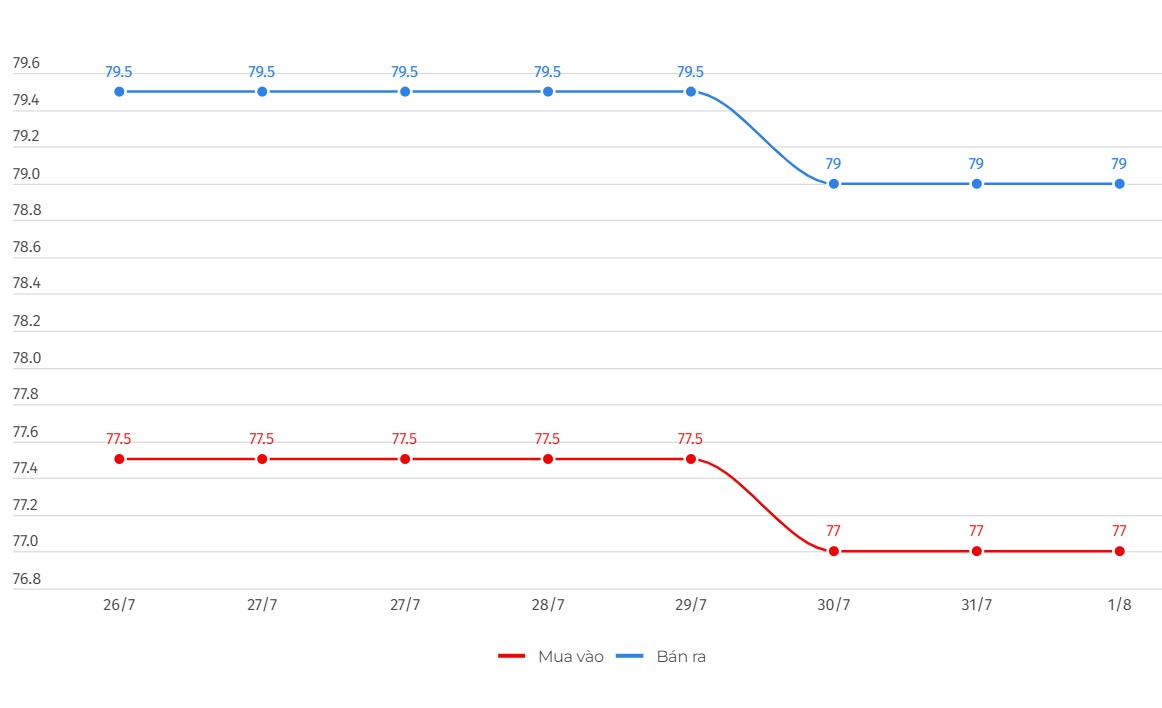

SJC gold bar price

Gold ring price 9999

As of 6:00 a.m., the price of 9999 Hung Thinh Vuong plain round gold ring at DOJI was listed at 76.10-77.30 million VND/tael (buy - sell); increased 350,000 VND/tael of purchased afternoon tea and increased 300,000 VND/tael of sold afternoon tea.

Saigon Jewelry Company lists gold ring prices at 75.95-77.3 million VND/tael (buy - sell); increased sharply by 350,000 VND/tael when purchased and increased by 300,000 VND/tael.

Bao Tin Minh Chau listed the gold ring price at 76.28-77.28 million VND/tael (buy - sell); increased 450,000 VND/tael of purchased afternoon tea and increased 250,000 VND/tael of sold afternoon tea.

In recent sessions, gold ring prices often fluctuate in the same direction as the world market. In the context of world gold prices skyrocketing early this morning, gold ring prices may increase sharply in today's trading session, August 1.

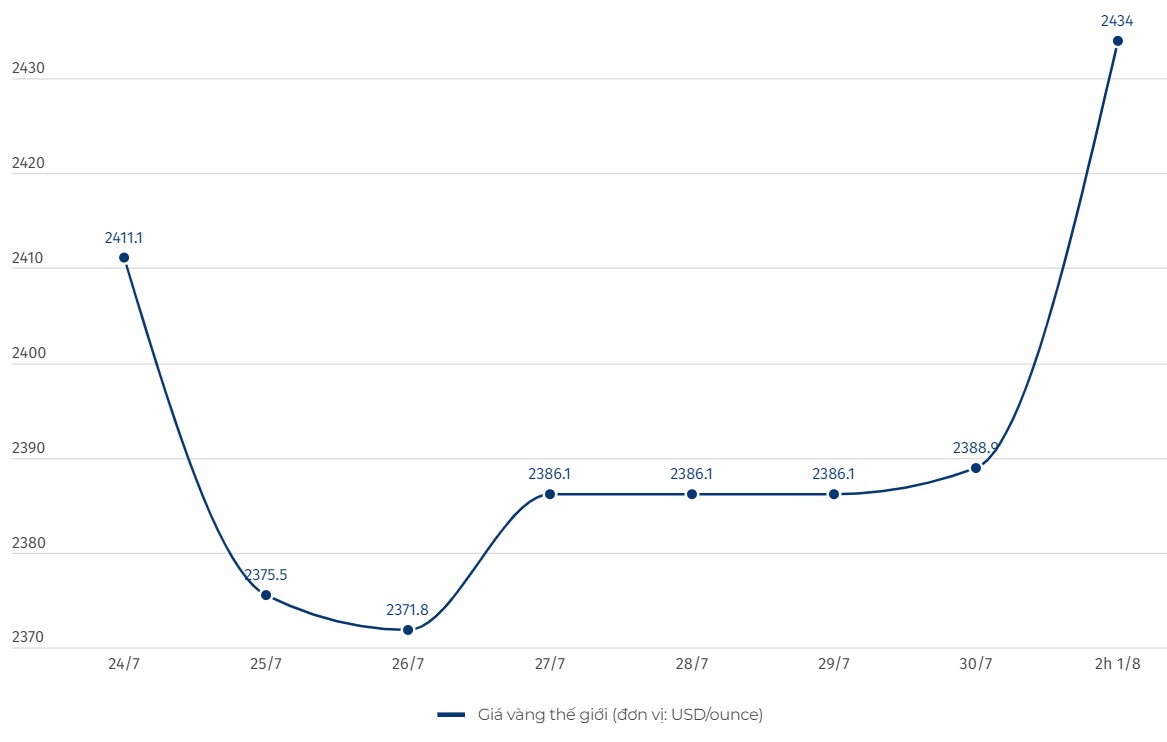

World gold price

As of 6:00 a.m. on August 1, the world gold price listed on Kitco was at 2,434 USD/ounce, a sharp increase of 26 USD/ounce compared to the beginning of yesterday morning's session.

Gold price forecast

World gold prices broke out in the context of the USD index falling. Recorded at 2:00 a.m. on August 1, the US Dollar Index measuring the fluctuation of the greenback with 6 major currencies was at 103,847 points (down 0.44%).

Gold prices increased after the announcement of the US monetary policy decision from the FED's Open Market Committee (FOMC). As expected by many experts, the unit kept the federal funds rate unchanged in the range of 5.25% to 5.50%.

Elsewhere, the Bank of Japan raised its key interest rate from 0% to 0.25% on Wednesday. BOJ also said it will reduce the amount of government bonds purchased by half. This news pushed the Yen up against the USD.

Tighter monetary policy in Japan, combined with the possibility of upcoming US interest rate cuts this year, has changed investment flows, putting pressure on the USD, thereby supporting gold prices.

Precious metals also benefit from safe-haven buying as geopolitical tensions tend to escalate.

Besides, Ole Hansen - Head of Commodity Strategy at Saxo Bank commented that even if gold loses all of its 2024 gains, the precious metal will continue to shine because ETF investors are showing their enthusiasm. renewed interest in gold.