Many experts predict that gold prices will reach $3,000/ounce next year, but this increase is expected to only occur in the second half of 2025. Meanwhile, with current prices hovering around $2,650/ounce, next year's target would be equivalent to an increase of about 13%, much lower than the nearly 30% increase this year.

In a recent interview with Kitco News, Chantele Schieven, Head of Research at Capitalight Research, said that the gold market is in a “wait and see” mode, as investors assess the health of the economy amid uncontrollable inflation.

At the same time, markets are also weighing geopolitical risks and uncertainties as President-elect Donald Trump prepares to take office.

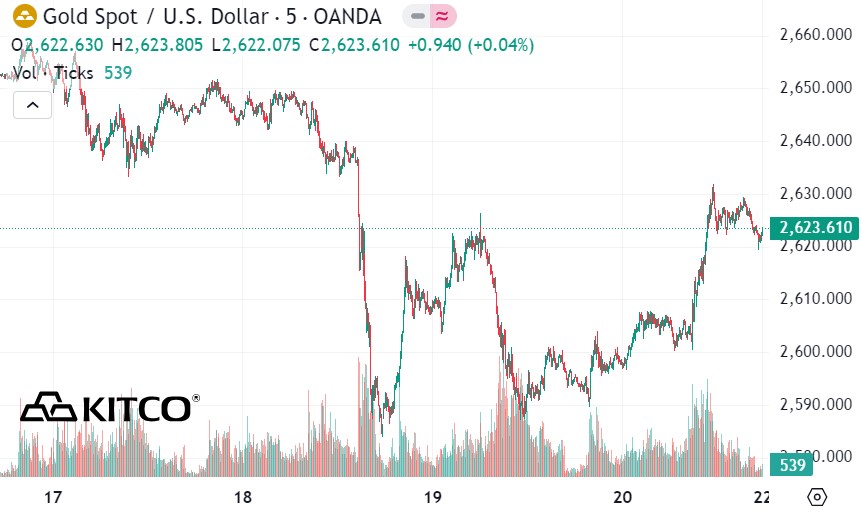

Although gold prices have been sideways since peaking in late October, Schieven said the market has remained stable despite major headwinds.

Prospects for early 2025

Entering the new year, gold prices held important support around $2,600/ounce, after the US Federal Reserve (FED) in its last monetary policy meeting of 2024 signaled fewer interest rate cuts next year.

According to the Fed's updated economic forecast, the agency expects to cut interest rates twice next year, instead of four times as predicted in September.

In this context, Schieven forecasts gold prices to trade in the range of $2,500-2,700/ounce in the first half of 2025. However, she expects a rally in the second half of the year, pushing gold prices above the $3,000/ounce threshold.

In early 2024, Schieven was the most optimistic forecaster in the London Bullion Market Association (LBMA) survey.

“I am still as bullish on gold in 2025 as I am on 2024, but the gold market needs a breather for now,” she said.

Bank of America (BofA) also forecasts that gold prices will continue to move sideways in the first half of 2024, although they expect prices to surpass the $3,000 mark.

“The market is in a state where there is nothing concrete to attract investors back,” Michael Widmer, managing director/head of metals research at BofA, said at the bank’s annual outlook conference.

Factors affecting gold prices

Gold is facing major challenges, in part because Western investors are facing potentially higher bond yields and a stronger US dollar, according to BofA's outlook report.

Meanwhile, demand from emerging market central banks continues to play a key role. John LaForge, head of real asset strategy at Wells Fargo, predicts that central bank demand for gold will continue to increase as countries seek to diversify their foreign exchange reserves away from the US dollar.

In addition to central bank demand, analysts are also focusing on consumer demand in emerging markets. Gold prices in early 2024 were supported by record central bank purchases and unprecedented demand from Asia, especially China.

In India, demand for gold continues to rise sharply. According to the World Gold Council (WGC), India's gold imports in November hit a record $14.8 billion, more than double the previous month and four times higher than the same period last year.

Analysts at the WGC believe the gold market in 2025 will be more complex as investors assess the health of the global economy. However, factors such as central bank demand, high inflation, and geopolitical uncertainty will continue to support gold prices.

See more news related to gold prices HERE...