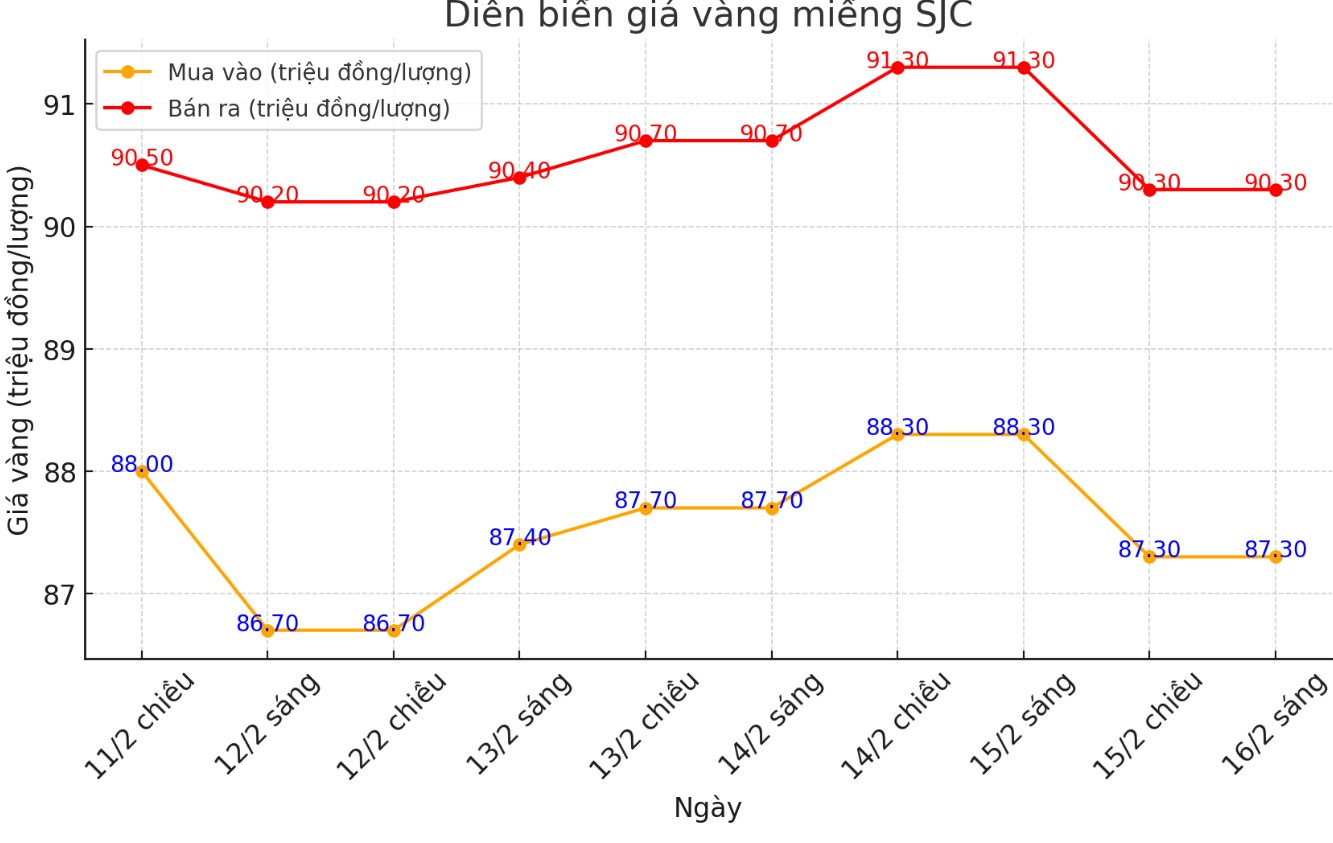

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 87.3-90.3 million VND/tael (buy in - sell out).

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 87.3-90.3 million VND/tael (buy in - sell out). The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 3 million VND/tael.

DOJI Group listed the price of SJC gold bars at 87.3-90.3 million VND/tael (buy in - sell out). The difference between the buying and selling prices of SJC gold was listed by DOJI at 3 million VND/tael.

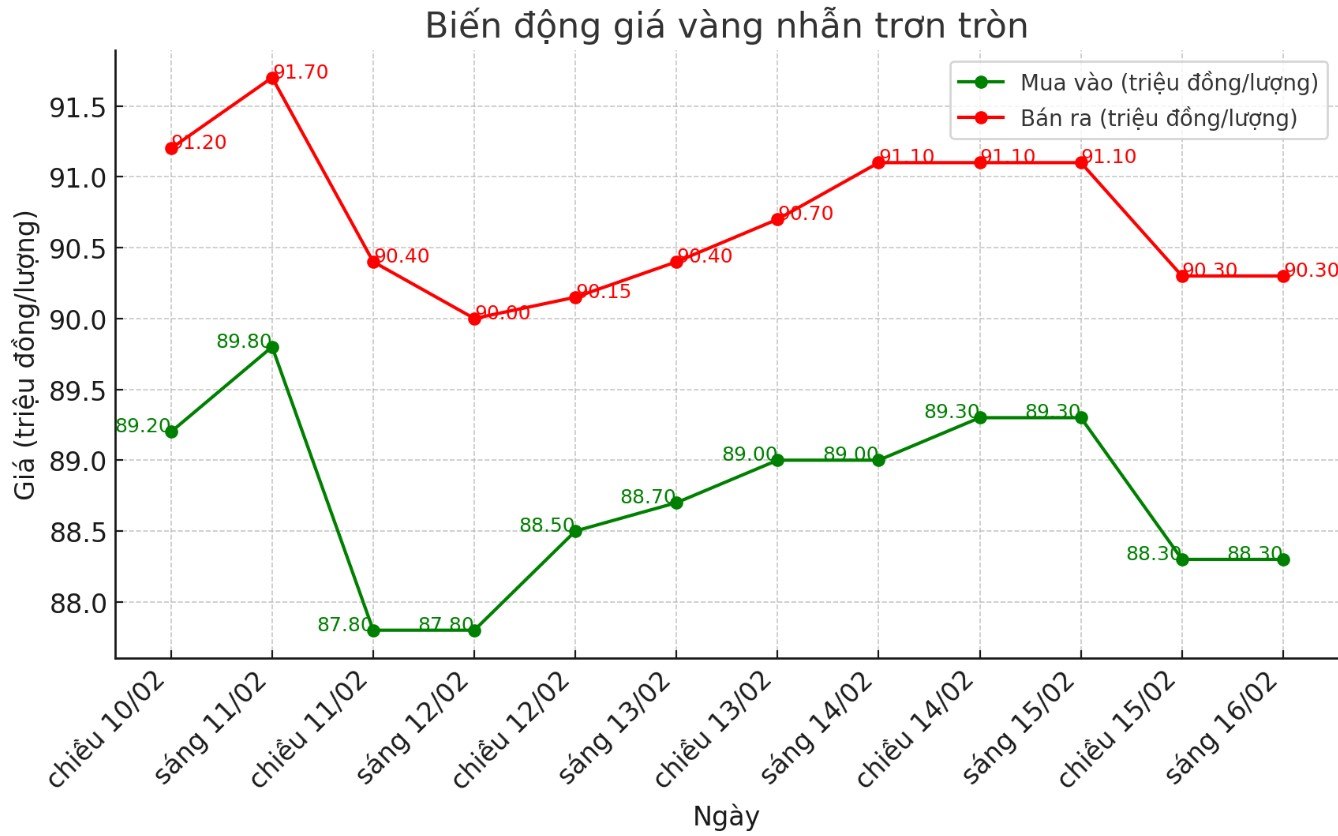

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at 88.3-90.3 million VND/tael (buy in - sell out). The difference between buying and selling is listed at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.45-90.3 million VND/tael (buy in - sell out). The difference between buying and selling is 1.85 million VND/tael.

World gold price

As of 6:00 a.m. on February 17, the world gold price listed on Kitco was at 2,882.4 USD/ounce.

Gold price forecast

World gold prices fell in the last trading session of the week despite the decline of the USD. Recorded at 6:00 a.m. on February 17, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.580 points (down 0.6%).

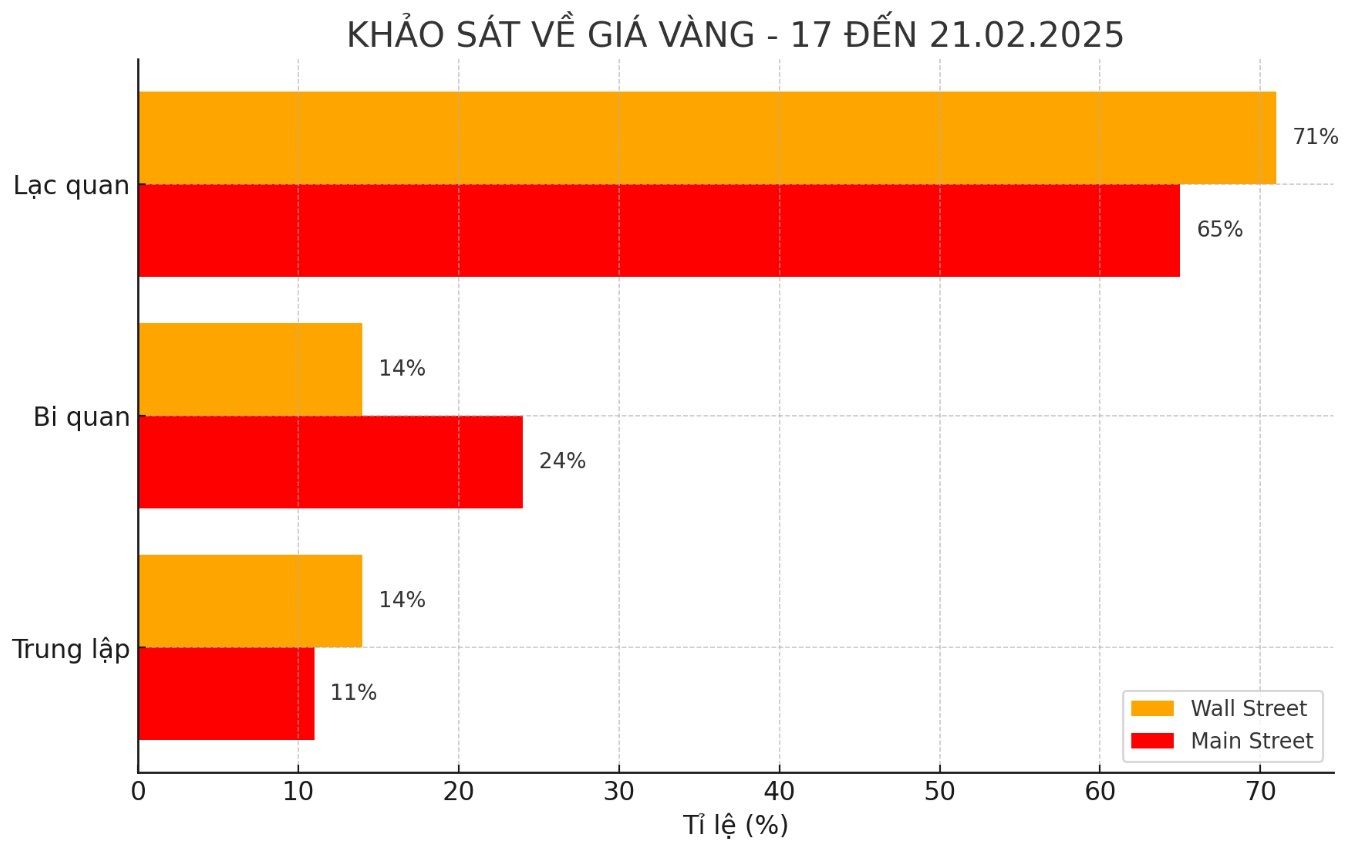

The latest weekly gold survey from Kitco News shows that industry experts are still bullish but more divided than last week. Meanwhile, retail traders are also cautious in expecting gold prices to continue to rise.

Of the 14 experts participating in the Kitco News Gold Survey, 10 people (equivalent to 71%) predict that gold prices will continue to increase this week. Two (14%) see the precious metal falling. The remaining two predict gold prices will remain flat.

Meanwhile, Kitco's online poll attracted 201 votes. Small investors are also less optimistic but still maintain a positive view on the outlook for gold. 131 retail traders (65%) expect gold prices to rise this week. 48 people (24%) predict prices will fall and the remaining 22 people (11%) see gold moving sideways in the short term.

The Bank of America (BofA) has recently maintained its forecast of world gold prices reaching $3,000/ounce in the near future, but admitted that this could be just a milestone in a stronger price increase.

Michael Widmer - commodity strategist at BofA commented that the main driver behind the recent increase in gold prices is the fact that central banks around the world are increasing gold purchases to cope with economic and geopolitical instability.

Factors such as the US budget deficit, trade disputes, war, sanctions and the risk of international asset freezes have boosted the flow of money into the precious metal.

One of the key factors that could continue to push gold prices higher is China. The Chinese government has recently launched a pilot program allowing the country's insurance companies to invest up to 1% of their assets in gold.

According to BofA's estimate, if Chinese insurance companies take advantage of the 1% ceiling, the capital poured into gold could reach about 180-200 billion yuan (equivalent to 25-28 billion USD). This could create demand for an additional 300 tons of gold, accounting for about 6.5% of the total annual physical market demand. This is an important step in maintaining gold's long-term upward momentum.

Not only China, the US gold market is also witnessing significant fluctuations. Widmer said that one of the factors causing the sharp increase in the price of gold futures contracts is concerns about President Donald Trump's tariff policies.

Economic data that could impact gold prices this week include: Empire State Production Survey - an economic index released monthly by the US Federal Reserve (FED) branch in New York, to assess the performance of the manufacturing sector in New York state on Tuesday.

Minutes of the Fed's most recent monetary policy meeting and data on Construction Start-ups and US Housing Construction Permits on Wednesday; US weekly jobless claims report and Philadelphia Federal Reserve Production Survey on Thursday morning. Finally, the S&P Flash PMI and the US home sales report on Friday.

See more news related to gold prices HERE...