Increased concerns about recession are partly supporting gold prices, as the US economy started 2025 in a not-so-good way with a decline of 0.3% in the first quarter.

According to the US Bureau of Economic Analysis, GDP in the first quarter of 2025 decreased by 0.3% over the same period, contrary to experts' expectations of an increase of 0.3%.

This is the first time the US economy has recorded negative growth since 2022, while the fourth quarter of 2024 still achieved 2.4%.

The report said that the main reasons for GDP decline are increased imports ( deducted from GDP) and decreased government spending, although there is still a slight increase in investment, personal consumption and exports.

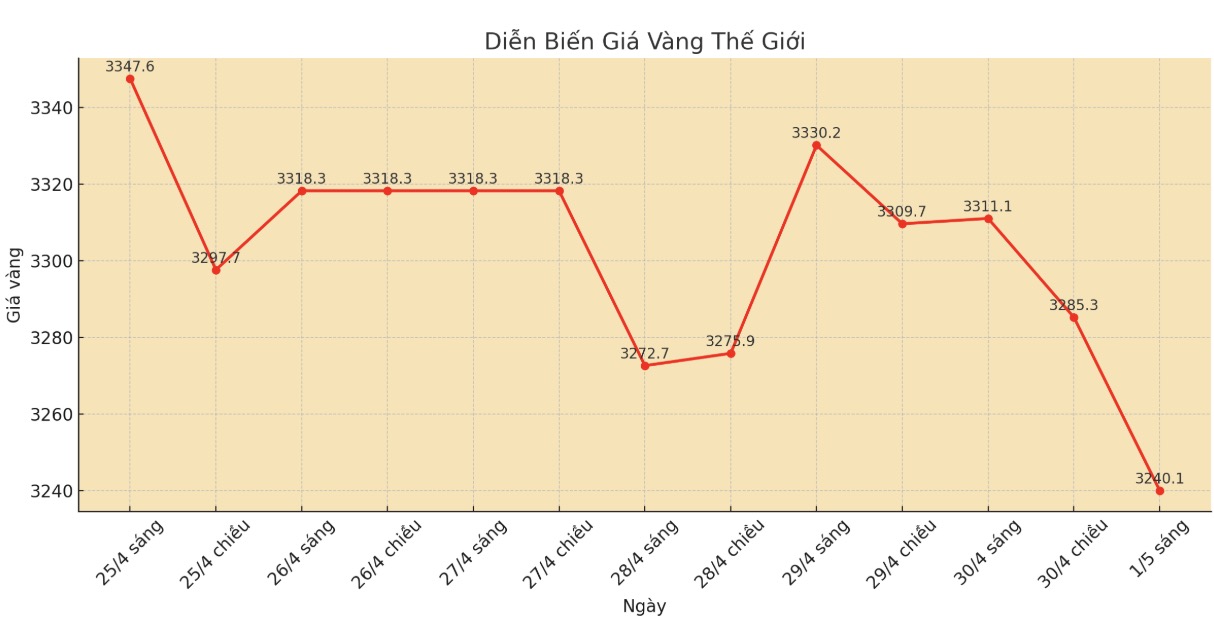

Notably, after receiving negative economic data from the US, the gold market was under strong profit-taking pressure. The spot gold price recorded at 8:05 a.m. on January 1 (Vietnam time) on Kitco was at 3,240.1 USD/ounce.

However, many experts believe that this weak data could boost safe-haven demand for gold. The slow growth momentum could force the US Federal Reserve (FED) to cut interest rates, although inflation remains high.

In addition to the GDP decline, inflationary pressures also increased sharply in the first quarter. The GDP price index increased to 3.7%, much higher than the 2.3% in the fourth quarter and exceeded expectations of 3.1%.

According to economists, US President Donald Trump's tough import tax policy earlier this year has caused businesses to import goods en masse in advance, causing data fluctuations.

Adam Button - currency strategist at Forexlive.com commented: "This report is negative and in fact, it is worse than appearance. Domestic and consumer spending are both weak, while inflation is hotter than expected.

He predicted that the decrease in imports in the second quarter of 2025 could help balance trade data somewhat. However, consumption is expected to weaken due to high prices.

The report shows that personal consumption in the first quarter of 2025 increased by only 1.8%, much lower than the 4.0% increase in the fourth quarter of last year.

Although the overall figure is disappointing, some experts believe that the possibility of the US falling into recession is not high. Jeffrey Roach, chief economist at LPL Financial, said that if global trade policy is resolved stably, much of the current instability will be resolved. Consumers are still spending big, there are no signs of a recession.

However, Bill Adams - chief economist at Comerica Bank - noted that fluctuations due to trade uncertainty in April made the GDP figures for the first quarter of 2025 less meaningful, but it still showed a slowing trend.

From the GDP report, the April ADP report and recent surveys of businesses and consumers, it can be seen that the economy is losing momentum and the risks are increasing, the expert said.