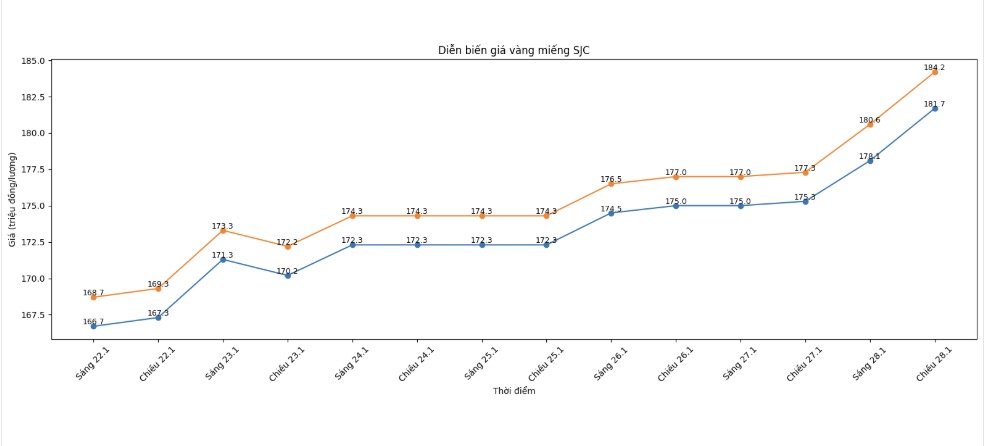

SJC gold bar price

As of 6:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 181.7-184.2 million VND/tael (buying - selling), an increase of 6.4 million VND/tael on the buying side and an increase of 6.9 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 181.7-84.2 million VND/tael (buying - selling), an increase of 6.4 million VND/tael on the buying side and an increase of 6.9 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 180.1-183.2 million VND/tael (buying - selling), an increase of 5.6 million VND/tael on the buying side and an increase of 6.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3.1 million VND/tael.

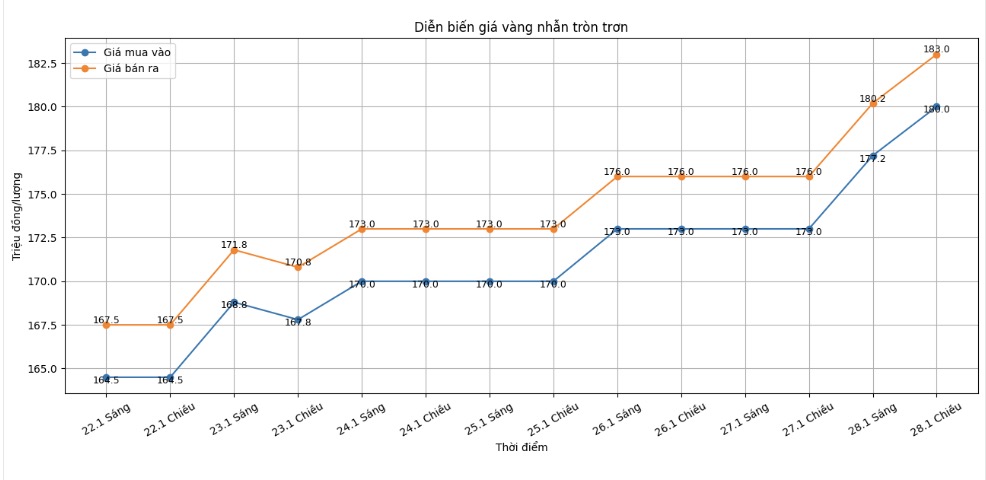

9999 gold ring price

As of 6:00 PM, DOJI Group listed the price of gold rings at 180-183 million VND/tael (buying - selling), an increase of 7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 180-183 million VND/tael (buying - selling), an increase of 6.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 179.9-182.9 million VND/tael (buying - selling), an increase of 6.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

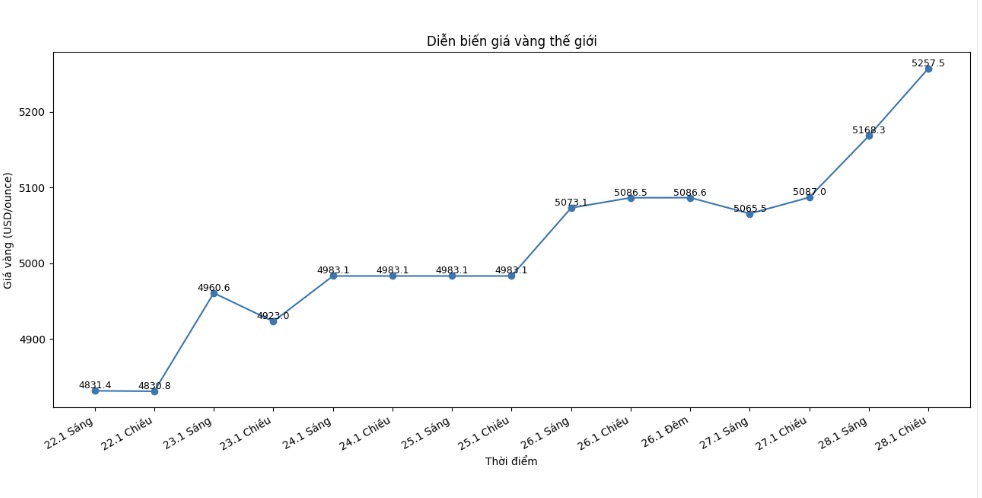

World gold price

At 6:13 PM, the world gold price was listed around the threshold of 5,257.5 USD/ounce; up 170.5 USD compared to the previous day.

Gold price forecast

World gold prices continued to create surprises when breaking through strongly, far exceeding previous forecast scenarios and continuously setting new historical milestones. After surpassing 5,000 USD/ounce for the first time, this precious metal quickly approached the 5,300 USD zone, showing that shelter sentiment is spreading on a global scale.

Price movements show that the gold market is no longer simply reacting to short-term factors such as interest rates or currency fluctuations, but is reflecting deeper changes in the global financial-geopolitical structure.

The weakening USD, government bonds of many major countries being sold off, along with concerns about budget deficits and the sustainability of legal tender have boosted capital flows to gold with increasing intensity.

In the latest report, BMO Capital Markets' analysis team believes that the current upward momentum has gone beyond the "safe zone" of traditional models. According to BMO, betting on gold at this time also means that investors are betting on the reshaping of global order.

In the extreme scenario offered by this bank, if purchasing power from central banks and ETFs continues to be high, while the USD and real yields weaken, gold prices could reach the 6,350 USD/ounce mark by the end of 2026 and even reach 8,650 USD/ounce by 2027.

From a shorter perspective, the market still witnesses strong fluctuations as prices increase rapidly and speculative sentiment increases. However, many experts believe that adjustments, if they occur, are mainly technical.

Ms. Suki Cooper, Head of Global Commodity Research at Standard Chartered, said that expectations of a softer monetary policy in the US, along with prolonged geopolitical risks, are still creating a solid foundation for gold's upward trend. "If short-term fluctuations are ignored, the risk balance is currently still leaning towards rising prices," she said.

In that context, analysts believe that gold prices are likely to continue to maintain in the highs in the coming time, as the safe-haven asset role of this precious metal is increasingly strengthened, despite strong reversal sessions that may still appear.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...

It's a bit of a bit of a bit of a bit of a bit of a bit.