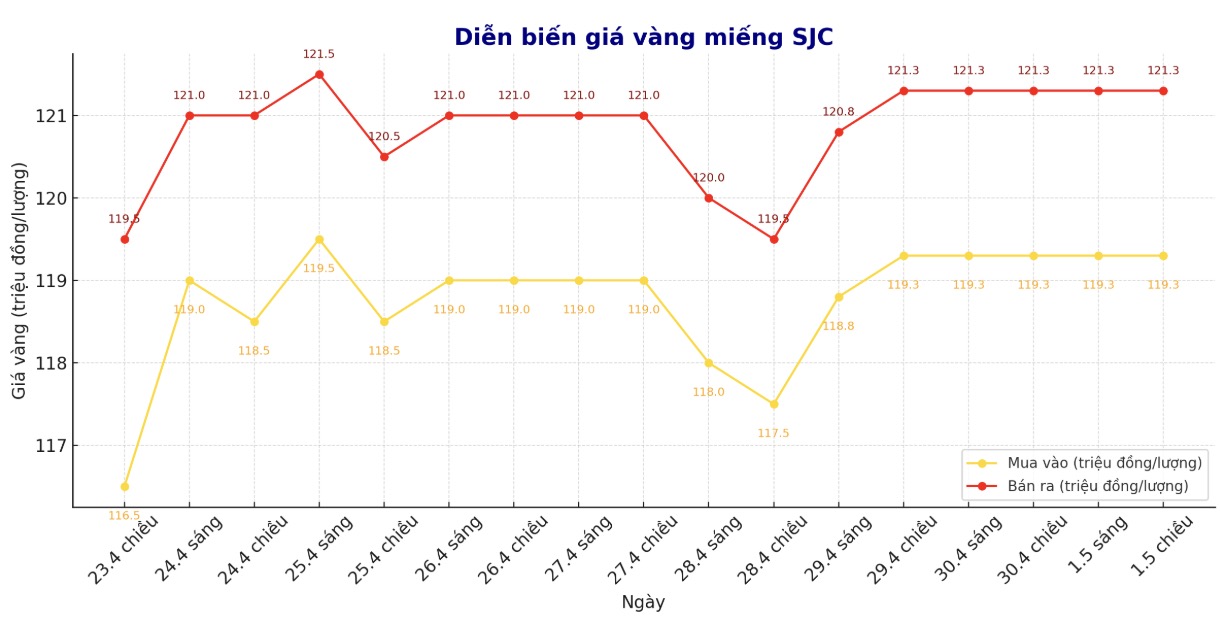

Updated SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-121 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 3 million VND/tael.

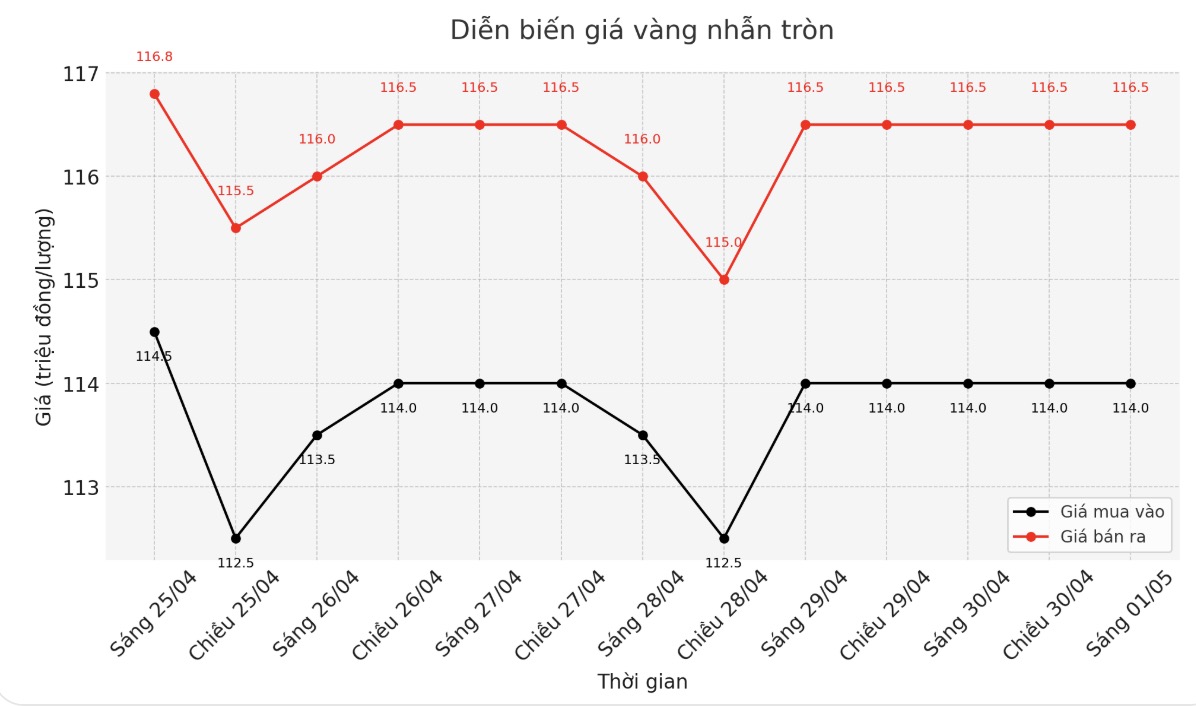

9999 round gold ring price

As of 5:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119 1.6 million VND/tael (buy - sell), down 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is 3.3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 4:45 p.m., the world gold price listed on Kitco was around 3,222.4 USD/ounce, down 22.4 USD.

Gold price forecast

Gold prices fell to a two-week low due to a stronger US dollar and temporary easing of trade tensions, weakening the appeal of gold as a safe-haven asset.

Investors are waiting for the US non-farm payrolls report, due on May 2, to assess more clearly the monetary policy orientation of the US Federal Reserve (FED).

US President Donald Trump revealed the possibility of signing new trade agreements with India, South Korea and Japan, contributing to reducing tariff tensions between the US and key partners.

Mr. Ilya Spivak - Head of Global Macro Analysis at Tastylive - commented that gold prices are under pressure due to concerns about the cooling trade war, but warned that the market is still vulnerable to new information.

In April, gold prices set a record due to increased global instability. According to Mr. Spivak, the Fed's dovish stance may continue to support gold, but the market needs time to adjust after strong fluctuations.

In the first quarter of 2025, the US economy declined for the first time in three years, largely due to businesses increasing imports to avoid new tariffs expected from Mr. Trump. Some experts believe that the weak growth prospects could force the Fed to cut interest rates soon.

Economic data to be released should be noted

Thursday:Weekly jobless claims and the US Manufacturing across Market Management Index (ISM Manufacturing PMI).

Friday: Non-farm Payrolls report in the US.

See more news related to gold prices HERE...