"Difficult to boost growth before the new year"

The Federal Reserve’s hawkish stance and forecast of fewer rate cuts in 2025 are weighing on gold, with the precious metal facing key support tests during the holiday week, according to James Hyerczyk, an analyst at FX Empire.

Gold is struggling to find direction amid quiet holiday trading, Hyerczyk said.

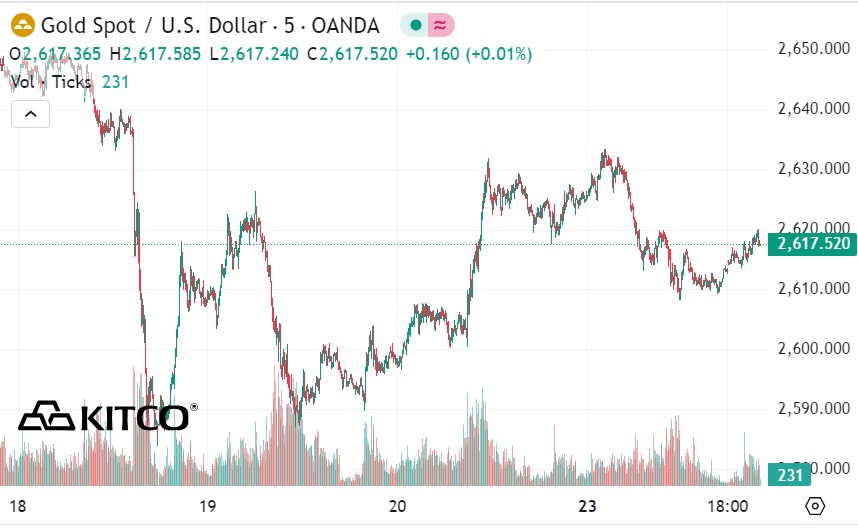

“Gold prices fell on Monday as thin trading kept gains in check. After last week’s sharp decline, gold is attempting to recover but faces resistance between $2,607.25/oz and $2,607.35. A breakout above $2,629.13/oz is possible, but traders need stronger volumes to fuel gains — something unlikely before the new year,” he wrote.

Hyerczyk noted that if gold breaks above $2,629.13 an ounce, prices could rise to near the 50-day moving average at $2,668.75 an ounce. “Conversely, if prices fall below $2,607.35 an ounce, gold could fall back to $2,583.91 an ounce, with the next key support at $2,536.85 an ounce,” he said.

Gold price action was muted after the Fed cut interest rates by 25 basis points last week, said Hyerczyk.

“While the cut initially supported prices, the Fed’s forecast of just two rate cuts in 2025 – down from four expected in September – triggered a sell-off, sending gold to its lowest level since mid-November,” he said.

With limited economic data this week and traders pulling out of the market ahead of the holidays, gold is expected to trade in a narrow range. Low liquidity reduces volatility, keeping price movements insignificant.

Besides, US Treasury yields and the USD also maintained recent strength amid thin market trading.

“Treasury yields rose slightly to start the week, with the 10-year yield rising to 4.536% and the 2-year yield inching up to 4.325%. Yields rose sharply last week after the Fed’s policy update but eased slightly on Friday after weaker-than-expected inflation data,” said Hyerczyk.

He added that avoiding the risk of a US government shutdown over the weekend helped stabilize markets, “but trading volumes are expected to fall further ahead of the Christmas holiday.”

Gold Technical Analysis and Long Term Outlook

According to Hyerczyk, gold's short-term outlook hinges on its ability to successfully hold the support level of $2,607.35 an ounce. "A break below this level could see prices fall quickly to $2,583.91 an ounce or even $2,536.85 an ounce," he said. "Conversely, a break above $2,629.13 an ounce could open the way to $2,668.75 an ounce, but any significant gains are unlikely before the holidays."

Longer-term, the outlook for gold remains positive, with the combination of interest rate cuts, persistent inflation and geopolitical risks continuing to support demand through 2025.

“Traders should be wary of changes in economic data or political developments that could spark interest in gold as a safe-haven asset,” Hyerczyk concluded.

See more news related to gold prices HERE...