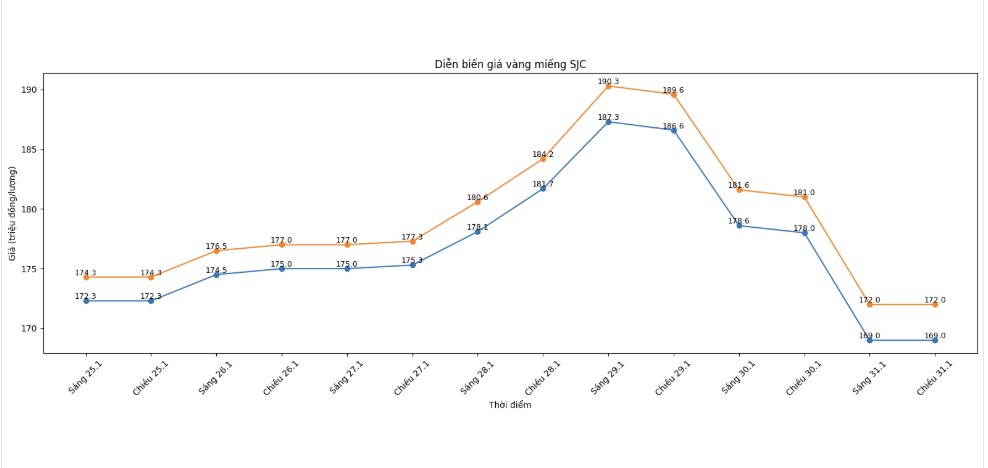

SJC gold bar price

As of 5:30 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 169-172 million VND/tael (buying - selling), down 9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar prices were listed by Bao Tin Minh Chau at the threshold of 169-172 million VND/tael (buying - selling), down 9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 169-172 million VND/tael (buying - selling), down 8.6 million VND/tael on the buying side and down 9 million VND/tael on the selling side. The difference between buying and selling prices is at 3 million VND/tael.

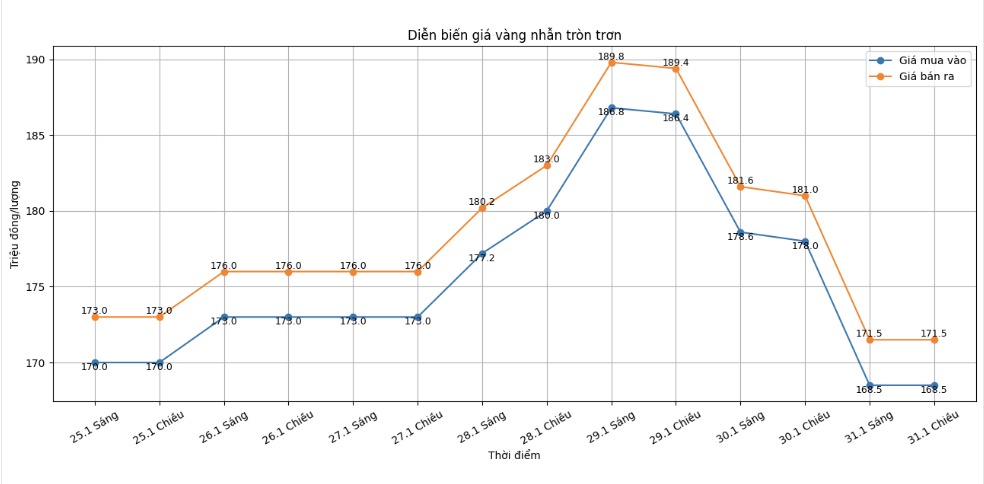

9999 gold ring price

As of 5:30 PM, DOJI Group listed the price of gold rings at 168.5-171.5 million VND/tael (buying - selling), down 9.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 169-172 million VND/tael (buying - selling), down 9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 168.5-171.5 million VND/tael (buying - selling), down 8.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

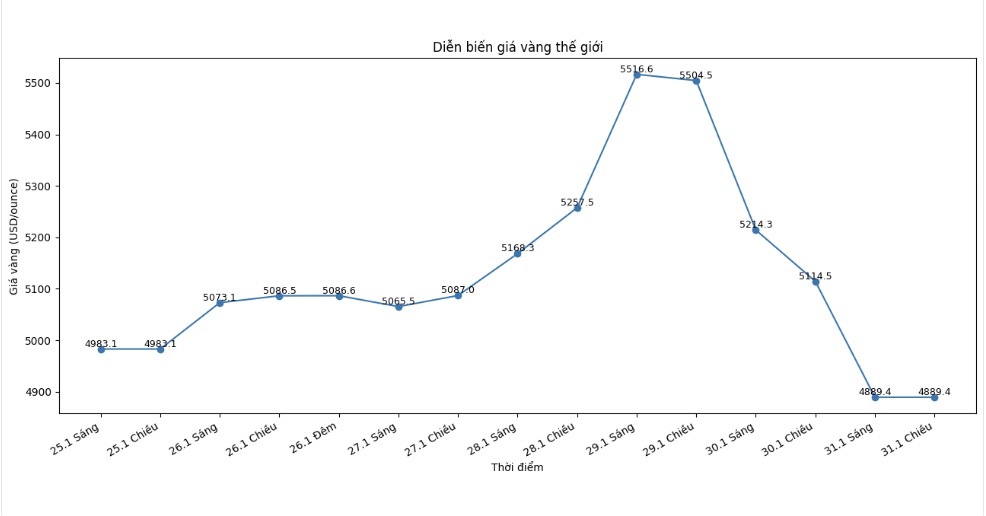

World gold price

At 5:41 PM, world gold prices were listed around the threshold of 4,889.4 USD/ounce; down 225.1 USD compared to the previous day.

Gold price forecast

After a deep decline in the last sessions of the week, the gold market is entering a sensitive phase when previous supporting factors temporarily weakened, while short-term correction risks are still present. This development has led analysts to make quite cautious assessments of gold price prospects in the coming time.

According to the latest weekly gold survey by Kitco, the views of Wall Street experts are strongly divided. Among the 18 experts participating in the survey, only 39% believe that gold prices may recover back to the 5,000 USD/ounce zone next week. Conversely, there is also an equivalent ratio forecasting prices to continue to go down, while the rest believe that the market will fluctuate unpredictably in both directions. This shows that cautious sentiment is prevailing after a period of "hot" gold price increases and then reverses very quickly.

In the opposite direction, individual investors still maintain relative optimism. Kitco's online poll results recorded that more than 70% of small investors believe that gold prices will increase again, despite the recent strong correction. However, analysts warn that this optimism may face a major challenge as a series of important economic information is about to be released.

Next week, the global market will focus on monitoring US jobs data, from the JOLTS, ADP reports to the non-farm payrolls. These are key factors directly affecting the interest rate roadmap expectations of the US Federal Reserve (Fed). In the context of weakening interest rate cut expectations and the USD tending to stabilize again, gold may continue to be under pressure.

Mr. Tom Price - an analyst at Panmure Liberum, said that the market is assessing that the Fed will maintain a more cautious stance in the near future, thereby reducing the attractiveness of gold in the short term.

Agreeing with this view, Mr. Ole Hansen - Commodity Strategy Director at Saxo Bank - said that the recent adjustment was necessary after a too rapid increase, and warned that gold prices may still fluctuate sharply before finding a new balance zone.

Summarizing the above factors, many opinions believe that gold prices in the short term are unlikely to avoid strong fluctuations. Investors are recommended to closely monitor macroeconomic developments and monetary policy, and be cautious with buying and selling decisions in the context that the market still contains many risks.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...