Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

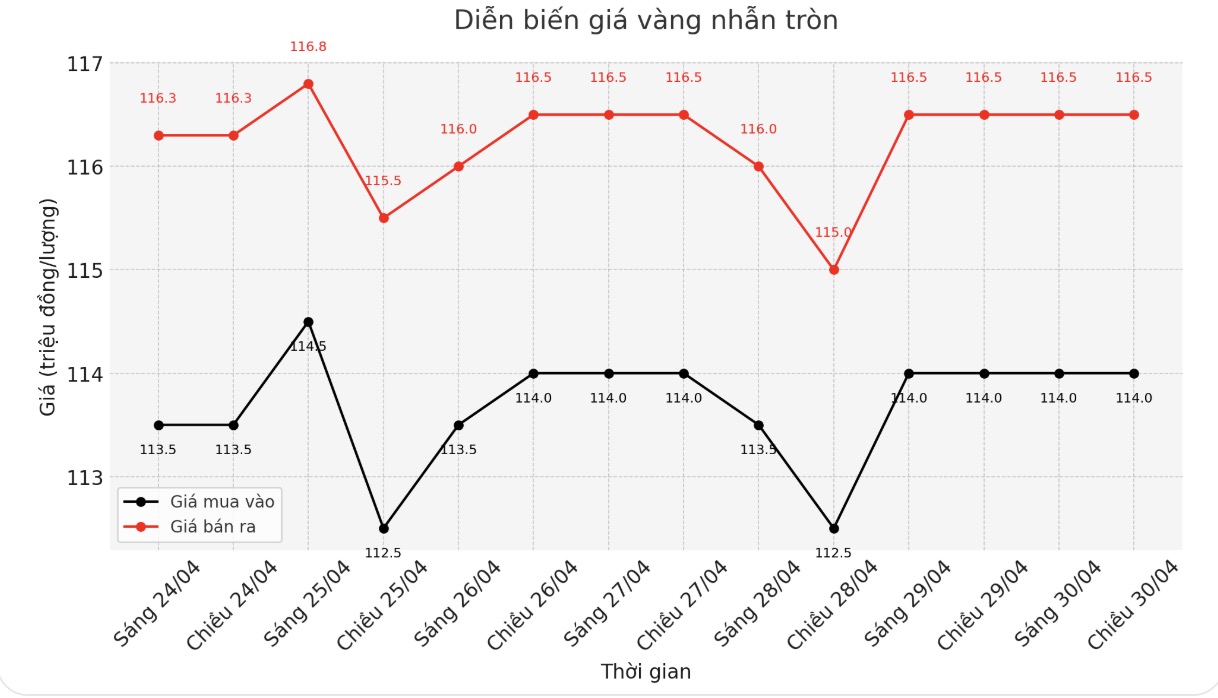

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.9-119,5 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

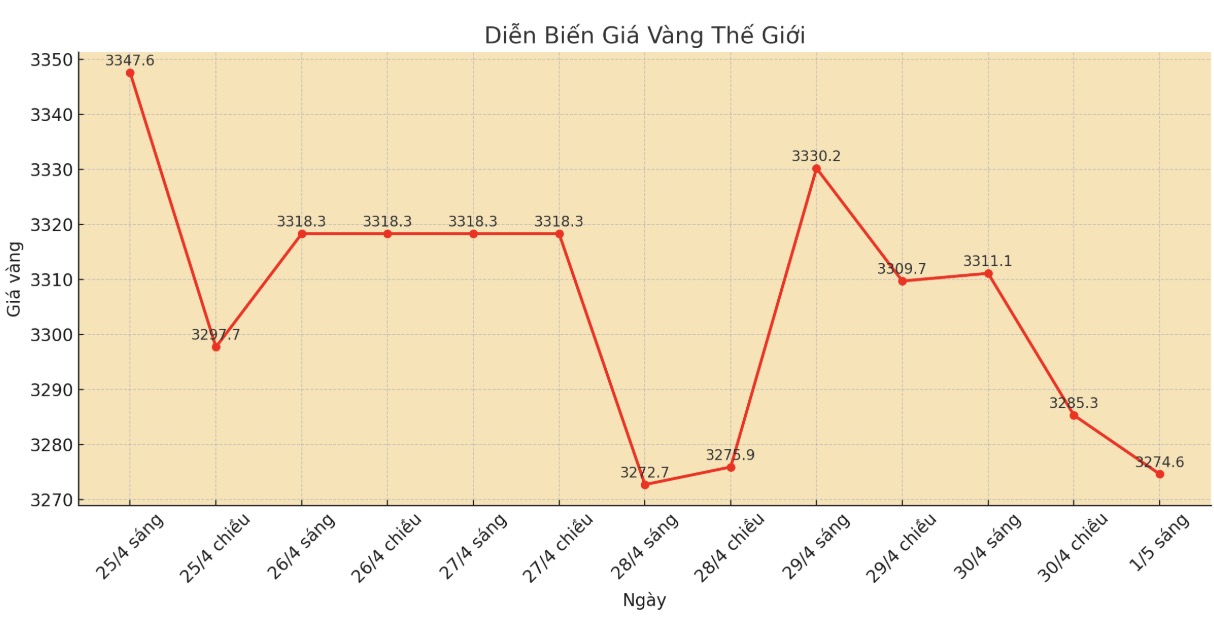

World gold price

At 6:00 a.m., the world gold price listed on Kitco was around 3,274.6 USD/ounce, down 39 USD.

Gold price forecast

Gold prices fell despite weaker-than-expected US economic data. Meanwhile, silver prices fell sharply. The plummeting crude oil price this week also put pressure on both the gold and silver markets.

June gold contract decreased by 15.2 USD, to 3,318.6 USD/ounce; May silver contract decreased by 0.67 USD, to 32.605 USD/ounce.

The US National ADP Employment Report for April was disappointing, recording only 62,000 new jobs, while expectations were 120,000. At the same time, US GDP in the first quarter of 2025 decreased by 0.3%, contrary to the forecast increase of 0.4%. These figures raised expectations that the Fed will soon cut interest rates.

The US stock index fell sharply in the lunch session due to the impact of weak economic data. Investors are waiting for the US Department of Labor's key jobs report due on Friday, which is considered the most influential economic data since the beginning of the year.

In other developments, China's economy has begun to be significantly affected by the trade war with the US. New export orders in April plummeted to their lowest level since the pandemic, and production activity weakened for more than a year.

The sharp decline shows that Donald Trumps tariffs on Chinese goods are starting to tighten the economy, forcing China to step up growth stimulus measures, according to Dow Jones Newswires.

Technically, the short-term trend of June gold delivery is still leaning towards buyers. The next target for buyers is to close above $3,509.9/ounce. The bears will try to push prices below the strong support level of $3,200/ounce.

The immediate resistance was a high of $3,337.6 an ounce and then a weekly high of $3,363.8/ounce. The most recent support was $3,300/ounce and followed by last week's low of $3,270.8/ounce.

In the outside market, the USD index increased slightly, Nymex crude oil prices fell sharply, trading around 58.5 USD/barrel. The yield on the US 10-year Treasury note is currently around 4.2%.

Note: Gold price data is compared to the same time of the previous trading session.

See more news related to gold prices HERE...