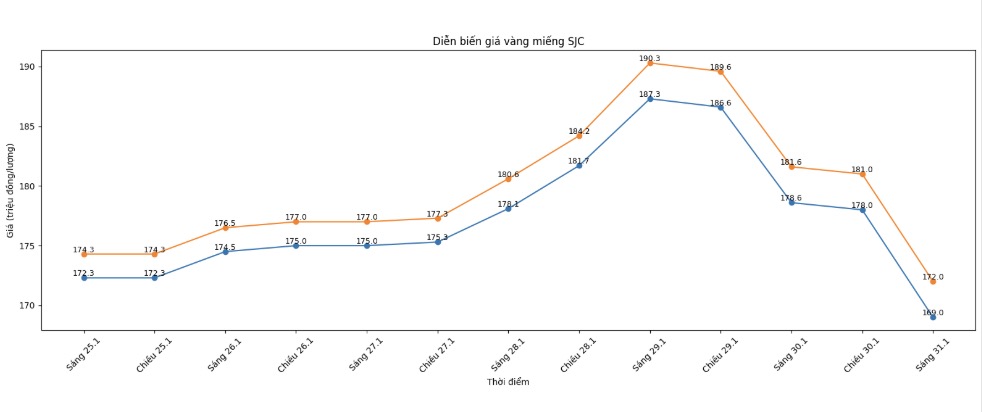

SJC gold bar price

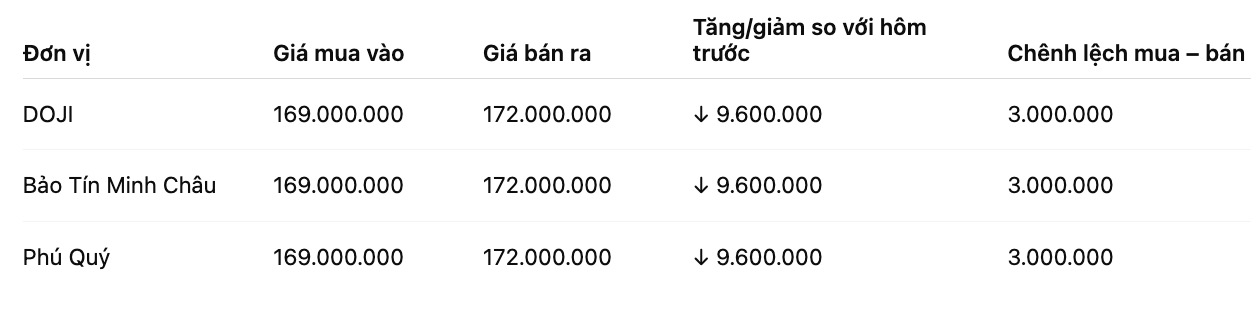

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 169-172 million VND/tael (buying - selling), down 9.6 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar prices were listed by Bao Tin Minh Chau at the threshold of 169-172 million VND/tael (buying - selling), down 9.6 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 169-172 million VND/tael (buying - selling), down 9.6 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

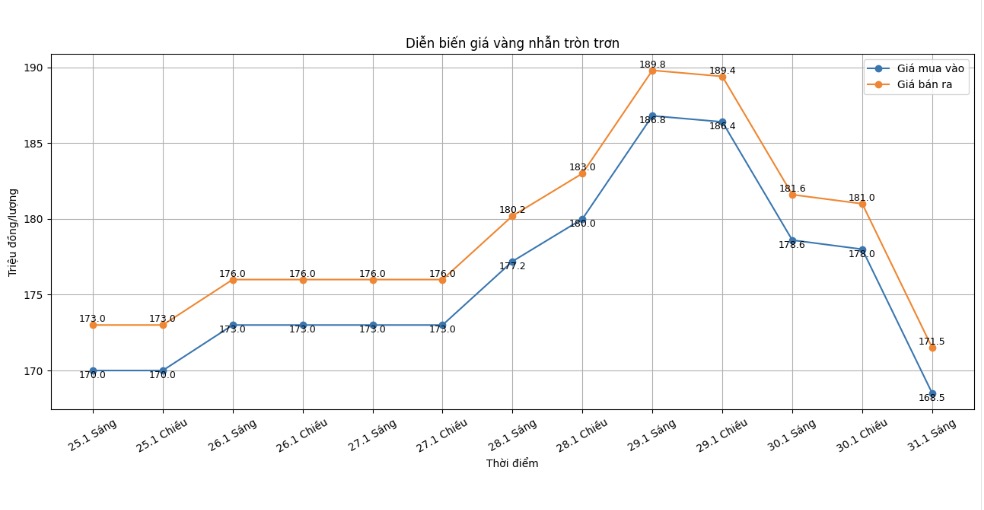

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 168.5-171.5 million VND/tael (buying - selling), down 10.1 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 169-172 million VND/tael (buying - selling), down 9.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 168.5-171.5 million VND/tael (buying - selling), down 9.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

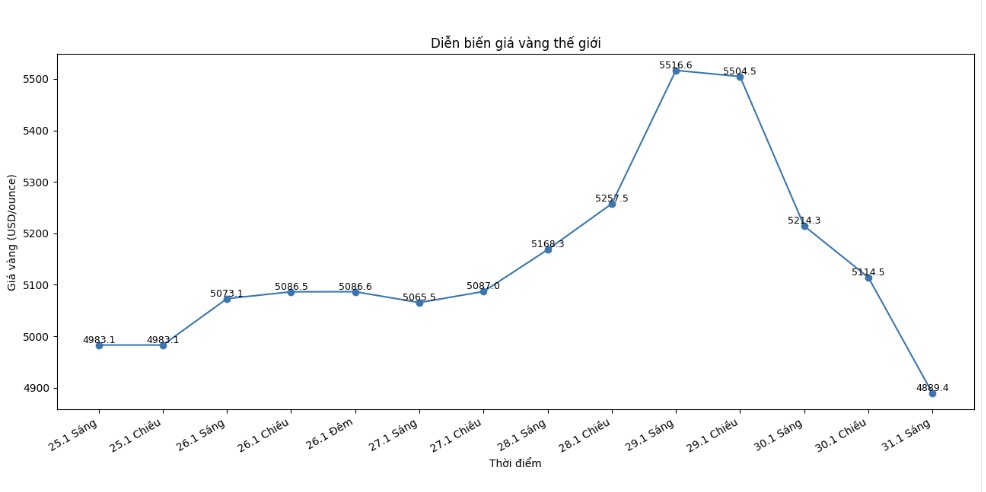

World gold price

At 11:05 AM, world gold prices were listed around the threshold of 4,889.4 USD/ounce, a sharp decrease of 324.9 USD compared to the previous day.

Gold price forecast

The sharp decline in gold and silver prices in the world market in the recent session shows that the precious metal is entering a clear correction phase, after a series of prolonged hot increases from the beginning of January. A series of unfavorable factors appearing at the same time quickly "cooled down" the excitement of investors.

First of all, expectations for the US Federal Reserve (Fed) to soon ease monetary policy are clearly weakening. Recent signals show that the Fed is likely to continue to maintain a cautious stance in interest rate management, instead of accelerating the reduction cycle as the market once expected.

Notably, the information that US President Donald Trump officially chose former Fed Governor Kevin Warsh as Fed Chairman in succession when Jerome Powell's term ends next May has strengthened this view, thereby strongly impacting investor sentiment in the global financial market.

According to Mr. Tom Price - an analyst at Panmure Liberum, the market assesses Mr. Kevin Warsh as a person with a relatively tough operating stance, not leaning towards drastic monetary easing. This makes investors quickly adjust expectations, while promoting profit-taking to preserve achievements after a period of too rapid price increases.

Along with the interest rate factor, the recovery of the USD also puts more pressure on the precious metal. The Dollar Index rebounded from a multi-year low, making gold and silver - which are valued in USD - less attractive to international investors. The combination of stronger USD and increased real yield expectations has triggered technical sell orders, thereby amplifying the downward momentum.

In addition, profit-taking selling pressure is considered a decisive factor in this correction phase.

According to Ms. Suki Cooper - Goods Research Director at Standard Chartered Bank, the market is undergoing a technical correction, as many capital flows are shifting away from assets that have increased too sharply in a short time.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...