Update SJC gold price

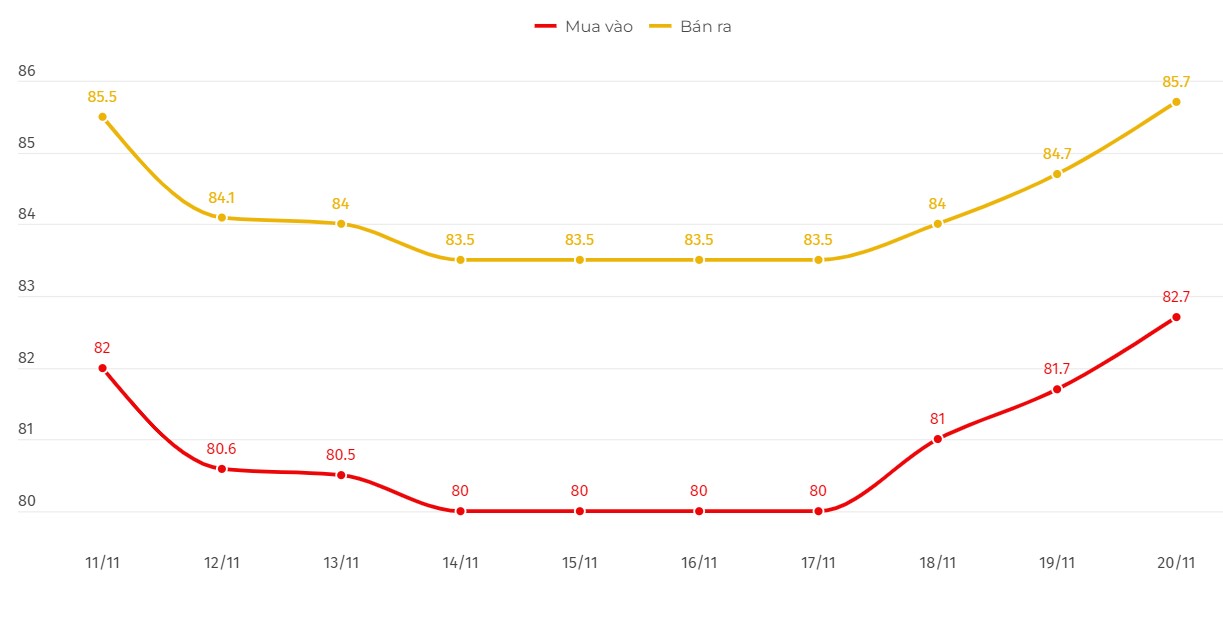

As of 7:00 p.m., the price of SJC gold bars was listed by DOJI Group at 82.7-85.7 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold price at DOJI increased by 700,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.7-85.7 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.2-85.7 million VND/tael (buy - sell).

Compared to the previous trading session, gold price at Bao Tin Minh Chau increased by 200,000 VND/tael for buying and increased by 700,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.8 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 3 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

Price of round gold ring 9999

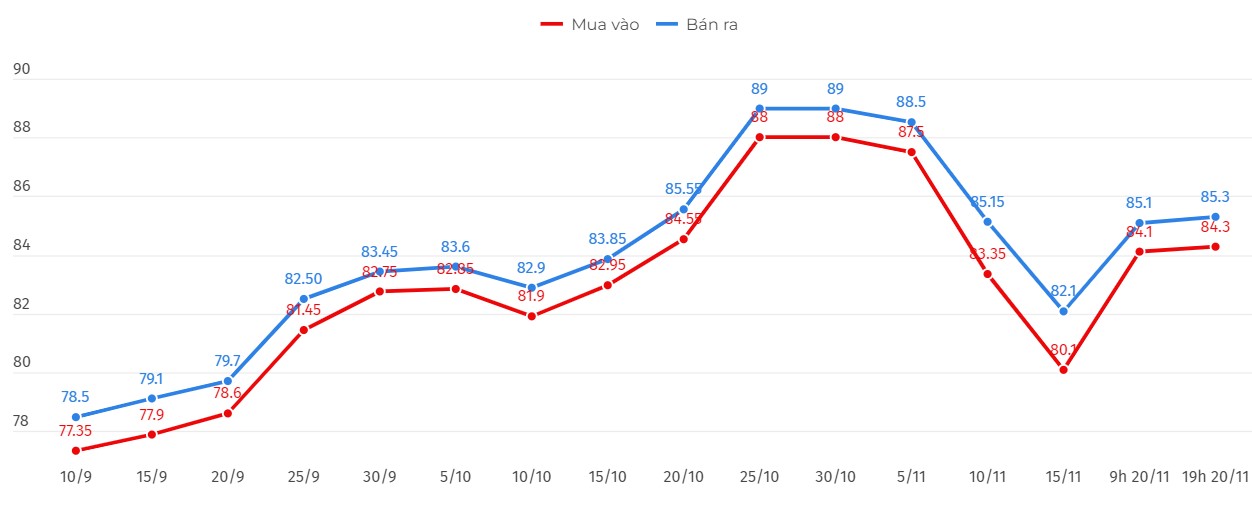

As of 7:10 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.3-85.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.33-85.28 million VND/tael (buy - sell); increased by 450,000 VND/tael for buying and increased by 500,000 VND/tael for selling.

World gold price

As of 7:10 p.m., the world gold price listed on Kitco was at 2,629.4 USD/ounce, down 9.2 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell amid an increase in the USD index. Recorded at 7:10 p.m. on November 20, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 106.564 points (up 0.39%).

Several US Federal Reserve (FED) officials are expected to clarify the roadmap for interest rate cuts this week.

Traders now see a 58.9% chance that the Fed will cut rates by 25 basis points in December. Recent strong economic data and US President-elect Donald Trump's tax proposals suggest rates will stay higher for longer.

Gold prices are always sensitive to US interest rate adjustments. Higher interest rates will help the USD strengthen, but will significantly reduce the attractiveness of non-yielding assets such as gold.

Markets are adjusting expectations for a Fed rate cut next year as inflation becomes a bigger concern, which could be negative for gold, said Ilya Spivak, head of global macro at investment manager Tastylive.

Meanwhile, Kansas City Fed President Jeffrey Schmid said there was still uncertainty about the magnitude of the rate cut, although the initial cut was a signal that inflation was returning to the 2% target.

According to observers, worrying information surrounding the Russia-Ukraine conflict is contributing to market instability, boosting investment demand for safe-haven assets such as gold.

See more news related to gold prices HERE...