Update SJC gold price

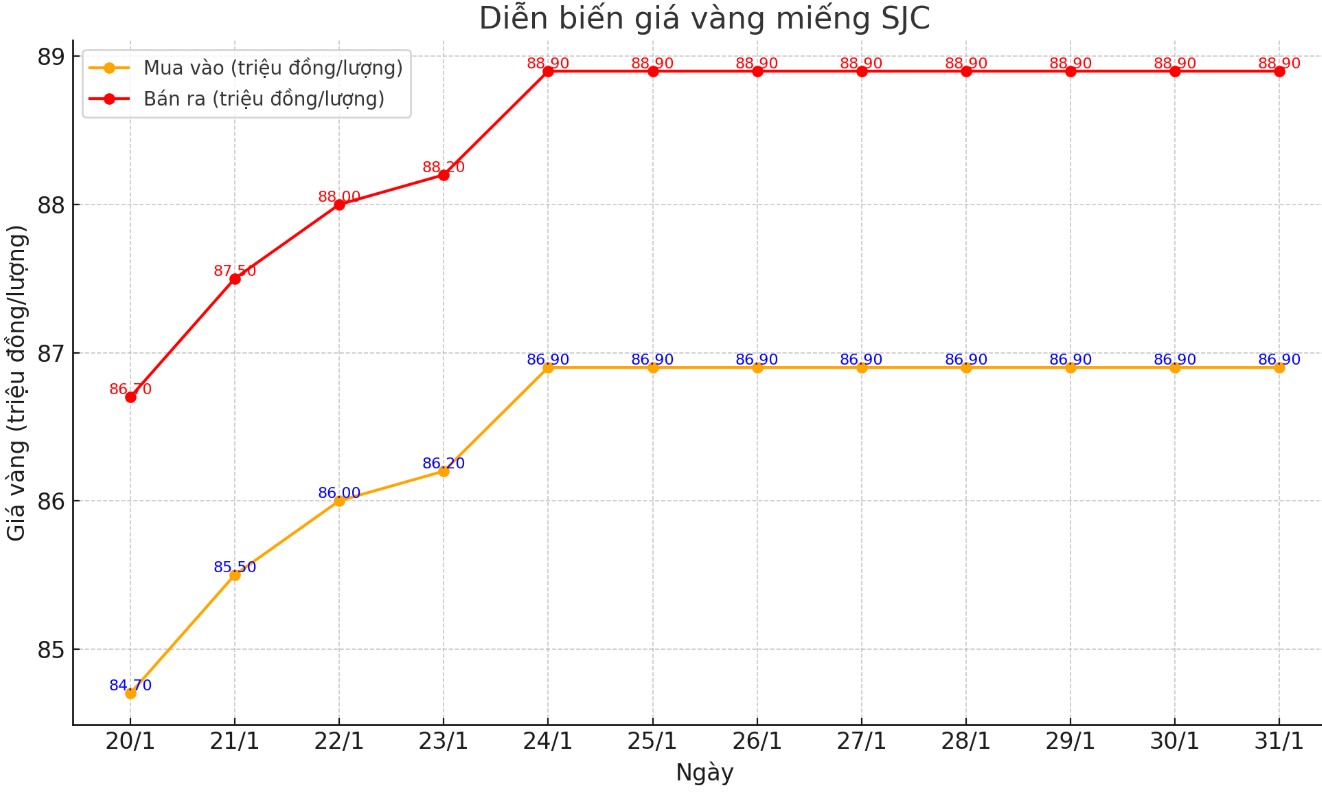

As of 8:45 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

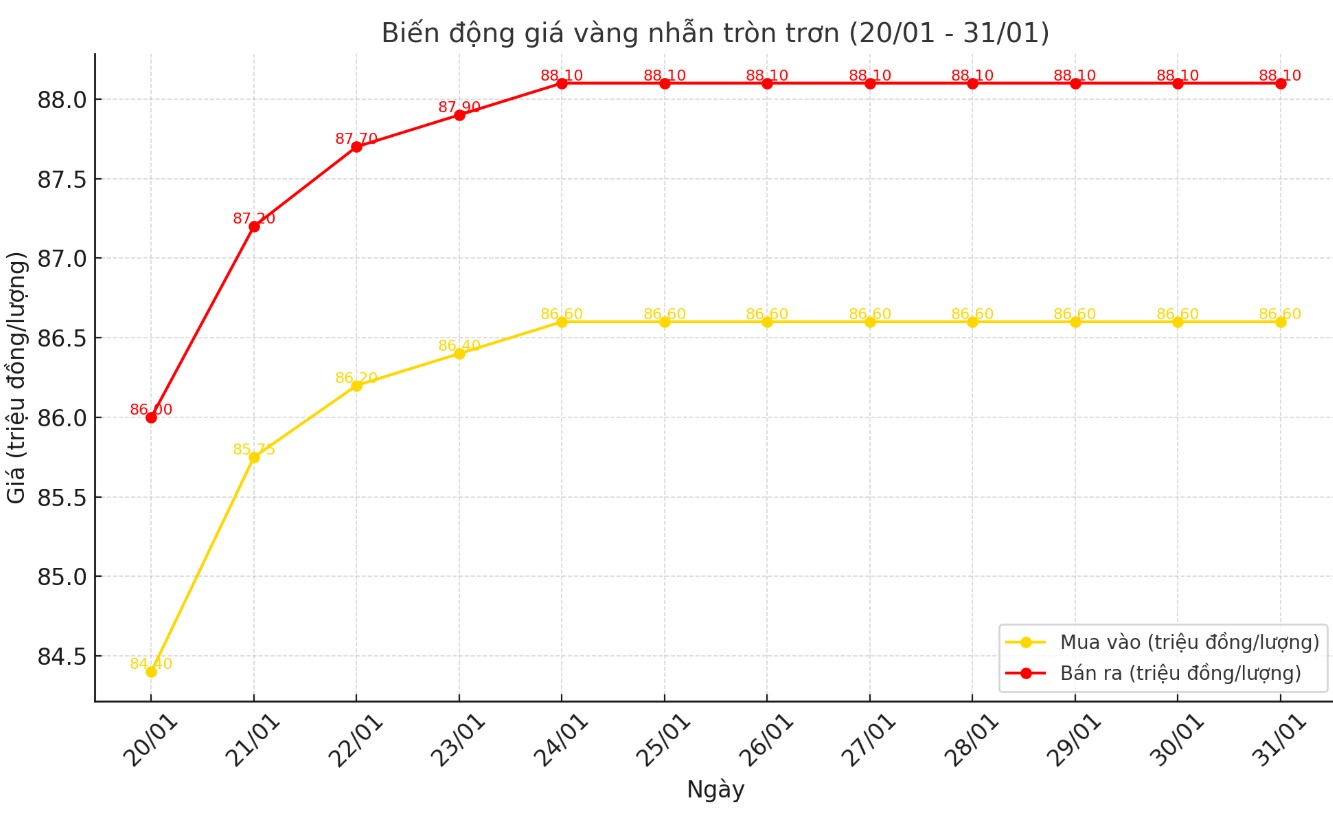

As of 8:45 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both selling prices remain the same compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 8:35 a.m., the world gold price listed on Kitco was at 2,794.9 USD/ounce, up 33.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased amid the decline of the USD. Recorded at 8:35 a.m. on January 31, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 107.940 points (down 0.04%).

Gold prices surged to a three-month high and are on track to hit a new record high, with safe-haven demand and technical buying fueling the gains in both precious metals.

According to Kitco - the market remains concerned about the trade and foreign policy of the new US President's administration, especially new tariff measures.

The US Federal Reserve (FED) in the Federal Open Market Committee (FOMC) meeting on Wednesday sent the message that they will keep interest rates unchanged for the foreseeable future. The FED emphasized that "inflation remains high".

However, Fed Chairman Jerome Powell dismissed the idea that there was no progress in controlling inflation in a press conference. He said the change in wording was just a “small wording adjustment” — “we just chose to shorten that sentence.” Powell declined to comment on how President Donald Trump’s policies might affect Fed policy. Markets did not react significantly to the FOMC statement or Powell’s remarks.

In another development, the European Central Bank (ECB) cut interest rates by 0.25%, marking the fifth consecutive meeting implementing monetary easing policy, amid economic data showing the Eurozone is stagnating.

Gold prices surged after U.S. pending home sales disappointed with a 5.5% drop in December, according to Ernest Hoffman, market analyst at Kitco News.

Data from the National Association of Realtors (NAR) released Thursday showed that its index of pending home sales in the United States fell 5.5% in December, following a revised 1.9% increase in November.

The data was much worse than forecast, with economists expecting a 0% change. All four regions in the US recorded declines in transactions compared to the previous month, with the West seeing the sharpest decline.

See more news related to gold prices HERE...