In a recent interview, Jesse Colombo - an independent analyst on precious metals, founder of BubbleBubble Report said that with the current 2-year yield on bonds, interest rates must certainly decrease, thereby boosting gold prices to $4,000/ounce.

He added that the market's question about the political independence of the US Federal Reserve (FED) is raising expectations that the Fed could loosen policy too much when faced with unfavorable economic data.

The Feds loss of independence means we could see more easing than we need. All this uncertainty will continue to support gold prices Colombo said.

Not only policy factors, he is also monitoring a potential storm that could push gold prices higher. He said that the VIX volatility Index - a measure of fear psychology - has dropped to its lowest level since the beginning of the year, signaling a major breakthrough coming.

History shows that when volatility drops to unusual levels, the market is often about to have a strong shift, he said.

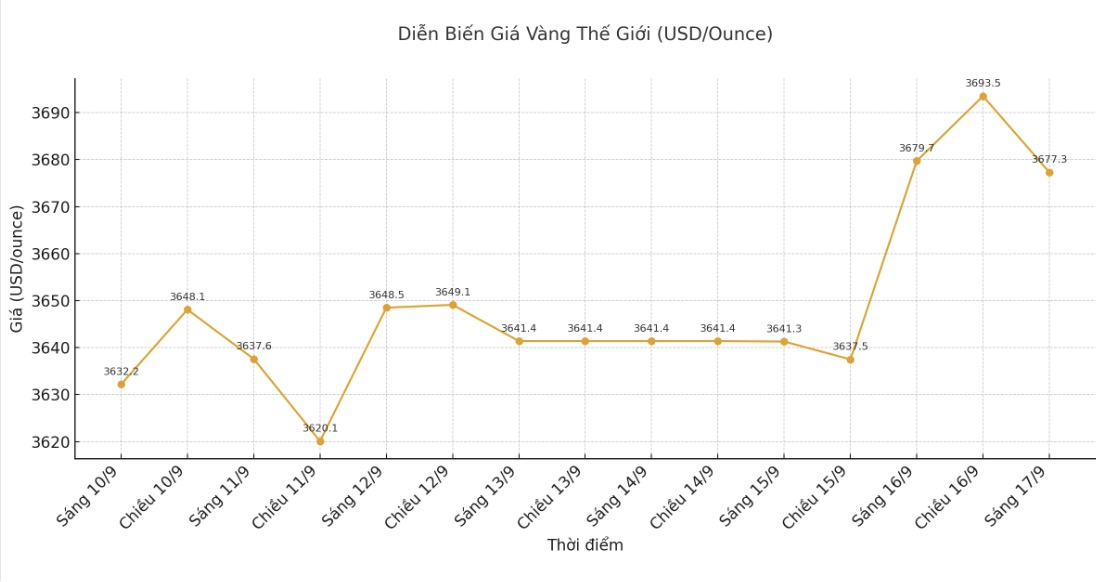

Colombo recalled last summer, when gold traded around $3,300 an ounce, the market also saw similar fluctuations, and when that pressure was released, gold prices skyrocketed. Spot gold is currently approaching a record high, around $3,687.4 an ounce, up 7% for the month and about 40% since the beginning of the year.

He also saw a reverse pattern forming in US stocks and the US dollar - both of which benefited from low volatility. When this quiet is over, I will lean towards the scenario of a weakening USD, thereby continuing to support gold.

Although it is the end of the year, gold reaching 4,000 USD/ounce is still in the scenario thanks to the strong increase of the market. This is the type of motivation that a bull market shows, he said.

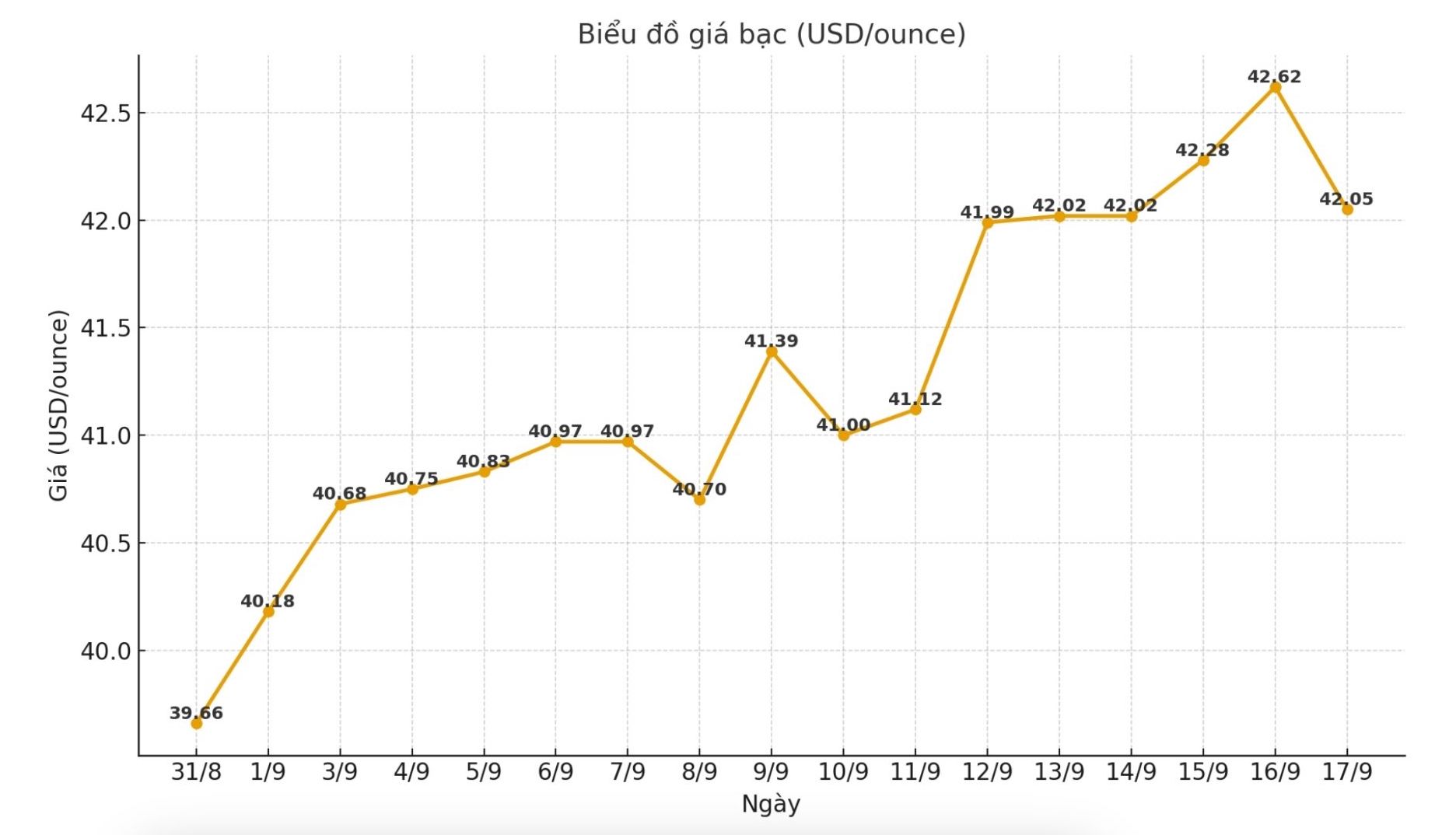

In parallel with the goal of $4,000 for gold, Colombo also predicts that investment demand will soon bring silver prices back to the $50/ounce mark. Currently, silver has increased by about 46% since the beginning of the year, trading over 42 USD/ounce, but he believes that this metal is still very cheap compared to gold.

According to Colombo, higher gold prices, along with increased instability and fluctuations, will attract more investors to silver. People are looking for ways to diversify, looking for assets that are not related. Gold and silver are perfect for this need. This is the time for gold and silver to shine, he affirmed.

Update on domestic gold and silver prices

Gold price update

As of 9:05, the price of SJC gold bars was listed by DOJI Group at 130.3-132.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 130.3-132.3 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, DOJI Group listed the price of gold rings at 126.8-129.8 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.6-130.6 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Updated silver price

As of 9:40 a.m., the price of 999 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at VND 1.606 - 1.644 million/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 42.160 - 43.260 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 42.826 - 43.840 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.616 - 1.666 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 43.093 - 44.426 million VND/kg (buy - sell).