Wall Street experts disagree on forecasts

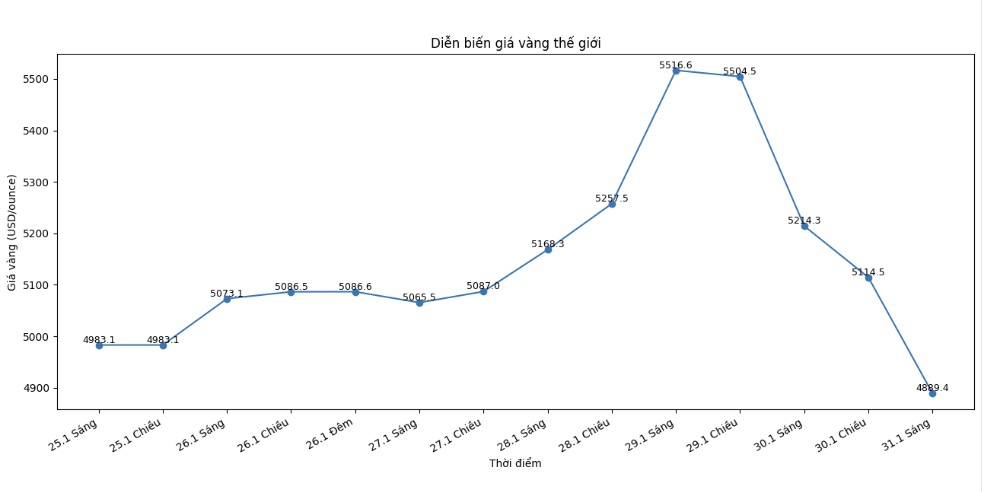

In the past trading week, the world gold market experienced particularly strong fluctuations. Gold prices increased rapidly, continuously breaking record levels and reaching a peak of 5,600 USD/ounce, before reversing to a deep decrease. Overall for the week, world gold decreased by 2.64% compared to the beginning of the week.

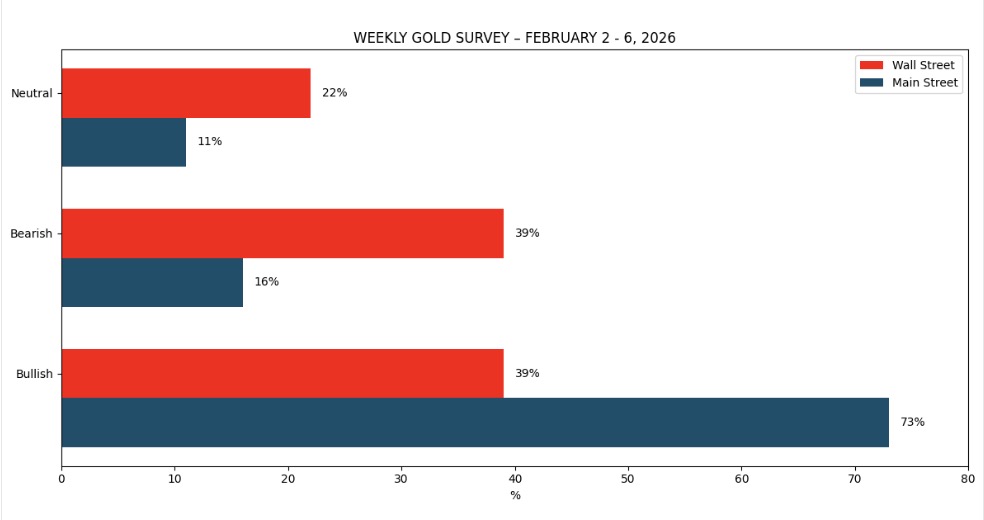

The latest weekly gold survey with Wall Street experts shows that analysts on Wall Street have very differentiated views and have not reached consensus on the short-term outlook of gold prices, while individual investors still maintain optimistic sentiment as the majority.

This week, 18 experts participated in the gold survey. The results showed that Wall Street shared views on the short-term trend of gold prices after a week of strong fluctuations with many mixed signals.

7 experts, equivalent to 39%, believe that gold prices may return to the 5,000 USD/ounce zone next week, while 7 others predict prices will continue to fall. The remaining 4 experts, accounting for 22%, believe that gold prices may fluctuate in both directions in the short term.

In the opposite direction, Kitco's online survey recorded 340 participations of individual investors. Despite the strong fluctuations and recent sharp drops in gold prices, the majority of small investors still maintain an optimistic view.

Accordingly, 249 people, equivalent to 73%, predict that gold prices will increase next week; 53 people, accounting for 16%, believe that prices will continue to go down. The remaining 38 investors, equivalent to 11%, predict that gold prices will move sideways in the near future.

Economic data to be tracked next week

Next week, the market will face a dense schedule of economic data releases, focusing on jobs data. Investors will monitor these data to assess and adjust expectations about the US Federal Reserve (Fed)'s interest rate roadmap, amid concerns about changes in the Fed's leadership personnel. In addition, many major central banks will also announce monetary policy decisions.

On Monday morning, the US will announce the ISM manufacturing PMI for January, while the Reserve Bank of Australia will make monetary policy decisions at the end of the day. On Tuesday, the market will follow the JOLTS US job vacancy report. On Wednesday morning, the ADP private sector jobs data and the ISM service PMI for January will be released in turn.

Thursday is the focus of the week, as major central banks simultaneously make decisions. The Bank of England will announce monetary policy early this morning, followed by the European Central Bank's interest rate decision. On the same day, the US also announced the number of weekly jobless claims.

The trading week closed on Friday morning with the US non-farm payroll report, followed by a preliminary survey of consumer psychology conducted by the University of Michigan.

See more news related to gold prices HERE...