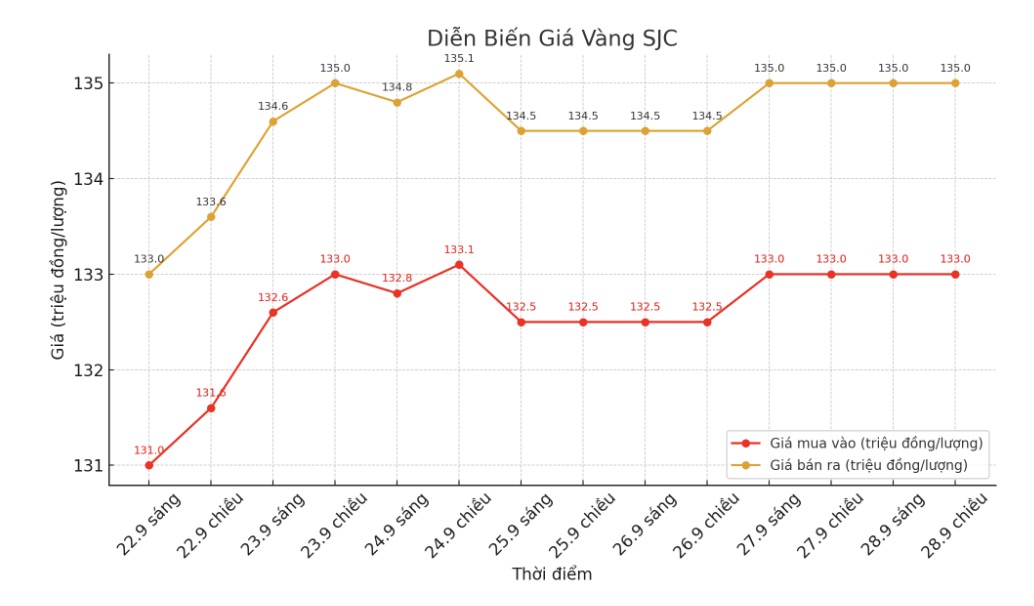

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by DOJI Group at 133-135 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133-135 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 132.5-135 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

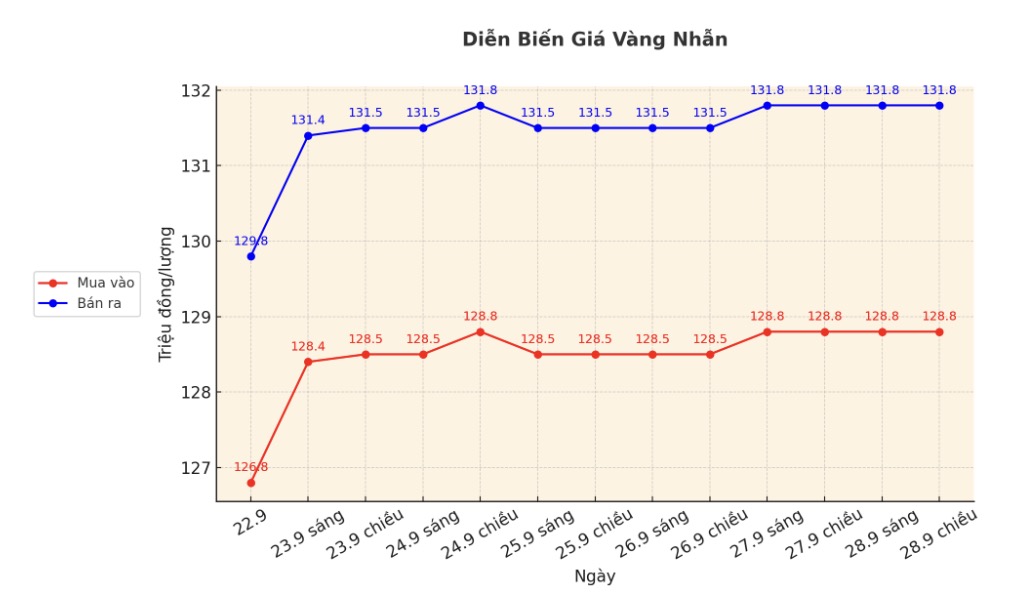

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.1-132.1 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

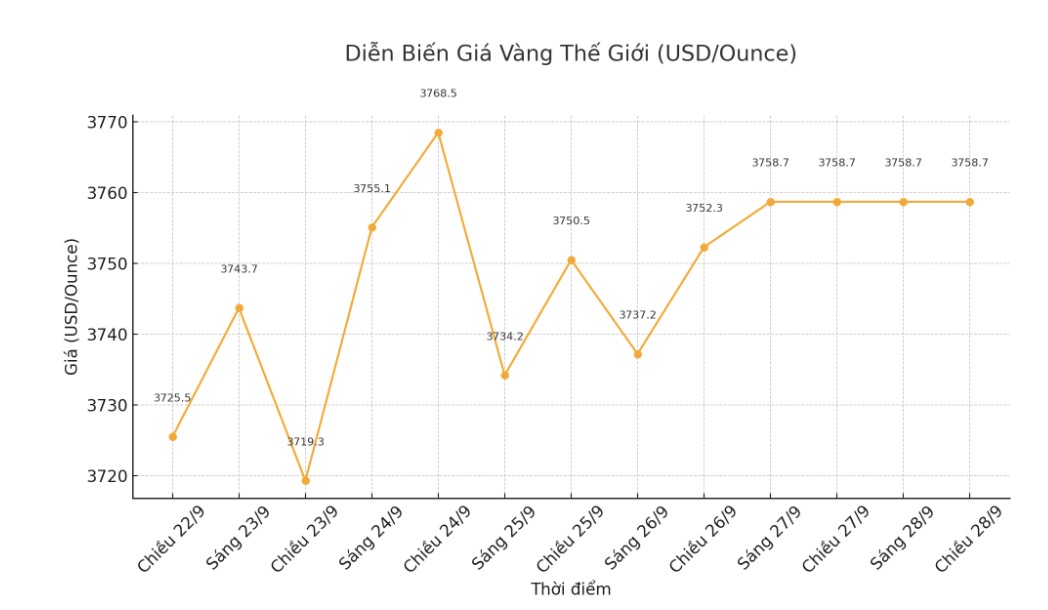

World gold price

The world gold price was listed at 6:00 a.m. at 3,758.7 USD/ounce.

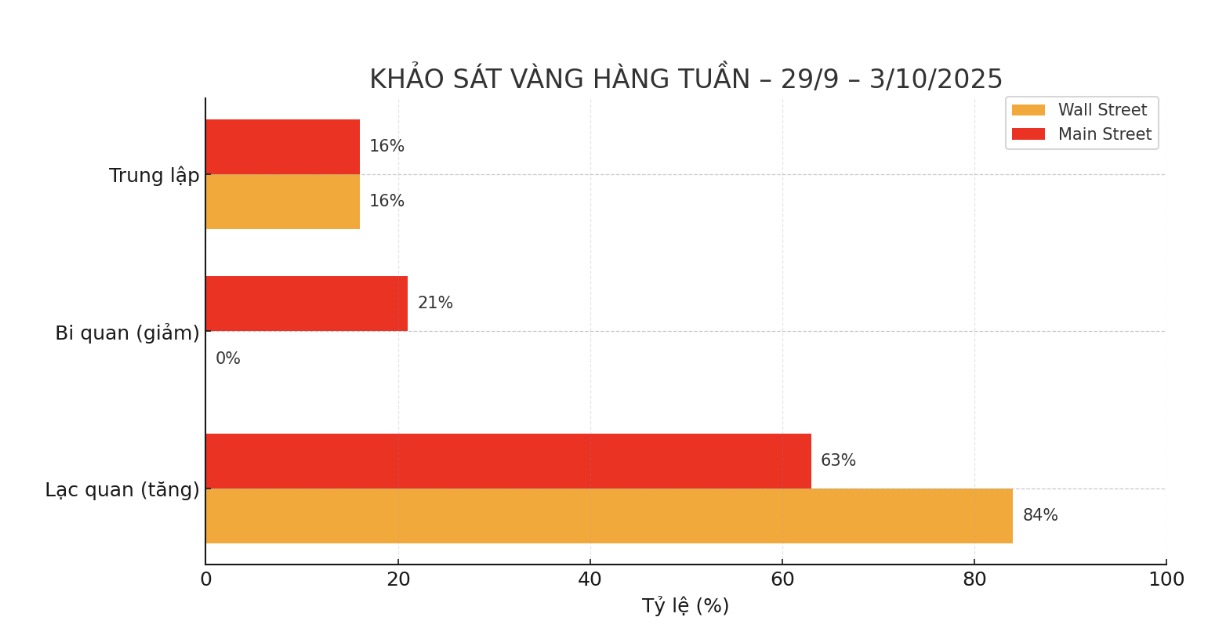

Gold price forecast

The gold survey with Wall Street experts shows unprecedented optimism, after gold prices continued to increase despite many obstacles. While retail investors are also slightly optimistic about the short-term outlook for the precious metal.

This week, 19 experts participated in the survey. Wall Street is particularly confident: 16 experts, equivalent to 84%, predict gold prices will continue to increase this week, no one predicts prices to decrease. The remaining three, or 16%, see prices moving sideways.

Meanwhile, the online poll received 265 votes from individual investors. Although optimism has also increased, the level is still far from the professional level: 166 people, equivalent to 63%, predict that gold prices will continue to increase next week; 56 people (21%) predict prices will decrease; and 43 people (16%) believe that prices will stabilize around the current level.

"I am optimistic about gold prices this week because the precious metal is still in a long-term uptrend against all currencies," said Mr. Colin Cieszynski, chief strategist at SIA Wealth Management.

Mr. Darin Newsom - senior market analyst at Barchart.com commented: "Gold prices will increase this week. Why? The increase is currently very strong, I do not recommend selling fake or fighting the trend".

Sharing the same view, Mr. Rich Checkan - Chairman and COO of Asset Strategies International said: "Although there are opinions that gold is being overbought, the trend is still supporting the increase this week. Central banks have not stopped hoarding gold. In addition, the falling gold/ silwer ratio (GSR) shows that individual investors are starting to get involved: they often buy both gold and silver. Silver has accelerated - a sign that small-scale cash flow is returning to the market.

David Morrison - senior analyst at Trade Nation - warned: "The yesterday MacD index is still too much to buy. Gold may need to adjust deeper or move sideways for a while to accumulate more momentum before reaching a new peak. However, I believe gold will soon hit a new record before creating a long-term peak.

Notable economic data this week

Monday: Waiting for signing a house contract (USA).

Tuesday: JOLTS job positions (USA), Consumer confidence index (USA).

Wednesday: ADP Private sector Employment Report (US), ISM Manufacturing PMI.

Thursday: Application for weekly unemployment benefits (US).

Friday: US Non-farm Payrolls, ISM Services PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...