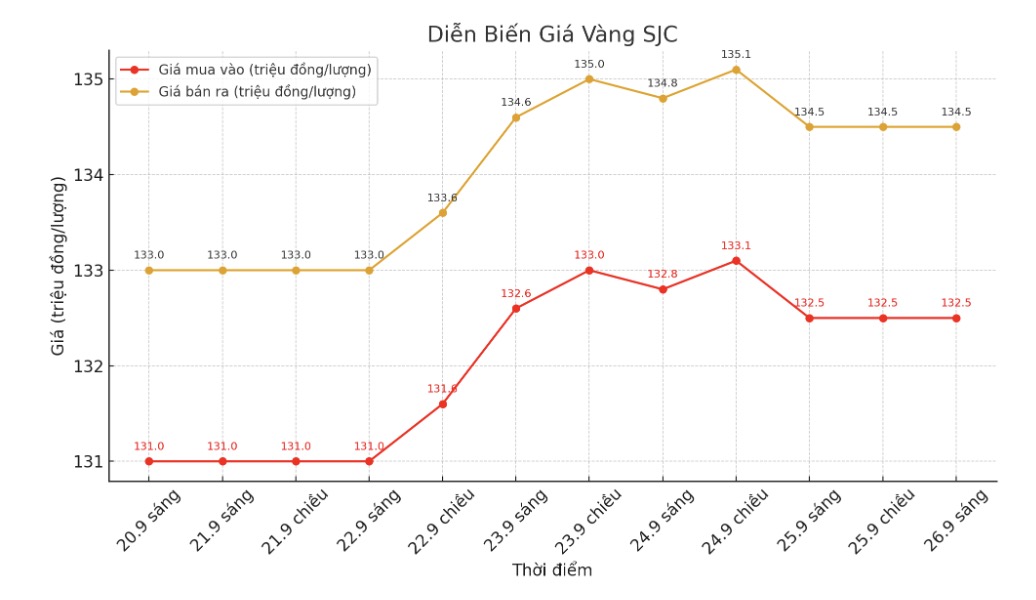

Updated SJC gold price

As of 9:20 a.m., DOJI Group listed the price of SJC gold bars at VND132.5-134.5 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.5-134.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132-134.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

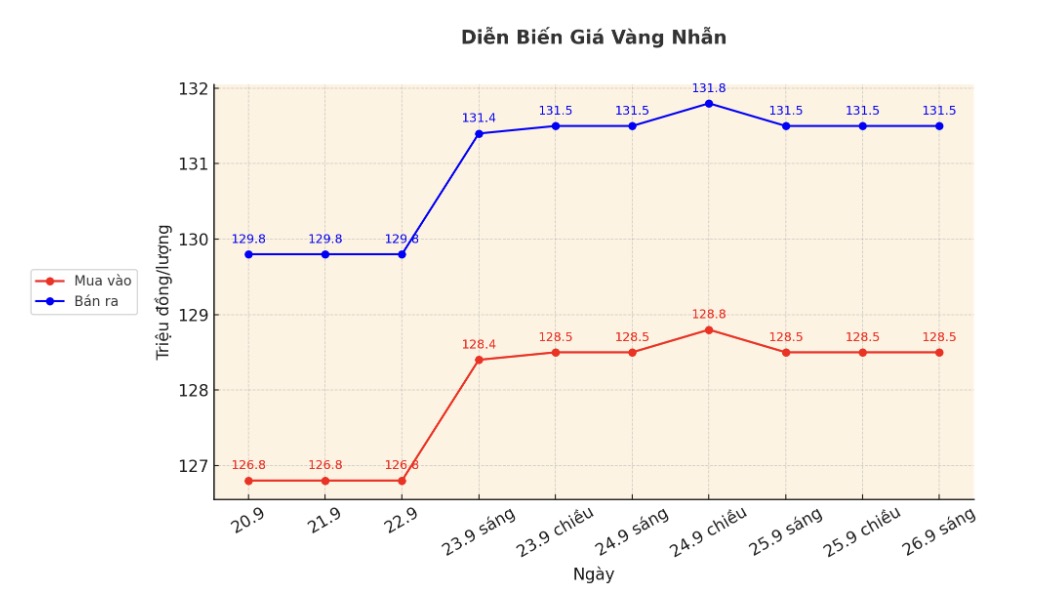

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129-132 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

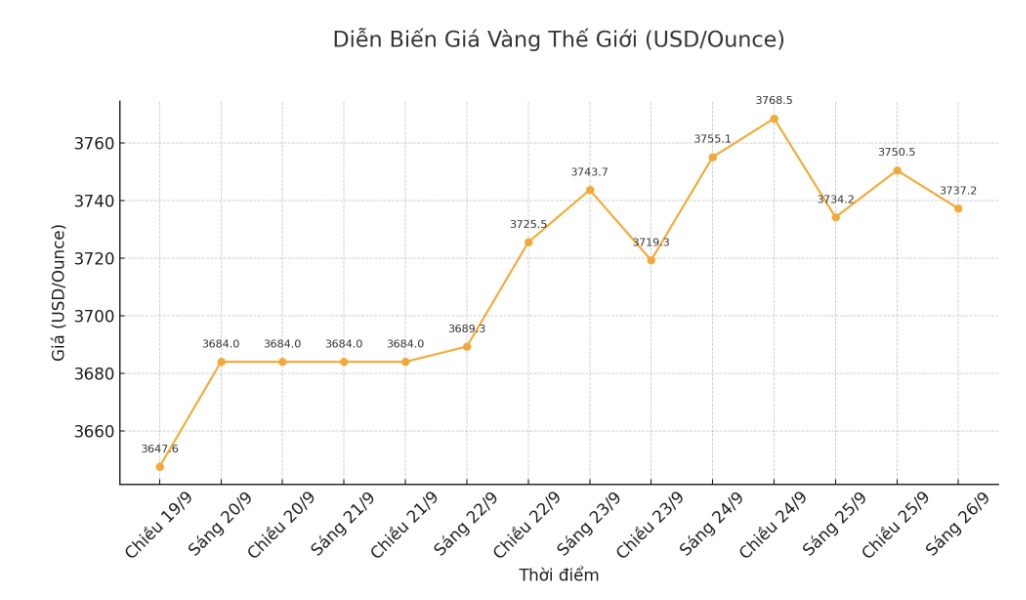

World gold price

At 9:20 a.m., the world gold price was listed around 3,737.2 USD/ounce, down 3 USD compared to a day ago.

Gold price forecast

The world gold price increase slowed down when the US economic report was more positive than expected. The US GDP report for the second quarter just released showed a 3.8% increase compared to the same period last year, higher than the market's forecast of 3.5%.

The PCE index on inflation in the GDP report was also slightly higher than expected. This GDP report is in the view of US "tailings" monetary policy makers and is somewhat at a disadvantage for precious metals.

Bart Melek - Executive Director and Head of Global Commodity Strategy at TD Securities - predicted that the price of gold at $4,000/ounce is a possible reality as the US Federal Reserve (FED) continues to loosen monetary policy.

Although the Fed Chairman has not fully confirmed, the market still expects one or two more interest rate cuts this year and 2026. The Fed's interest rate cut will reduce the cost of holding gold, encouraging investors to participate in the market.

According to CME Group's FedWatch tool, the market now predicts an 85% probability of the Fed cutting interest rates in October, down from 90% before the employment data was released. Gold is often rising in a low-interest- rate environment.

Peter Grant - Vice President and senior metals strategist at Zaner Metals - said that the biggest short-term risk for gold is the personal consumption expenditure (PCE) - the Fed's preferred inflation measure - higher than expected. If inflation spikes, it could push the USD up and temporarily put pressure on gold prices. The PCE index is expected to be released on September 26.

Technically, investors who are willing to increase their December gold contracts are still holding a strong advantage in the short term. The next target for buyers is to close the session above the solid resistance level of 3,900 USD/ounce. In contrast, the near target for the bears is to pull prices below the strong support level of $3,650/ounce.

The first resistance level was recorded at 3,800 USD/ounce, followed by the highest level this week at 3,824.6 USD/ounce. First support was identified at a low of $3,749.7/ounce on Wednesday, followed by a low of $3,718.1/ounce this week.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...