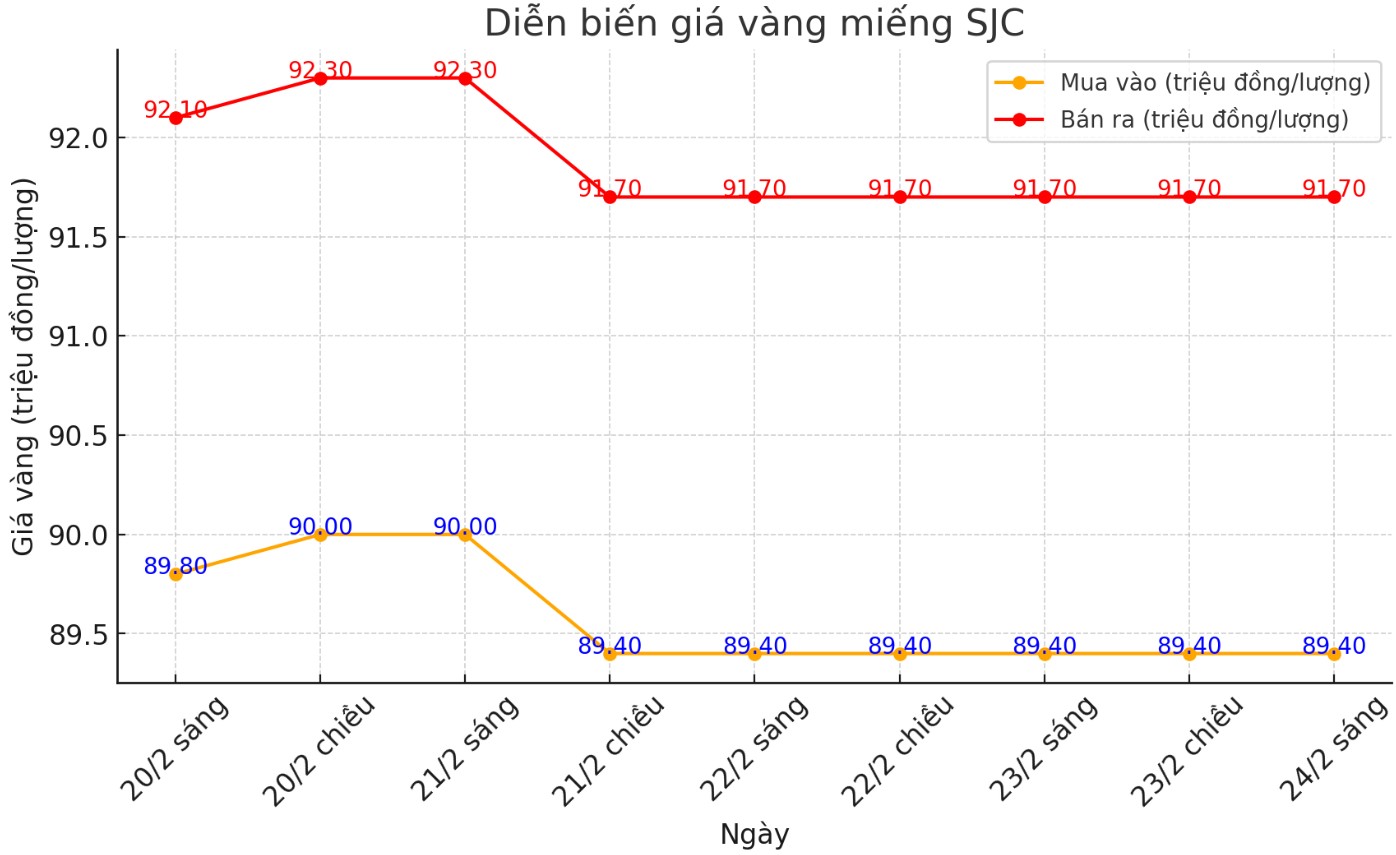

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.4-91.7 million/tael (buy in - sell out), unchanged in both directions.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND89.6-91.7 million/tael (buy in - sell out), keeping both buying and selling prices unchanged. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2.1 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND89.4-91.7 million/tael (buy in - sell out), unchanged in both directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

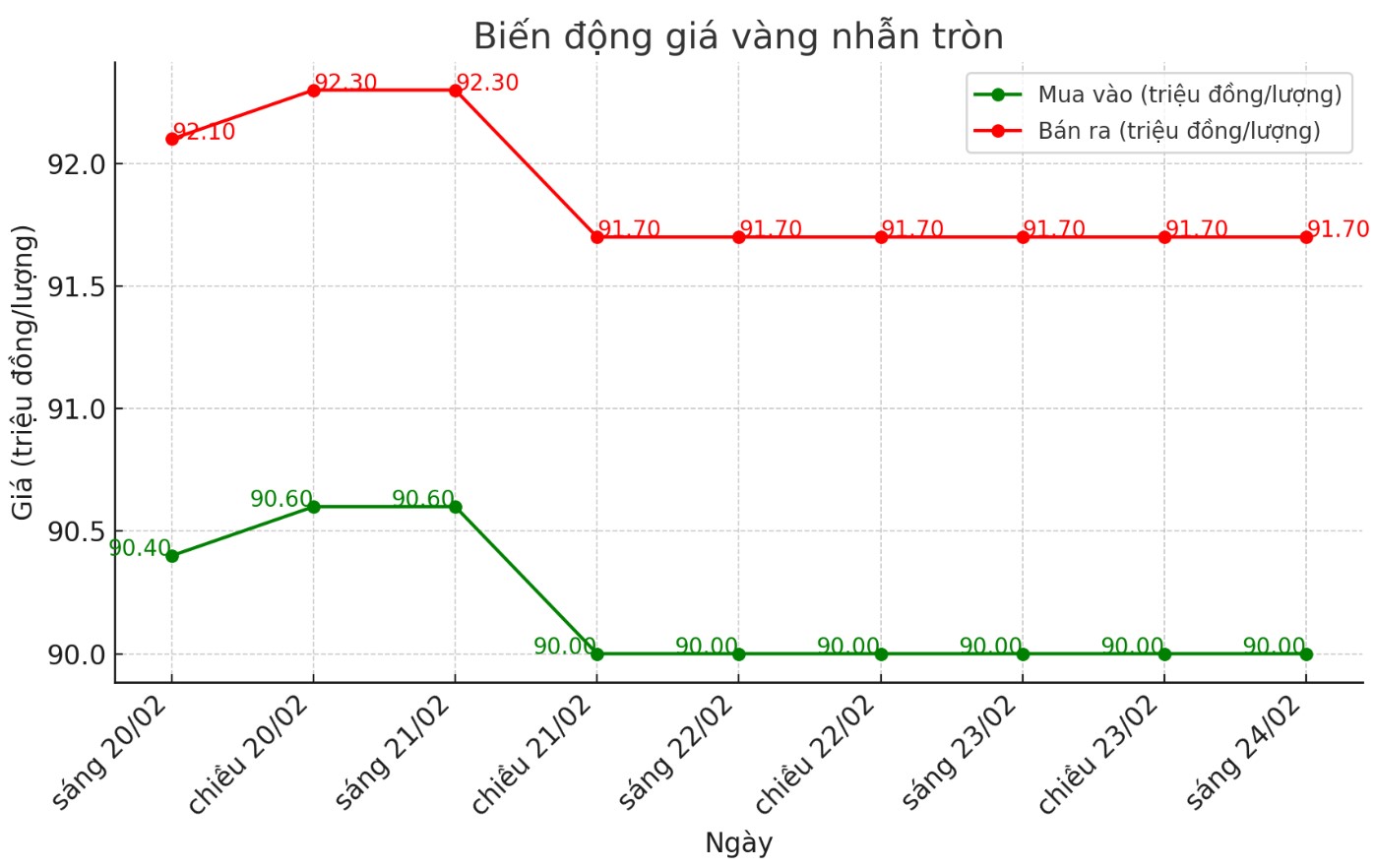

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at 90-91.7 million VND/tael (buy in - sell out); both buying and selling prices remain unchanged. The difference between buying and selling is listed at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.2-91.8 million VND/tael (buy in - sell out); both buying and selling prices remain unchanged. The difference between buying and selling is 1.6 million VND/tael.

World gold price

As of 6:00 a.m. on February 24, the world gold price listed on Kitco was at 2,936.2 USD/ounce, unchanged from the same time of the previous session.

Gold price forecast

World gold prices are under pressure in the context of the USD increasing. Recorded at 6:00 a.m. on February 24, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.520 points (up 0.24%).

Kitco News' weekly gold survey shows that industry experts are increasingly cautious about gold's short-term prospects, while individual investors are more optimistic about the possibility of price increases.

17 experts participated in the Kitco News gold survey, with optimism on Wall Street continuing to be restrained. 9 experts (53%) predict gold prices will increase this week. Four (24%) see prices falling, while the other four see gold moving sideways.

Meanwhile, 204 individual investors participated in Kitco's online survey, with an increasingly optimistic sentiment. 144 people (71%) expect gold prices to increase this week, 34 people (17%) predict gold will decrease, and 26 people (13%) expect gold prices to move sideways in the short term.

James Stanley - Senior market strategist at Forex.com said that gold prices will not face any significant resistance until they reach the $3,000/ounce mark. He emphasized that this is an important psychological threshold, which needs time for the market to absorb.

I expected gold to hit $3,000 an ounce, but it could hover around for a while, he said.

Stanley believes that gold's increase above the $3,000/ounce mark will depend on the US government's fiscal policy and the Fed's monetary policy.

Gold prices are rising because even though the Fed is keeping interest rates unchanged, they understand that they cannot continue to raise interest rates higher, he said.

Assessing gold prices this week, Naeem Aslam - Investment Director at Zaye Capital Markets believes that inflation data could be the biggest risk for gold prices.

Currently, the biggest risk for gold is a shift in monetary policy expectations. If inflation cooles down faster than expected or central banks tighten policy more strongly, gold prices may be under downward pressure.

In addition, any significant recovery of the US dollar or rising bond yields could threaten gold's current rally, he said.

Notable economic events that may affect gold prices

Tuesday: US consumer confidence index.

Wednesday: New home sales in the US.

Thursday: US Q4 preliminary GDP, US long-term goods orders, US weekly jobless claims, US pending home sales.

Friday: US core PCE index, personal income and spending.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...