Gold price developments last week

The gold market this week was affected by inflation data, the National Assembly hearing of US Federal Reserve Chairman Jerome Powell, tariff threats and geopolitical developments. However, by Friday afternoon, the pressure had eased and some traders began taking profits.

Spot gold prices opened the week at $2,863.31 an ounce, but quickly soared, hitting $2,880 an ounce at midnight Eastern time (EST) and reaching $2,905 an ounce when North American markets opened on Monday morning. At 9:00 p.m. EST on the same day, spot gold hit a new peak of $2,940 an ounce.

The $2,900/ounce threshold played a solid support role throughout the week, as gold prices fluctuated strongly in the face of economic data and statements that affected the market.

Fed Chairman Jerome Powell began a two-day hearing before the National Assembly on Tuesday morning. Gold prices fell to $2,884 an ounce at 8:00 a.m., but when Mr. Powell entered the hearing at the Senate Banking Committee at 10:00 a.m., prices returned to $2,900 an ounce.

On Wednesday morning, spot gold prices were at $2,871 an ounce, their lowest since the beginning of the week. However, higher-than-expected CPI inflation data at 8:30 a.m. pushed gold back up to $2,890 an ounce, and during Powell's hearing with the House Financial Services Committee, gold prices continued to increase to $2,908/ounce.

After a slight correction in the mid-afternoon, gold prices began to increase most steadily during the week, although not too strong. From $2,895/ounce at 6:15 p.m., prices gradually edged up to $2,922/ounce just overnight.

On Thursday morning, US PPI inflation data was higher than forecast, causing gold prices to slightly decline, but as the North American market closed, spot gold remained around $2,930/ounce.

Thanks to positive developments in trading sessions in Asia and Europe, gold prices continued to increase and reached nearly 2,940 USD/ounce at around 5:00 a.m. Eastern time.

However, this is the highest level of the week, as gold has tried to surpass the peak three times on Monday evening but failed, causing prices to plummet.

Selling pressure increased after the US retail sales report for January disappointed. Spot gold prices fell sharply from $2,932/ounce at 7:15 to $2,886/ounce at 1:45 p.m. and remained around this level throughout the weekend trading session.

What do experts predict about gold prices next week?

The latest weekly gold survey from Kitco News shows that industry experts are still positive but more cautious than last week. Meanwhile, retail traders are also cautious in expecting gold prices to continue to rise.

Last week, 17 experts participated in the Kitco News gold survey. Notably, none of them predict gold prices will fall. 15 experts, or 88%, expect gold to continue to set new peaks next week. Only 2 people, equivalent to 12%, thought the price would be flat.

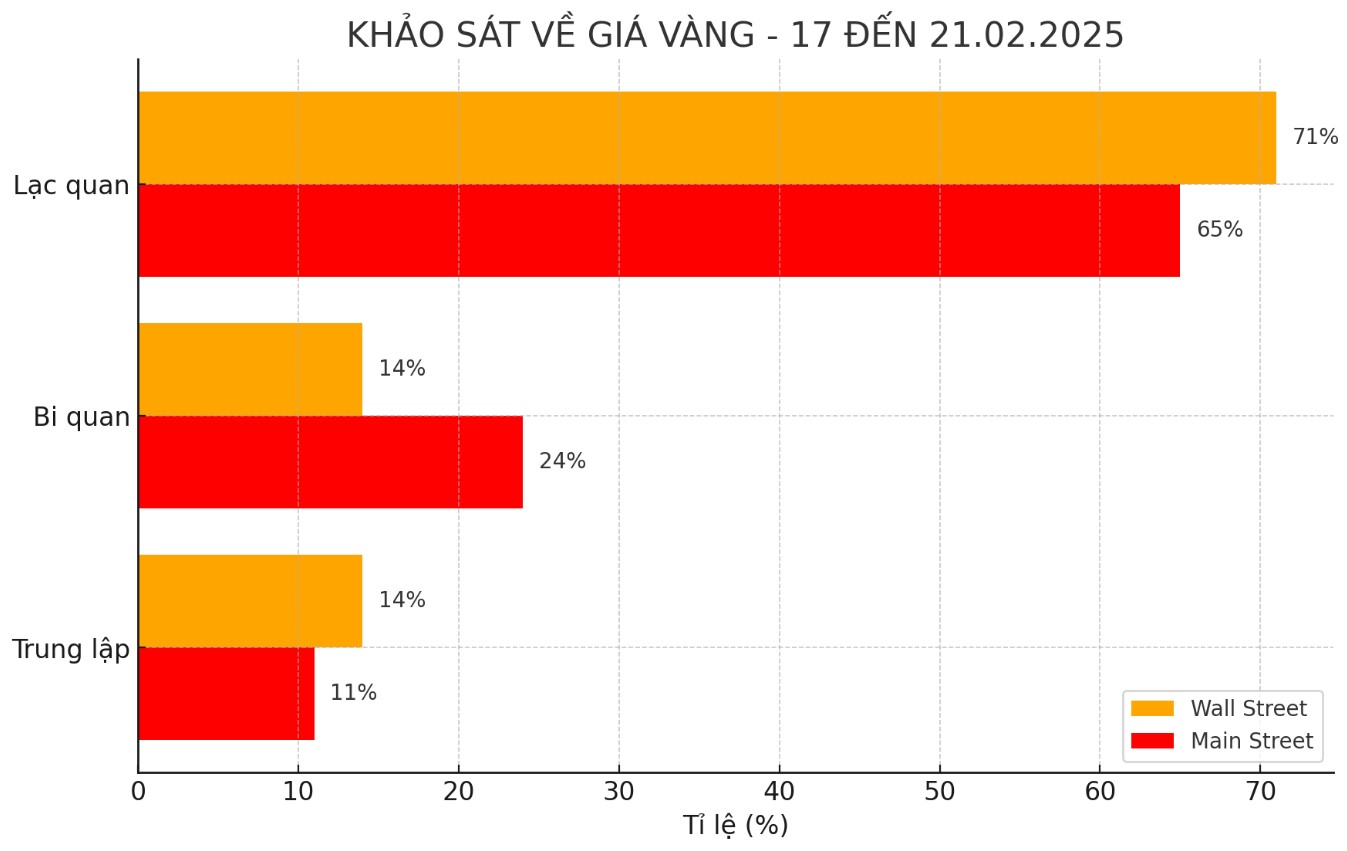

This week, out of 14 experts participating in the Kitco News Gold Survey. Ten people (71%) predict gold prices will continue to rise next week. Two (14%) see the precious metal falling. The remaining two predict gold prices will remain flat.

Kitco's online poll this week attracted 201 votes. Investors are also less optimistic but still maintain a positive view on the outlook for gold. 131 retail traders (65%) expect gold prices to rise next week. 48 people (24%) predict prices will fall and the remaining 22 people (11%) see gold moving sideways in the short term.

Economic calendar affecting gold prices next week

After a volatile week with a series of economic data and news strongly impacting the market, next week is expected to be less stressful when the US market closes on Monday on the occasion of President's Day.

Some data that could affect gold prices next week include:

Tuesday: Empire State Production Index (economic index measuring the business conditions of the manufacturing sector in New York state, USA. This index is published monthly by the US Federal Reserve (FED) New York branch, based on a survey of manufacturers in the region).

Wednesday: US housing data (New builds and Construction Permits), FED meeting minutes.

Thursday: USWeeks Unemployment Insurance Application, FED Philadelphia Production Survey.

Friday: S&P Flash PMI, Current home sales in the US

See more news related to gold prices HERE...