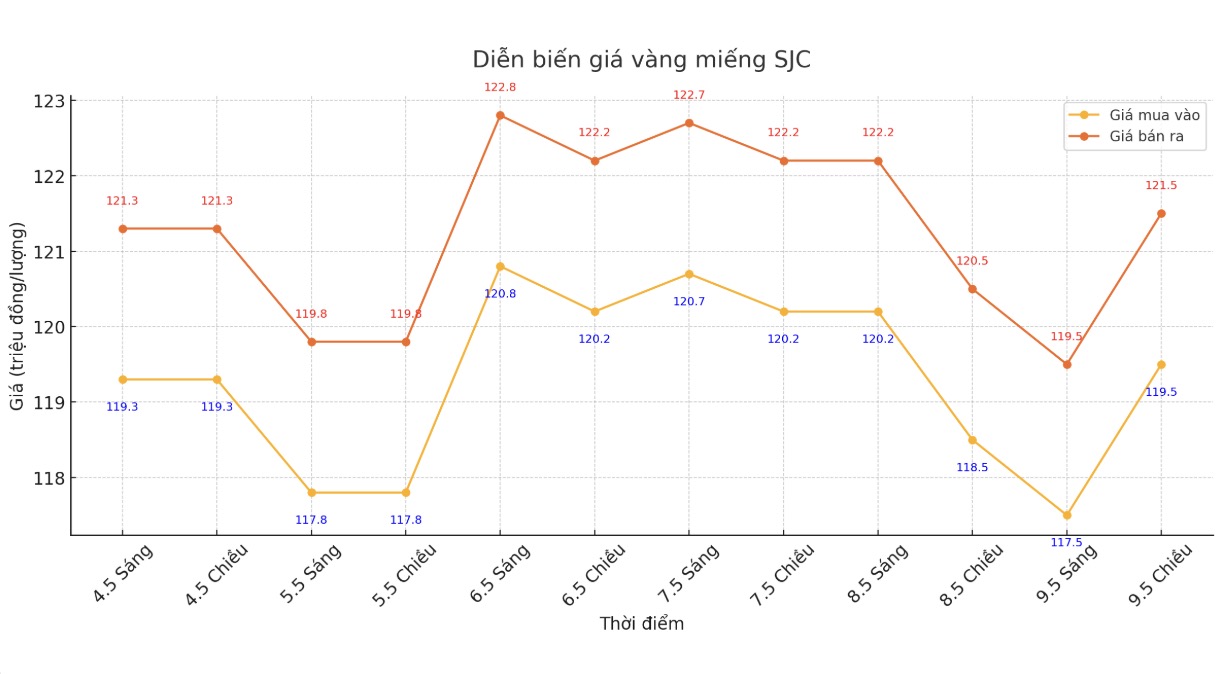

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.7 hyd20.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

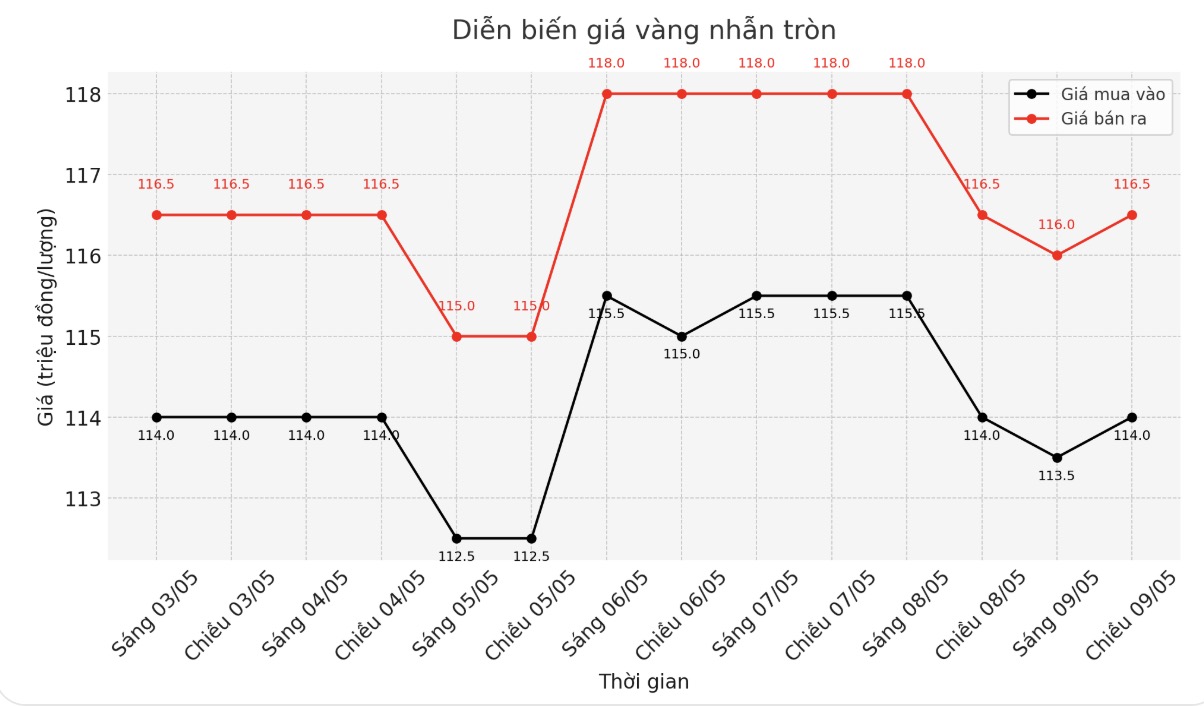

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-119 1.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

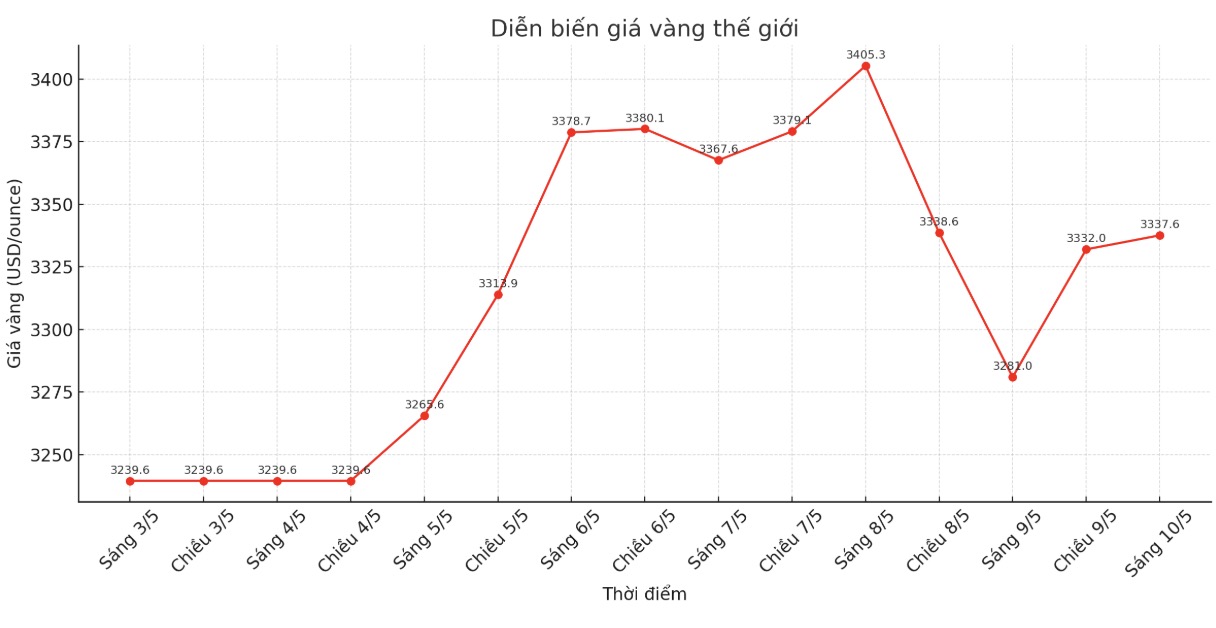

World gold price

At 0:00, the world gold price listed on Kitco was around 3,337.6 USD/ounce, up 12.7 USD.

Gold price forecast

According to Kitco, gold prices recovered quite well after the recent sell-off, thanks to support from external factors such as the declining USD index and rising crude oil prices. However, the risk-off sentiment of improving over the weekend and rising US Treasury yields are limiting the upward momentum of precious metals prices.

June gold futures rose $11.3 to $3,337.30 an ounce. July silver contract increased by 0.138 USD, to 32.755 USD/ounce.

Asian and European stocks traded in opposite directions but mostly increased slightly. The US market is expected to open up. Investment sentiment has improved after the US and UK reached a trade deal and ahead of US-China talks this weekend in Switzerland. David Morrison from Trade Nation said that although the meeting is only in the early stages, investors expect to create a premise for bilateral trade recovery.

However, he also warned that the stock market has increased quite strongly in recent times, positive news has reflected in prices, and just a little disappointment can cause investors to withdraw capital.

The negative impact of the US-China trade war is clearly visible when reviewing data on goods transportation. Bloomberg said the volume of goods imported through Los Angeles Port - the busiest container port in North America - has fallen by a third.

A CEO of the transportation industry said that the amount of goods from China decreased by 60%. This will affect the chain of many US businesses, from loading and unloading workers, logistics to retailers. Even with a trade deal, restoring the supply chain will take a long time.

No major US economic data was released on Friday.

Technically, June gold futures still have a short-term technical advantage. The target for buyers is to close above the resistance level of 3,448.2 USD/ounce - the peak of this week. On the contrary, the sellers need to pull the price below 3,209.4 USD/ounce - the bottom of last week.

The nearest resistance level was 3,350 and then $3,400/ounce. The most recent support was 3,300 and then reached the lowest level last night of 3,278.9 USD/ounce.

In the financial market, the USD index continues to weaken. WTI crude oil prices are trading around $61.25/barrel. The yield on the 10-year US Treasury note is currently at 4.382%.

See more news related to gold prices HERE...