Update SJC gold price

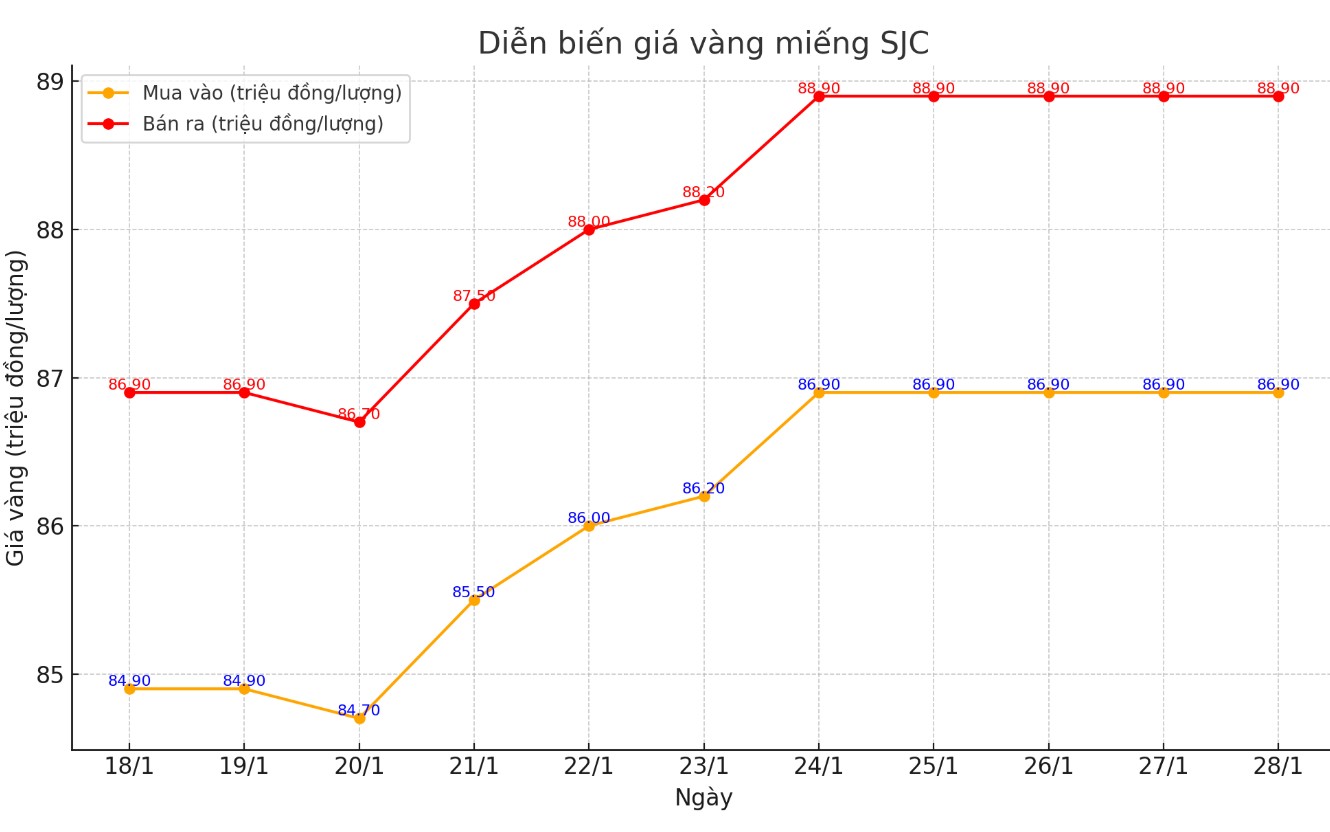

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

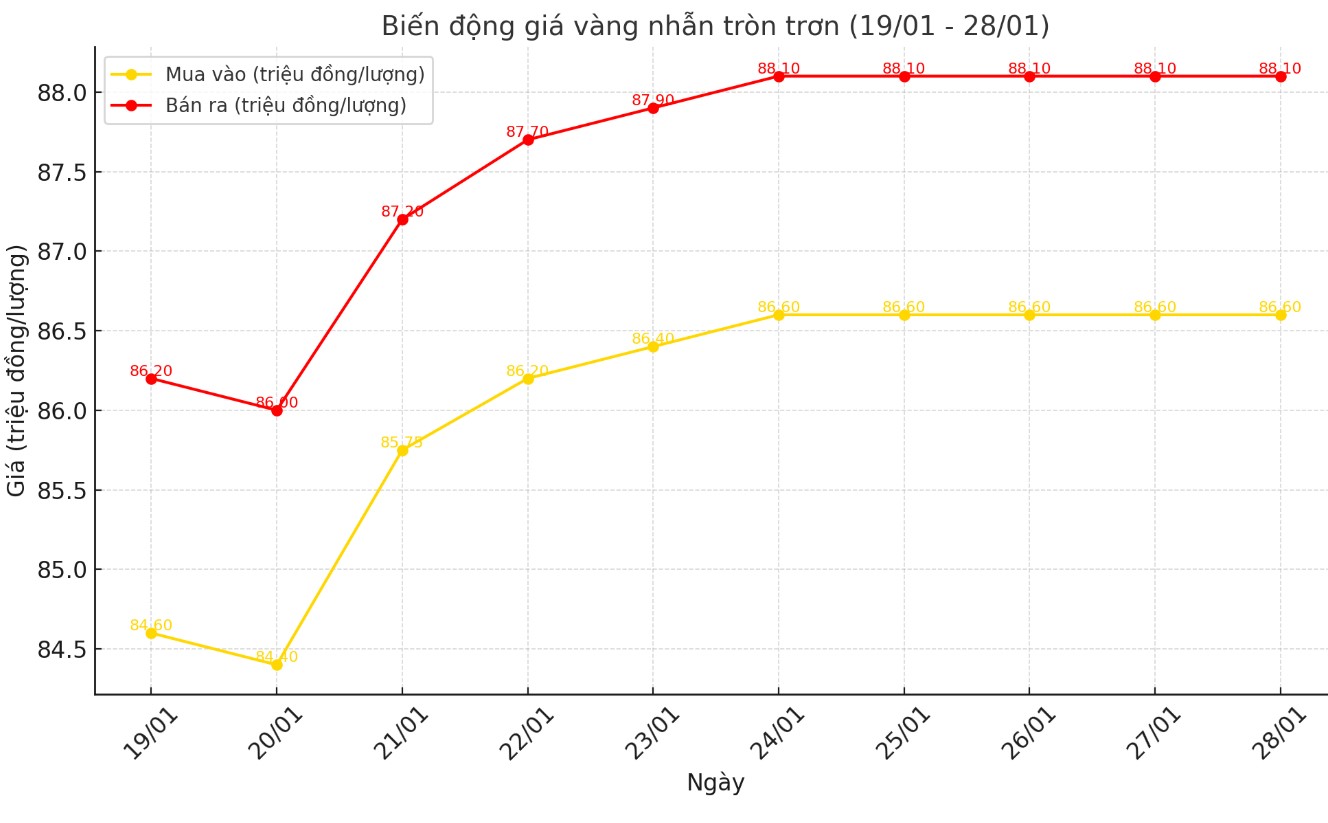

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 3:45 a.m. on January 28, the world gold price listed on Kitco was at 2,741.3 USD/ounce, down 29.5 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices fell despite the decline in the USD index. Recorded at 3:45 a.m. on January 28, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.160 points (down 0.08%).

According to Kitco, the world gold price fell sharply when the stock market faced a large wave of sell-off, causing confusion for investors and traders. The mentality of "if you can't sell what you want, you'll sell what you have" is spreading in the market.

However, safe-haven demand for gold has not yet emerged, although that could change if the stock sell-off extends into Tuesday. Meanwhile, the U.S. Treasury bond market saw safe-haven demand during the day.

Over the weekend, news broke that China was challenging the US for leadership in artificial intelligence (AI). DeepSeek, a small and emerging Chinese AI company, has reportedly developed a large language model that rivals leading US models at a fraction of the cost. DeepSeek’s AI assistant is now the highest-rated free app on Apple’s App Store.

The news has sparked a sharp sell-off in global tech stocks, with investors reassessing capital spending and valuations for U.S. AI models amid the threat from cheaper Chinese AI models that are said to be as good or superior.

According to Bloomberg, "DeepSeek's sudden emergence raises questions about the basis of the rally that has added $15 trillion to the value of Nasdaq 100 companies since late 2022." Barrons also headlined: "DeepSeek Threatens to Burst the AI Bubble."

This week, major tech companies began reporting fourth-quarter earnings. Before DeepSeek made headlines, earnings were forecast to be at their lowest level in nearly two years.

Meanwhile, China’s economy has started 2025 on a less than encouraging note, with the People’s Bank of China pumping a record amount of money into the financial system this month. China’s non-manufacturing and manufacturing PMIs both came in below expectations and lower than last month, which is weighing on the gold market as China is a net importer of raw materials, including precious metals.

The US economic focus of the week is the US Federal Reserve (FED) meeting. Analysts predict that interest rates will be kept unchanged at the FOMC meeting, which will take place from Tuesday to Wednesday afternoon. The meeting will conclude with a speech by FED Chairman Jerome Powell.

The peripheral market today saw WTI crude oil prices fall sharply, trading around $72.75/barrel. The 10-year Treasury yield is currently at 4.5%.

See more news related to gold prices HERE...