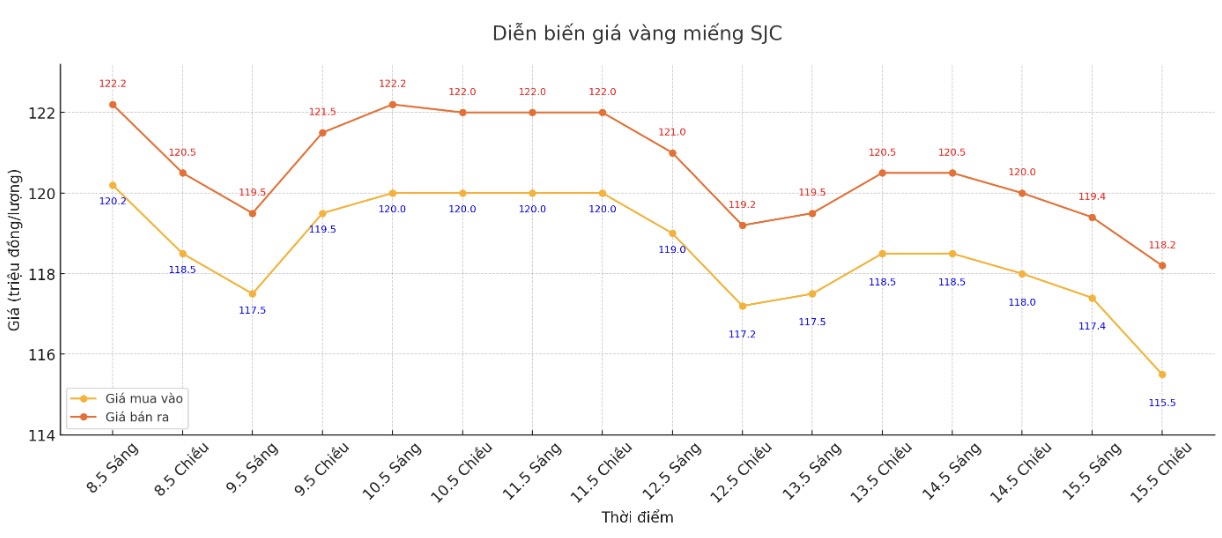

Updated SJC gold price

As of 6:00 a.m. on May 16, the price of SJC gold bars was listed by Saigon Jewelry Company at VND115.5-118.2 million/tael (buy - sell), down VND2.5 million/tael for buying and down VND1.8 million/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.5-118.2 million VND/tael (buy - sell), down 2.5 million VND/tael for buying and down 1.8 million VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.5-118.2 million VND/tael (buy - sell), down 2.5 million VND/tael for buying and down 1.8 million VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 114.5-118.2 million/tael (buy - sell), down VND 2.5 million/tael for buying and down VND 1.8 million/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

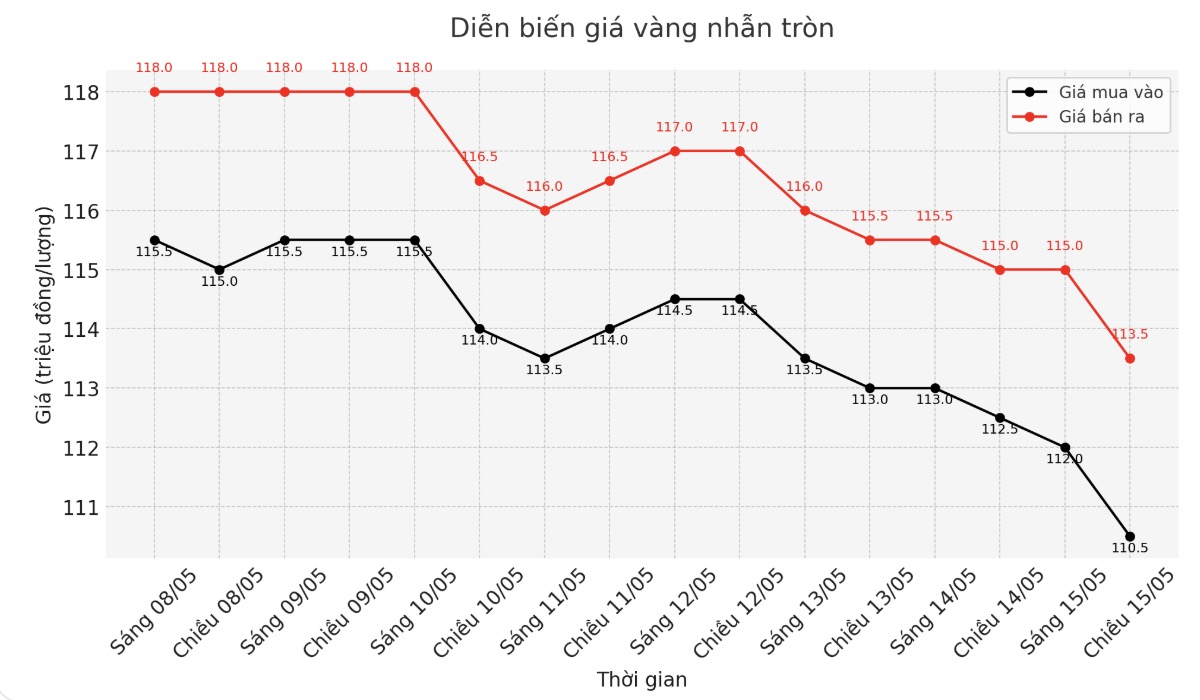

9999 round gold ring price

As of 6:00 a.m. on May 16, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND 110.5-113.5 million/tael (buy - sell), down VND 2 million/tael for buying and down VND 1.5 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.5-116.5 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111-114 million VND/tael (buy in - sell out), down 2.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

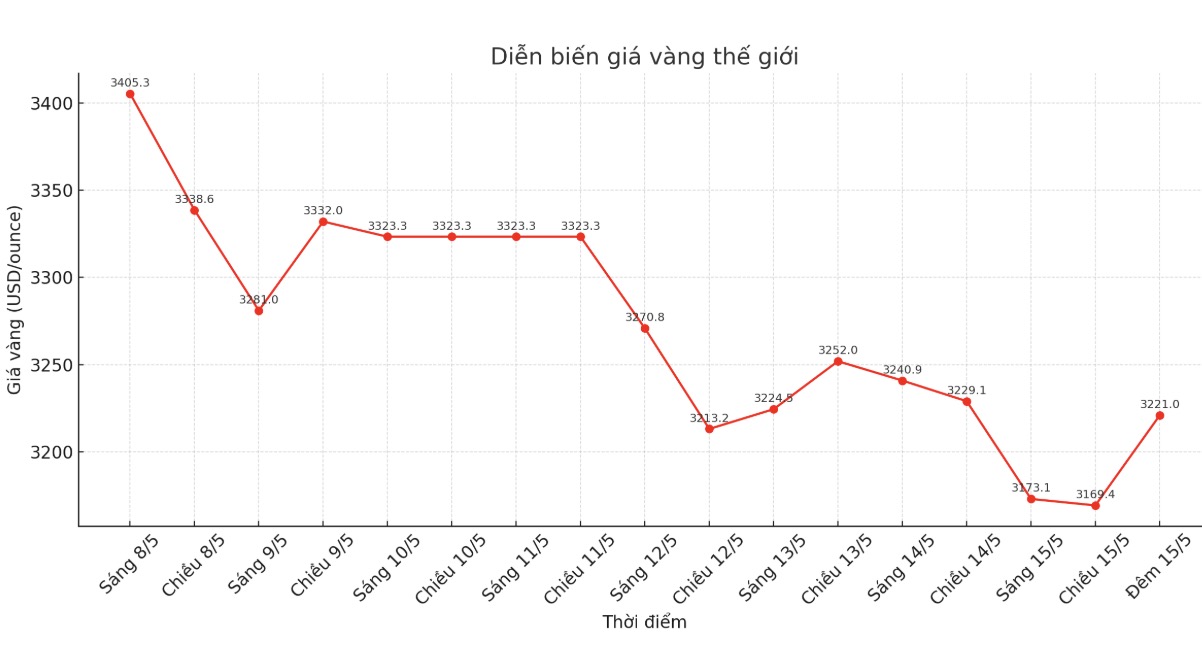

World gold price

At 11:40 p.m. on May 15, the world gold price listed on Kitco was around 3,221 USD/ounce, up 32.1 USD/ounce.

Gold price forecast

According to Kitco, gold selling pressure is being limited as risk appetite in the general market has declined this weekend. June gold contract decreased by 2.90 USD, to 3,185.4 USD/ounce. July delivery silver price decreased by 0.119 USD, to 32.325 USD/ounce.

Asian and European stock markets traded overnight with opposite movements or weakening. US stock indexes are expected to open weaker in today's session in New York.

David Morrison from Trade Nation commented: "Currently, the market seems to be in a state of stagnation. There is still a lack of clarity surrounding the trade policy of the Donald Trump administration, which creates a sense of uncertainty for the global economic outlook.

All eyes are now on negotiations between the US and other trading partners such as Japan, India and South Korea. Meanwhile, there are concerns about how much damage may have occurred since President Trump announced a counter-tax program early last month, said David Morrison.

In the short term, buyers and sellers on the June gold market are in a balanced position, but buyers are gradually weakening. The next upside target for buyers is to get prices above the resistance level of $3,300/ounce. The target for the bears to reduce prices is to push prices below the threshold of 3,100 USD/ounce.

The first resistance was seen at the overnight peak of $3,195.6 an ounce, followed by $3,200 an ounce. First support was $3,150/ounce, followed by an overnight bottom of $3,123.3/ounce.

The important outside market today recorded a weaker USD index. Nymex crude oil futures fell sharply, trading around $61/barrel. The yield on the US 10-year Treasury note is currently at 4.513%.

See more news related to gold prices HERE...