Update SJC gold price

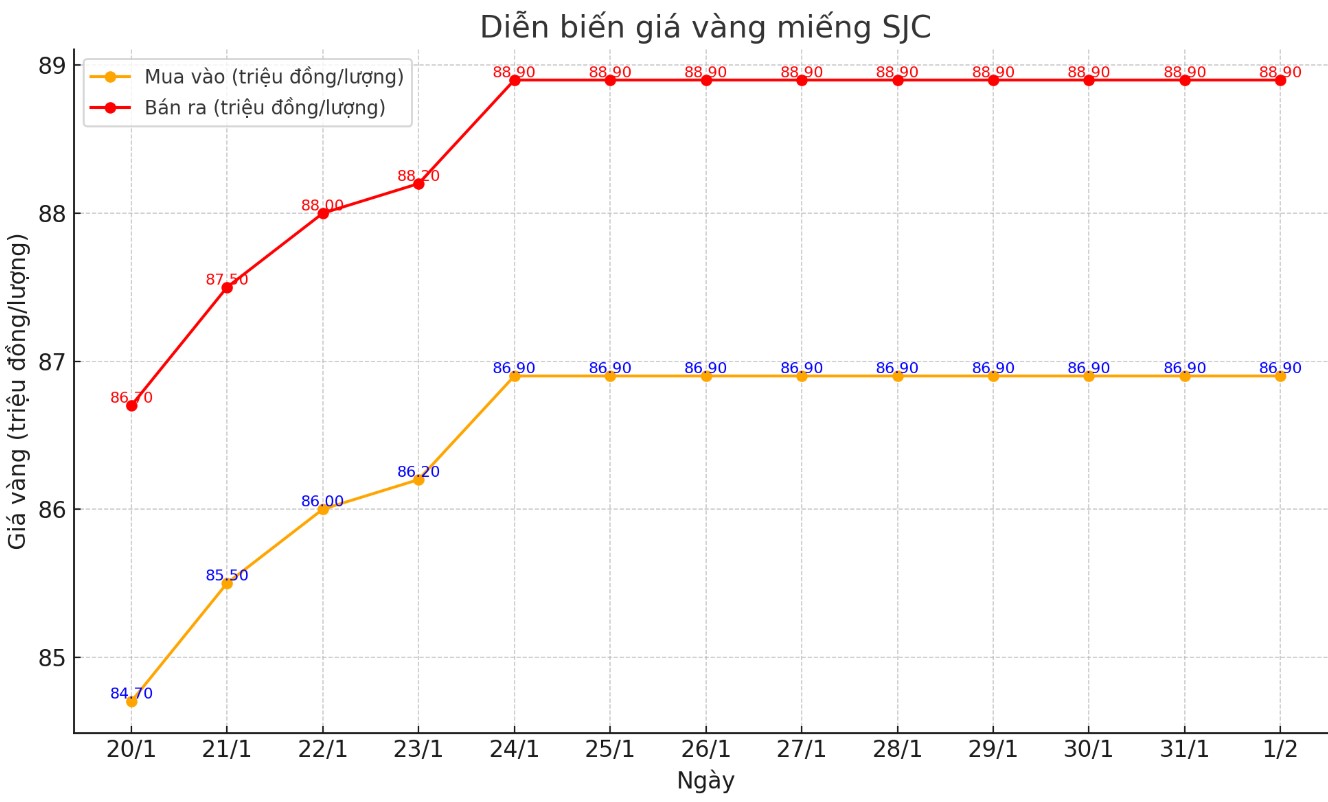

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

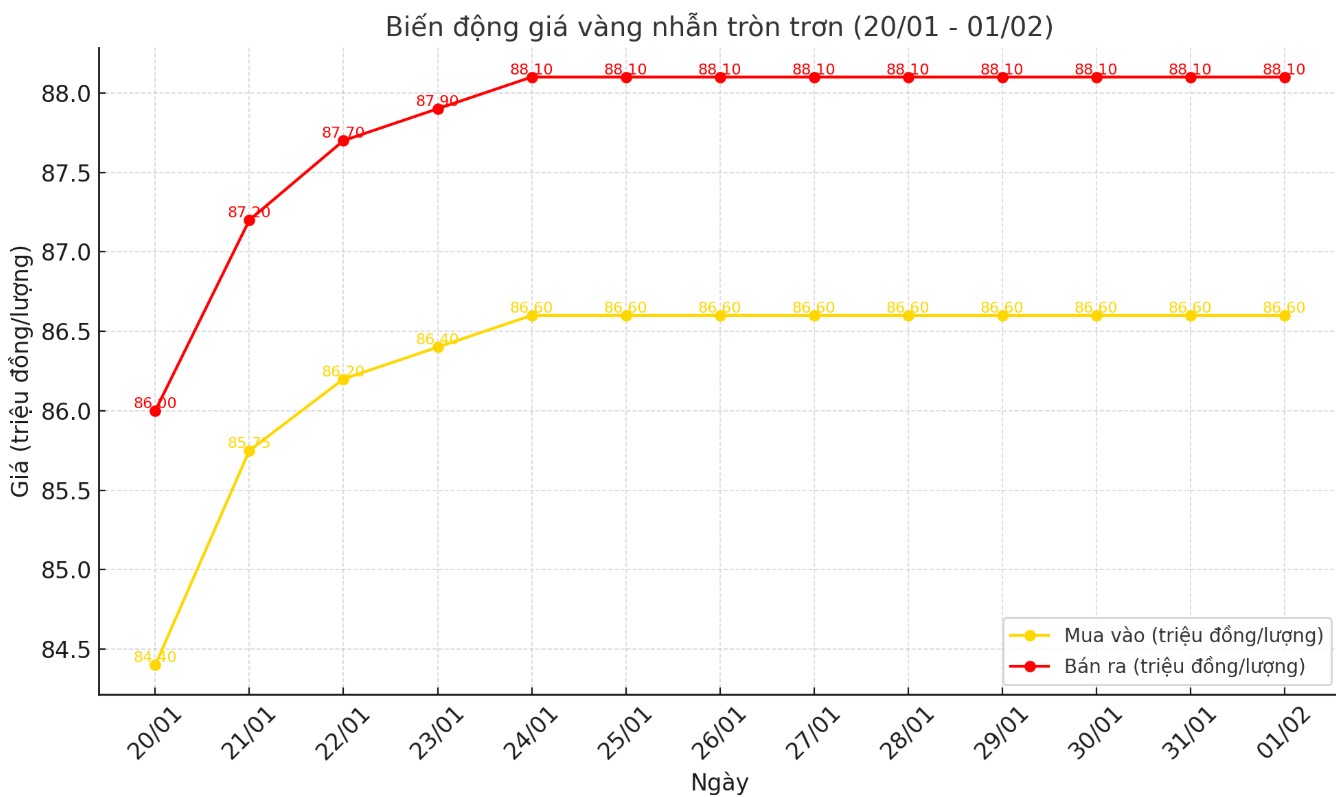

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 11:45 p.m. on January 31, the world gold price listed on Kitco was at 2,807.4 USD/ounce, a sharp increase of 15.7 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 11:30 p.m. on January 31, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 107.965 points (up 0.31%).

According to Kitco, the buying wave appeared as safe-haven demand continued to support the precious metal. The market remained concerned about the trade and foreign policies of the US president's administration, including new tariffs.

US President Donald Trump is set to impose his first round of trade tariffs on Friday, with Canada and Mexico as the main targets. The Wall Street Journal reported under the headline: “Trump’s Tariff Deadline Leaves World Worried.”

There have been reports of physical gold hoarding in the US, drawing attention as physical gold delivery schedules from the Bank of England have been stretched from days to months.

The focus is on the sharp increase in gold reserves on the COMEX floor in the US, causing the spread between gold in London and New York to reach a record level, according to reputable brokerage SP Angel.

Asian and European stocks were mixed overnight. European shares were poised for their biggest monthly gain in two years. Chinese markets remained closed for the Lunar New Year holiday. US stock indexes were expected to open higher when trading in New York began.

US officials continue to investigate whether DeepSeek circumvented US restrictions on computer chips to develop its new AI model.

In the outside market, Nymex crude oil futures were almost flat, trading around $72.50 a barrel. The yield on the 10-year US Treasury note is currently at 4.531%.

Technically, April gold futures remain bullish, with the short-term advantage tilted to the buyers. The bullish momentum is consolidating on the daily chart, with the next target being a challenge to the key resistance level at $2,900/ounce.

On the other hand, the bears are trying to push the price below the strong support at $2,760.20/ounce - the lowest level of the week. Currently, the first resistance zone is at $2,859.5/ounce, the high set overnight, followed by $2,875/ounce. Meanwhile, the nearest support is at $2,822.1/ounce, before heading towards $2,800/ounce.

See more news related to gold prices HERE...