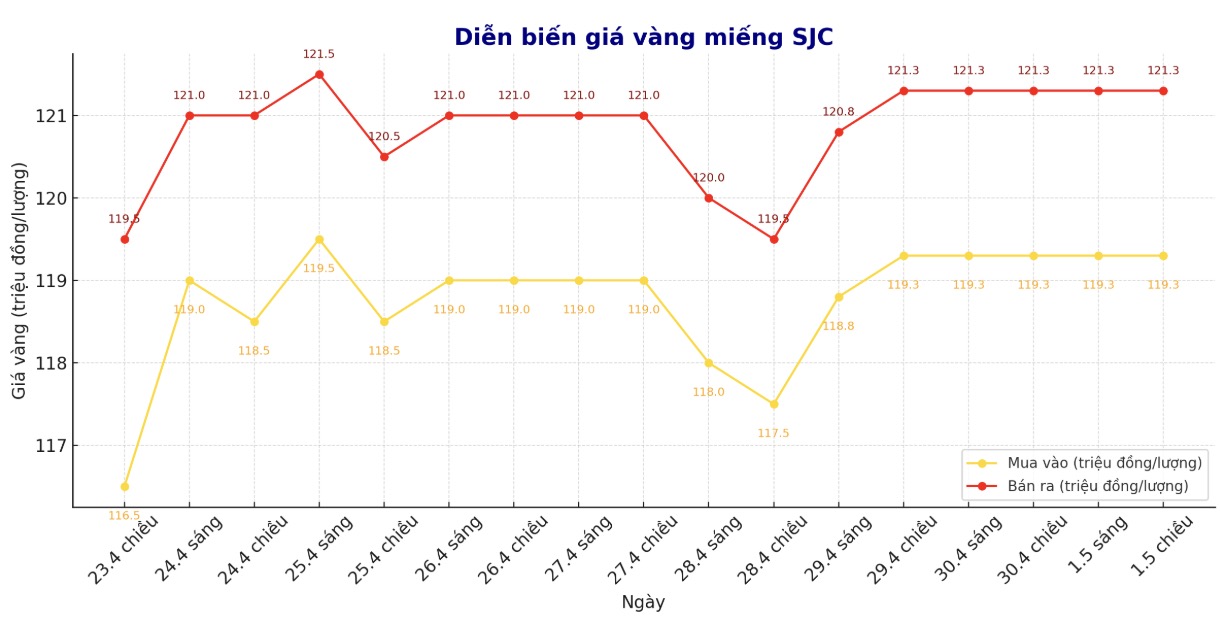

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

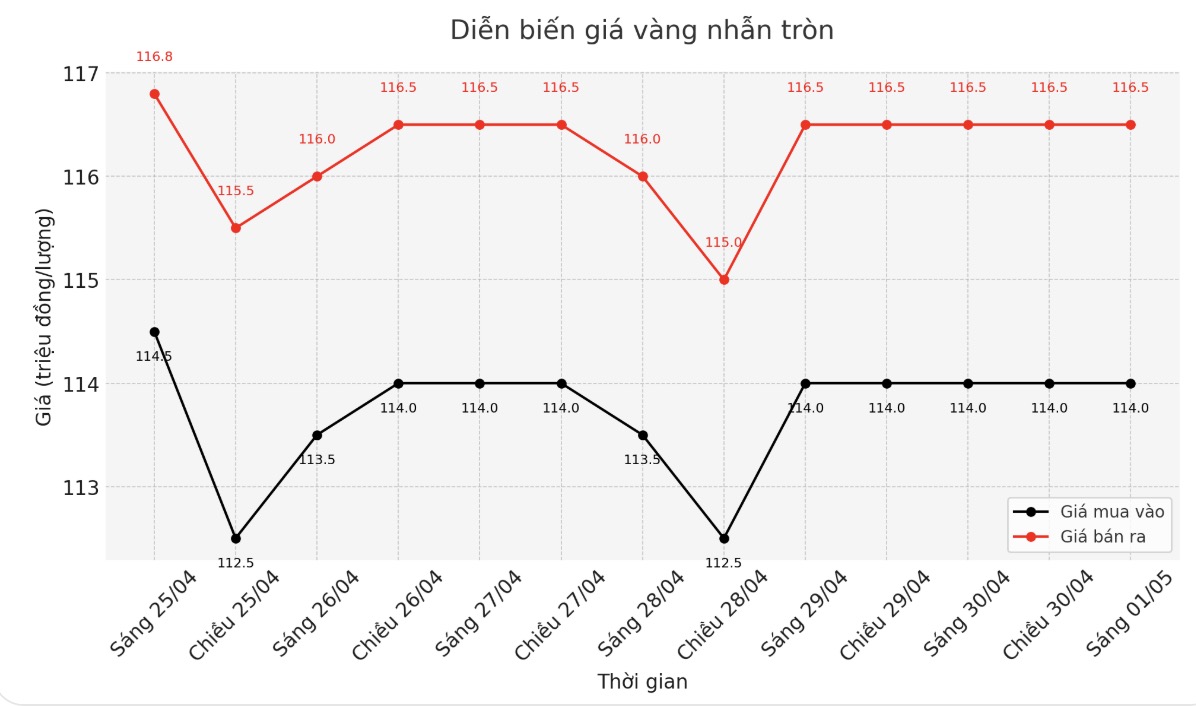

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119 1.6 million VND/tael (buy - sell), down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is 3.3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

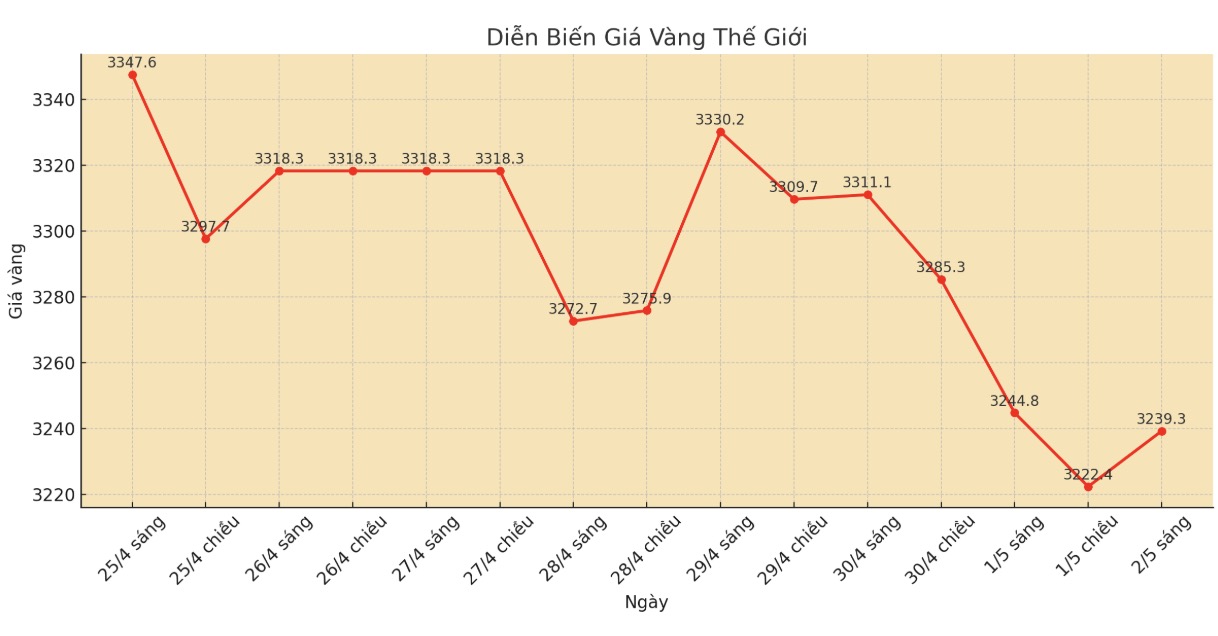

World gold price

At 4:45 a.m., the world gold price listed on Kitco was around 3,239.3 USD/ounce, down 35.3 USD.

Gold price forecast

According to Kitco, gold prices fell sharply as risk-off sentiment in the market improved over the weekend. Profit-taking and sell-off from short-term investors are the main reasons for price declines. Silver prices also decreased slightly.

The sharp decline in crude oil prices this week along with the soaring USD index has created additional downward pressure on both gold and silver. June gold contract lost 96.30 USD, to 3,222.5 USD/ounce. May delivery fell $0.366 to $22.165 an ounce.

The next focus is the US April jobs report, which will be released on Friday morning (US time). This is considered the most important economic data since the beginning of the year. Analysts predict that the number of non-farm jobs will increase by 133,000, much lower than the 228,000 figure in March.

Asian and European stock markets were largely closed on Thursday due to the International Labor Day. Meanwhile, the US stock index increased sharply in the middle of the session.

Investment sentiment has improved thanks to a series of US corporate profit reports exceeding expectations in recent days. In addition, the Trump administration is also hinted at the possibility of reaching new trade deals soon. Chinese media reported that the US has contacted China to resume negotiations.

Technically, June gold futures buyers are still dominating in the short term but are weakening. The next target for buyers is to get the closing price above $3,350/ounce. On the contrary, the sellers are aiming to bring prices below the support level of 3,100 USD/ounce.

The immediate resistance level is 3,250 USD/ounce, then 3,300 USD/ounce. The most recent support is $3,200/ounce, followed by $3,175/ounce.

Important external factors today include: the USD index increased sharply; WTI crude oil prices almost moved sideways at 58.25 USD/barrel; the yield on the 10-year US government bond is currently around 4.3%.

Note: Gold price data is compared to the same time of the previous trading session.

See more news related to gold prices HERE...