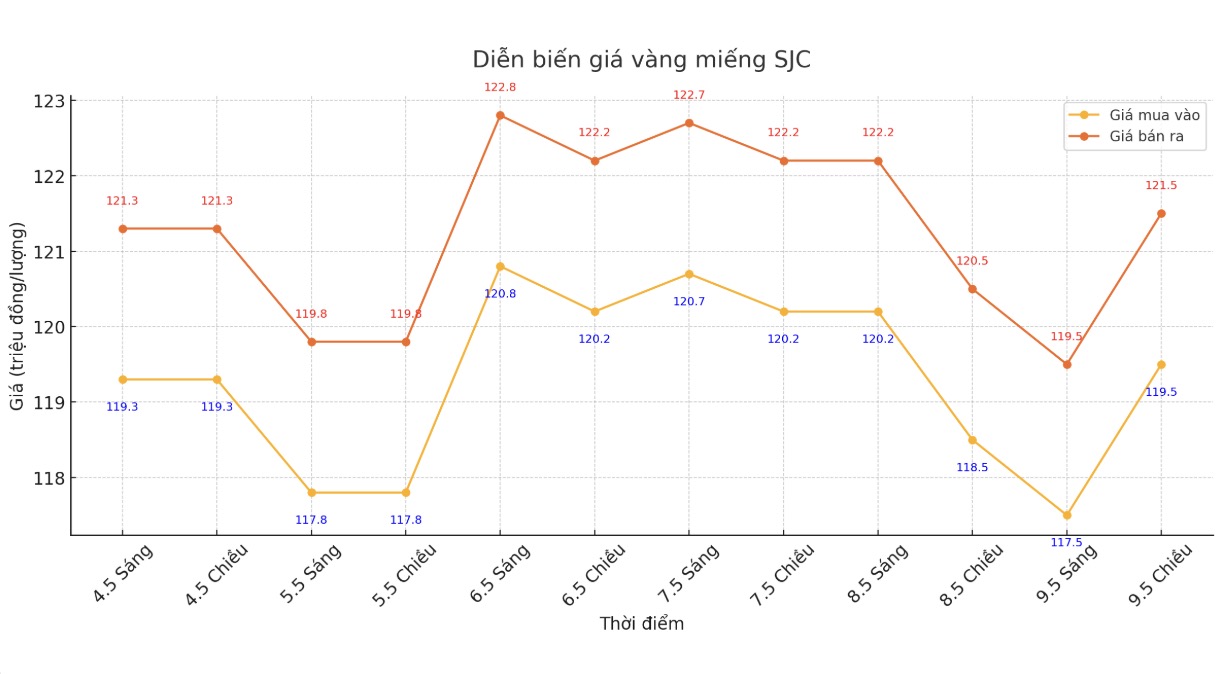

Updated SJC gold price

As of 6:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.7 hyd20.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

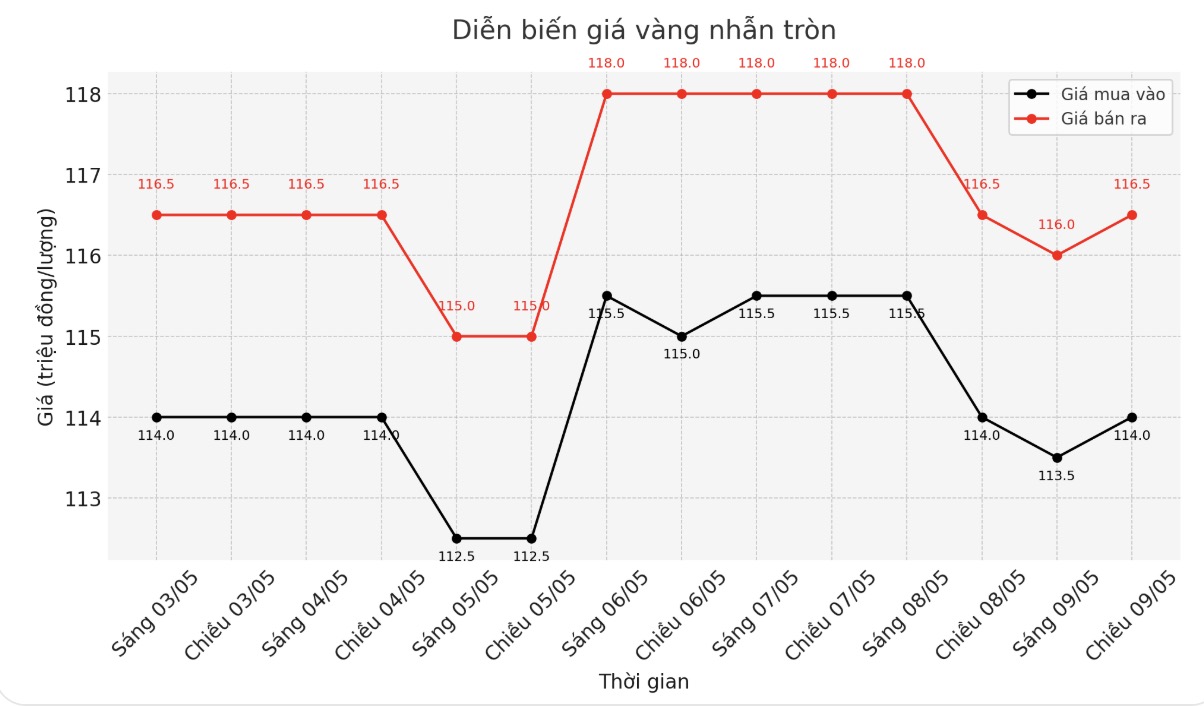

9999 round gold ring price

As of 6:30 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-119 1.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Domestic gold prices fluctuated strongly, the buying-selling gap was pushed too high, increasing risks for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

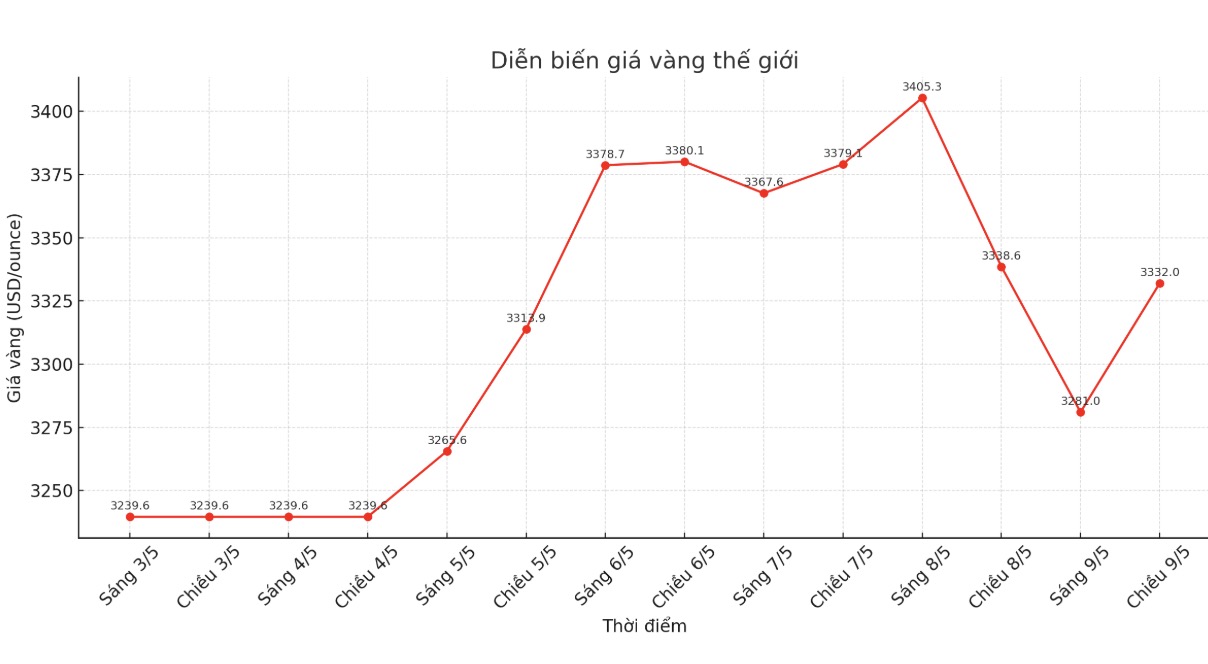

World gold price

At 6:45 p.m., the world gold price listed on Kitco was around 3,332 USD/ounce, down 6.6 USD.

Gold price forecast

World gold prices fluctuated strongly due to many mixed factors. According to Kitco, the precious metal is under pressure as US labor market data is more positive than expected. The number of initial unemployment claims in the US in the week ended March 3 was only 228,000, lower than the forecast of 230,000 claims from analysts according to the announcement from the US Department of Labor released on Thursday. Last week's figure remained unchanged at 241,000 orders.

The gold market is gradually losing its advantage over the British pound after the Bank of England (BOE) decided to cut interest rates at the core, but still maintains a cautious tone in monetary policy statements.

The BOE has cut interest rates by another 0.25 percentage points to 4.25%. However, the decision was not completely consensus, with seven members voting in favor and two against, while analysts expected absolute consensus.

According to Reuters, gold prices are supported by a weaker US dollar and prolonged geopolitical tensions, while the focus is still the US-China trade talks taking place this weekend.

Ross Norman, an independent analyst, said: The strong fluctuations in gold prices show great buying power due to economic concerns, while the selling pressure is also strong because some investors see high prices as a profit-taking opportunity.

The market is focusing on the possibility of reaching a trade deal between the US and China... At the same time, investors are also concerned about the India - Pakistan crisis".

The US and Chinese officials are scheduled to meet in Switzerland this weekend, which is seen as a first step in cooling down the damaging trade war between the world's two largest economies.

Regarding geopolitical situations, the Pakistan army carried out many strikes by drones and other weapons along the western border of India on Thursday night and early Friday morning - according to information from the Indian army.

Also today, many officials of the US Federal Reserve (FED) are expected to speak, possibly providing more clues about the economic situation and monetary policy orientation.

Fed Governor Michael barr said the Fed needs to be patient in assessing the impact of Donald Trump's tariffs on the economy, especially inflation and unemployment, before making rate adjustments.

See more news related to gold prices HERE...