Update SJC gold price

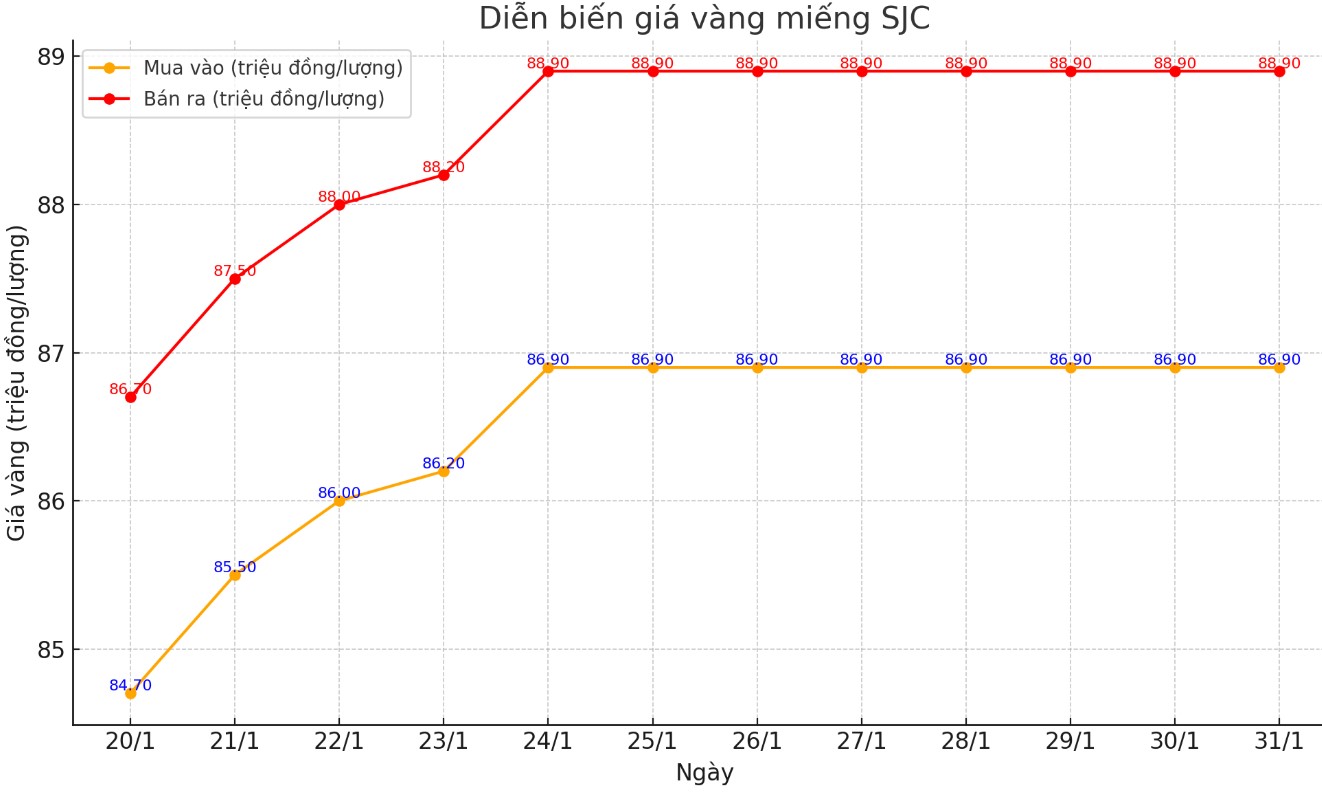

Up to now, the price of SJC gold bars listed by Saigon Jewelry Company SJC is at 86.8-88.8 million VND/tael (buy - sell); both buying and selling prices remain unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

As of 7:50 p.m. today, the price of round gold rings listed by DOJI Group is at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to the closing price of yesterday's trading session.

World gold price

As of 7:50 p.m., the world gold price listed on Kitco was at 2,807.5 USD/ounce, an increase of 29.8 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased despite the increase in the USD index. Recorded at 7:50 p.m. on January 31, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.110 points (up 0.45%).

The rise in gold prices came right after the US Federal Reserve (FED) decided to keep interest rates unchanged and signaled that the easing cycle could end sooner than market expectations.

In a press conference following the latest monetary policy decision, Fed Chairman Jerome Powell stressed that the committee is in no rush to cut interest rates as the inflation outlook remains uncertain and the labor market remains strong.

In an interview with Kitco News, Michele Schneider - chief strategist at MarketGauge - said that when gold clearly breaks through the $2,800/ounce threshold, prices could go straight to $3,000/ounce.

Some experts say geopolitical uncertainty due to the policies of the new US administration of President Donald Trump is boosting demand for safe havens, pushing gold prices higher sooner than expected.

Ricardo Evangelista, market analyst at ActivTrades, said gold's safe-haven appeal was outweighing the threat of higher interest rates.

“Despite Jerome Powell’s signal that interest rates could stay high for longer due to persistent inflation risks and a strong labor market, the reaction in U.S. bond yields has been muted. Investors remain concerned about the potential impact of the new administration’s protectionist trade policies.

This creates a favorable environment for gold - a non-yielding asset that attracts safe-haven flows from investors seeking protection against economic uncertainty," Evangelista analyzed.

See more news related to gold prices HERE...