At the close of the weekly trading session, the world gold price listed on Kitco was at 2,716.3 USD/ounce, a sharp increase of 153.1 USD/ounce compared to the close of the previous week's trading session.

Gold Price Forecast

World gold prices increased sharply despite the high USD index. Recorded at 5:00 p.m. on November 24, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107,510 points (up 0.54%).

Many analysts believe that the main reason driving up gold prices last week was increased demand for safe havens after the Russia-Ukraine conflict escalated.

“Gold has been quick to recover despite pressure from a stronger US dollar. Gold’s outperformance against silver suggests that this is a safe-haven rally, leading to a wave of buying from investors waiting for an opportunity,” said Ole Hansen, head of commodity strategy at Saxo Bank.

However, Hansen warned that the geopolitical rally may not last. “Unless there is further development in Eastern Europe, the upside is likely to be limited until there is clarity on the new actions of Donald Trump and the US Federal Reserve,” he said.

Mr. Naeem Aslam - Investment Director at Zaye Capital Market said that next week the gold market may witness an adjustment when gold prices increase at the same time as the USD and the stock market.

“It is unusual for risk assets and safe havens to rally together. This is largely due to investors reacting to geopolitical tensions while remaining optimistic that things will not get out of hand,” Aslam said.

Lukman Otunuga, chief market analyst at FXTM, believes that gold prices are still likely to rise in the current context. He believes that in addition to geopolitical tensions, gold is also supported by the dovish monetary policy stance from the FED, with the possibility of a rate cut next month at 50/50.

See more news related to gold prices HERE...