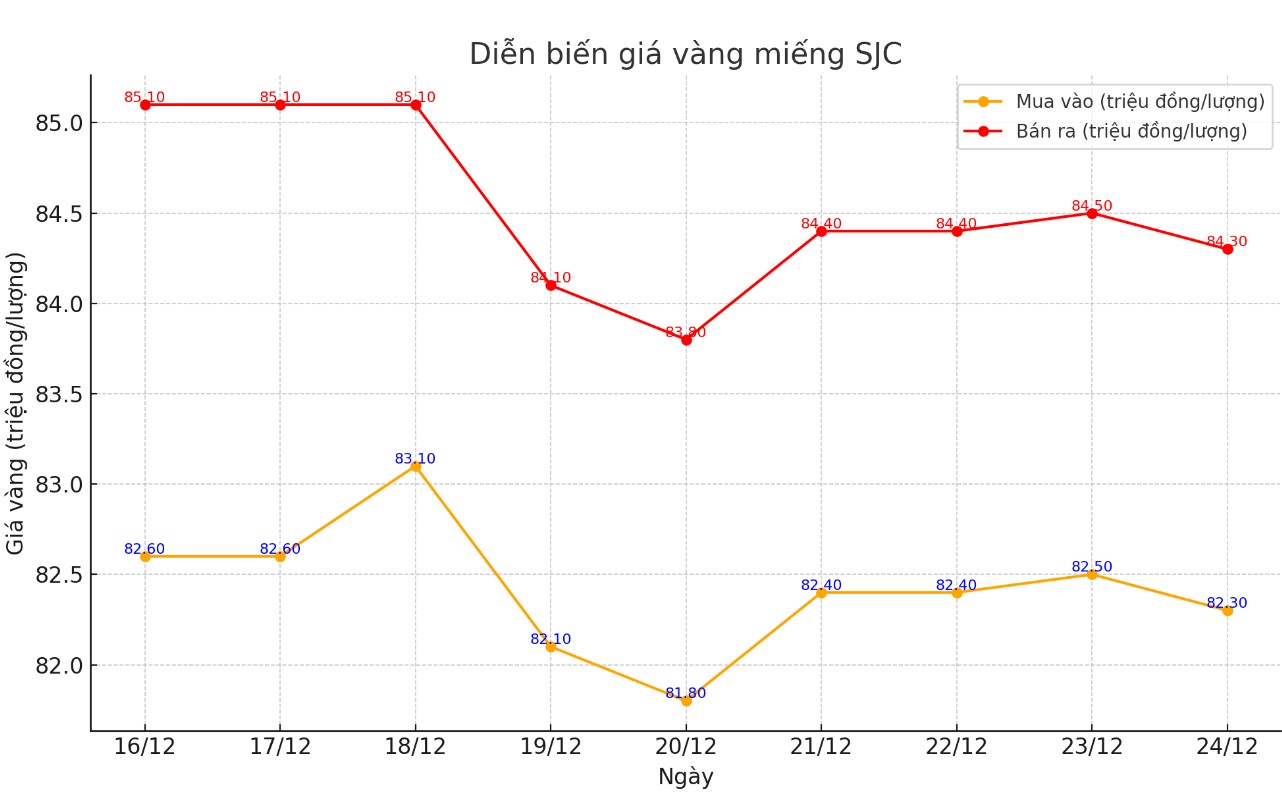

Update SJC gold price

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.3-84.3 million/tael (buy - sell), down VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 82.3-84.3 million VND/tael (buy - sell), down 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.3-84.3 million VND/tael (buy - sell), down 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

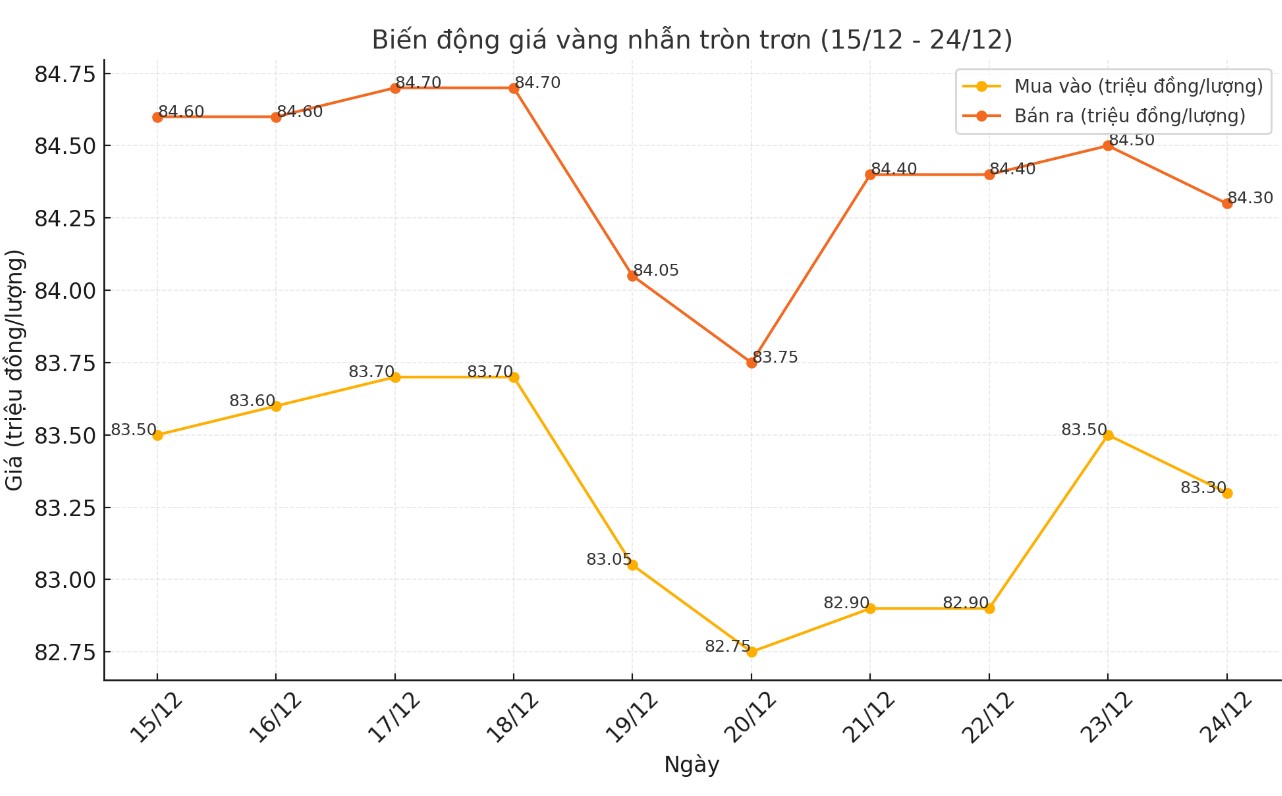

Price of round gold ring 9999

As of 6:15 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.3-84.3 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.5-84.3 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling compared to the close of yesterday's trading session.

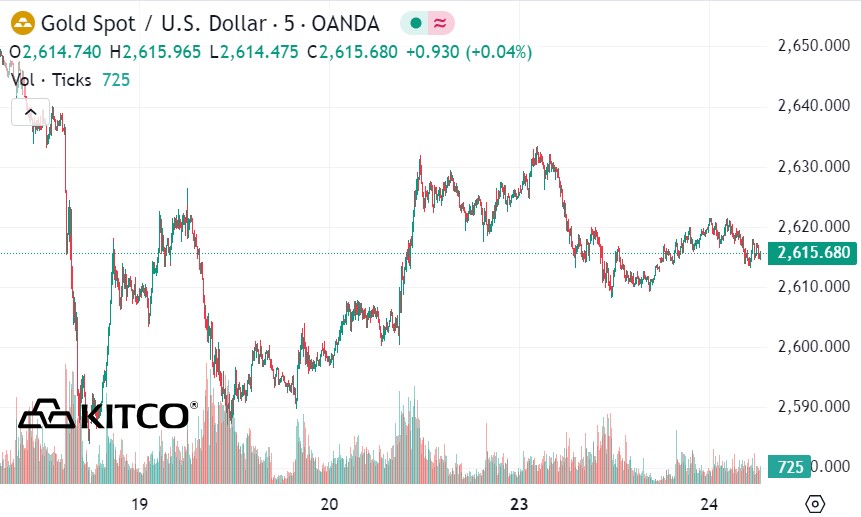

World gold price

As of 6:15 p.m., the world gold price listed on Kitco was at 2,615.6 USD/ounce, down 5 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell as the USD index increased. Recorded at 6:15 p.m. on December 24, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.880 points (up 0.07%).

According to Kitco - this week is expected to be a quiet trading week in all markets as the Christmas holiday falls on Wednesday. Gold has not shown any signs of increasing in price due to a sharper-than-expected decline in US consumer confidence.

The Conference Board reported Monday that its consumer confidence index fell to 104.7, down from a revised 112.8 in November. The reading was weaker than expected, with economists predicting the index would be largely unchanged.

The Federal Reserve’s hawkish stance and forecast of fewer rate cuts in 2025 are weighing on gold, with the precious metal facing key support tests during the holiday week, according to James Hyerczyk, an analyst at FX Empire.

Gold is struggling to find direction amid quiet holiday trading, Hyerczyk said.

“Gold prices fell as thin trading activity kept the upside momentum in check. After last week’s sharp decline, gold is attempting to recover but faces resistance between $2,607.25 and $2,607.35. A breakout above $2,629.13 is possible, but traders need stronger trading volumes to fuel the upside momentum — which is unlikely before the new year,” he said.

Hyerczyk noted that if gold breaks above $2,629.13 an ounce, prices could rise to near the 50-day moving average at $2,668.75 an ounce. “Conversely, if prices fall below $2,607.35 an ounce, gold could fall back to $2,583.91 an ounce, with the next key support at $2,536.85 an ounce,” he said.

Peter Grant, senior strategist at precious metals brokerage Zaner Metals, said the market is continuing to evaluate the results of last week's Federal Open Market Committee (FOMC) meeting.

Gold prices have set multiple records this year and are estimated to have risen 27%, marking their best year since 2010. The growth has been fueled by strong central bank buying, geopolitical tensions and monetary easing by major banks.

See more news related to gold prices HERE...