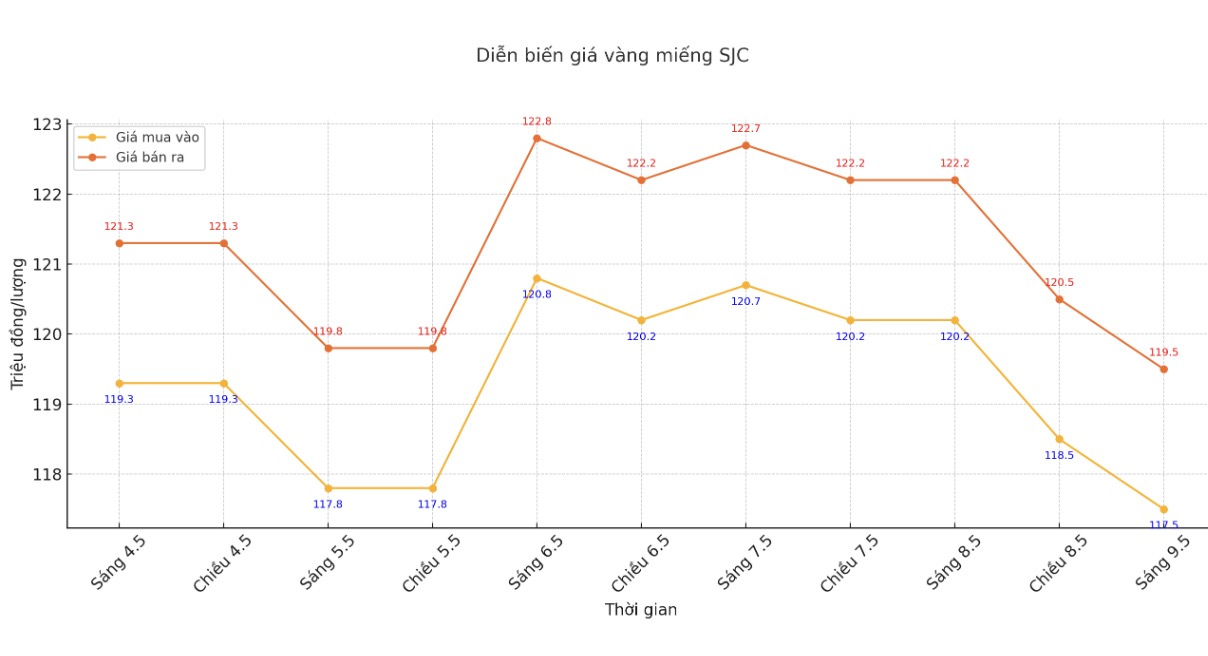

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out), down 2.7 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.5-111.5 million VND/tael (buy - sell), down 2.7 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy - sell), down 2.7 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 116.5-111.5 million/tael (buy in - sell out), down VND 2.7 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

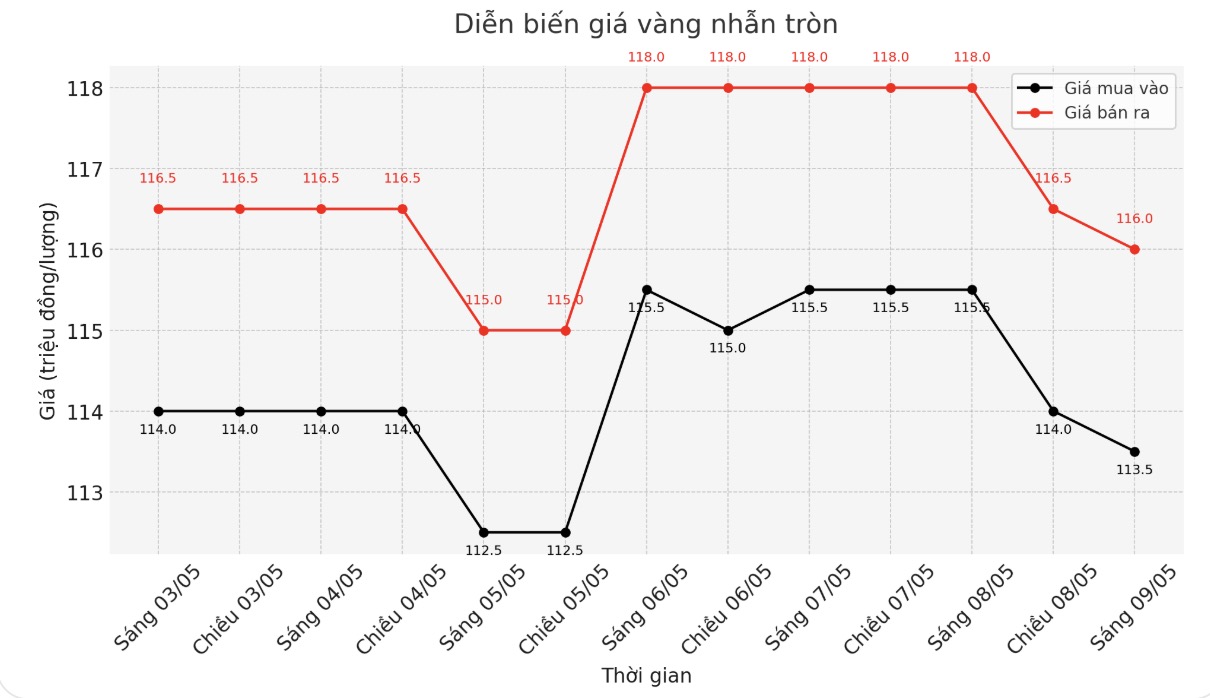

9999 round gold ring price

As of 9:30 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116 million VND/tael (buy in - sell out), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), down 2.5 million VND/tael for buying and down 2.3 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

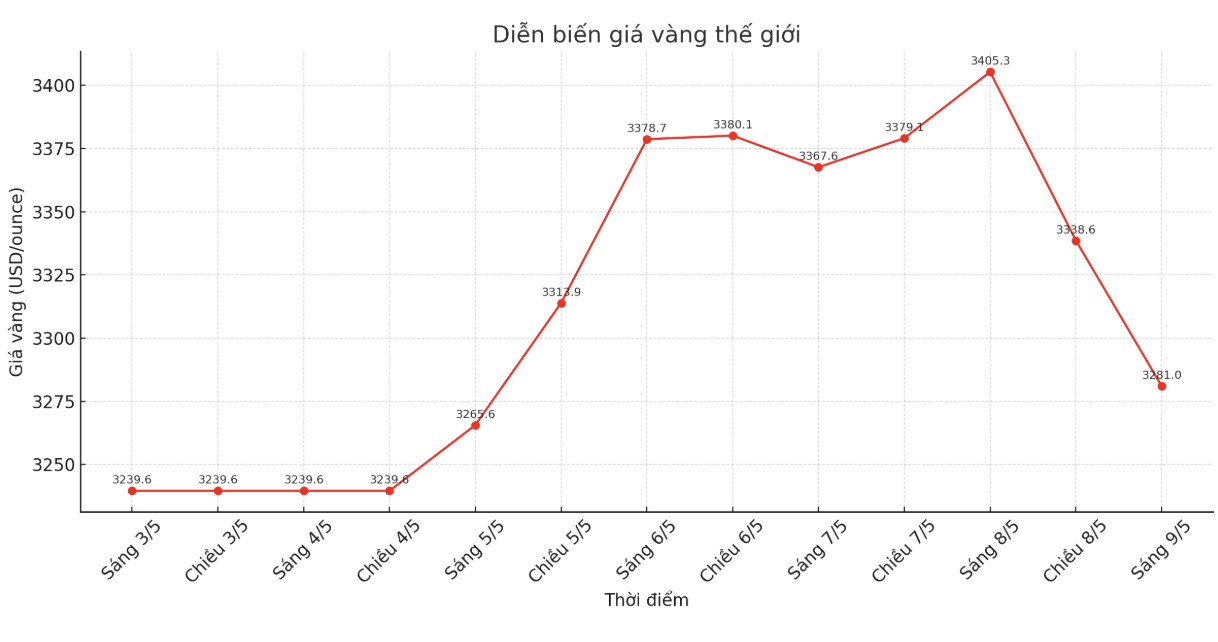

World gold price

At 9:30 a.m., the world gold price listed on Kitco was around 3,281 USD/ounce, down to 124.3 USD/ounce.

Gold price forecast

World gold prices fell sharply last night due to US employment data actively exceeding expectations and the Bank of England cutting interest rates.

The precious metal is under downward pressure as US labor market data is more positive than expected. The number of initial unemployment claims in the US in the week ended March 3 was only 228,000, lower than the forecast of 230,000 claims from analysts according to the announcement from the US Department of Labor released on Thursday.

The gold market is gradually losing its advantage over the British pound after the Bank of England (BOE) decided to cut interest rates at the core, but still maintains a cautious tone in monetary policy statements.

As expected, the BOE has cut interest rates by another 0.25 percentage points to 4.25%. However, the decision was not completely consensus, with seven members voting in favor and two against, while analysts expected absolute consensus.

Increased risk-off sentiment in the market has also put pressure on safe-haven metals. Investors' risk appetite improved after US President Donald Trump announced that he would hold a "big press conference" on Friday morning, with the content of a "big trade deal with the representative of a large and very dignified country" - said to be the UK.

Mr. Trump added that this will be the first of many deals. However, the specific details of the deal are still unclear and observers believe that this statement is in the context of many changes in the Trump administration's statements on trade.

Despite the decline in prices, the long-term outlook for gold is still positively assessed by experts. Sharing on Bloomberg, Ms. Grace Peters - Director of Global Investment Strategy of JP Morgan said that regional and monetary diversification is a key factor in the current market context.

She also said that JP Morgan had set a gold price target of 3,500 USD/ounce at the beginning of the year, but this level has now been exceeded, so the bank has raised the forecast to over 4,000 USD/ounce within the next year.

One of the main drivers of gold price increases is the increase in gold reserves by central banks in emerging markets, narrowing the gap with central banks in developed countries.

In addition, demand for gold from ETFs and technology and jewelry sectors is also expected to increase next year if GDP continues to maintain growth.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...