Updated SJC gold price

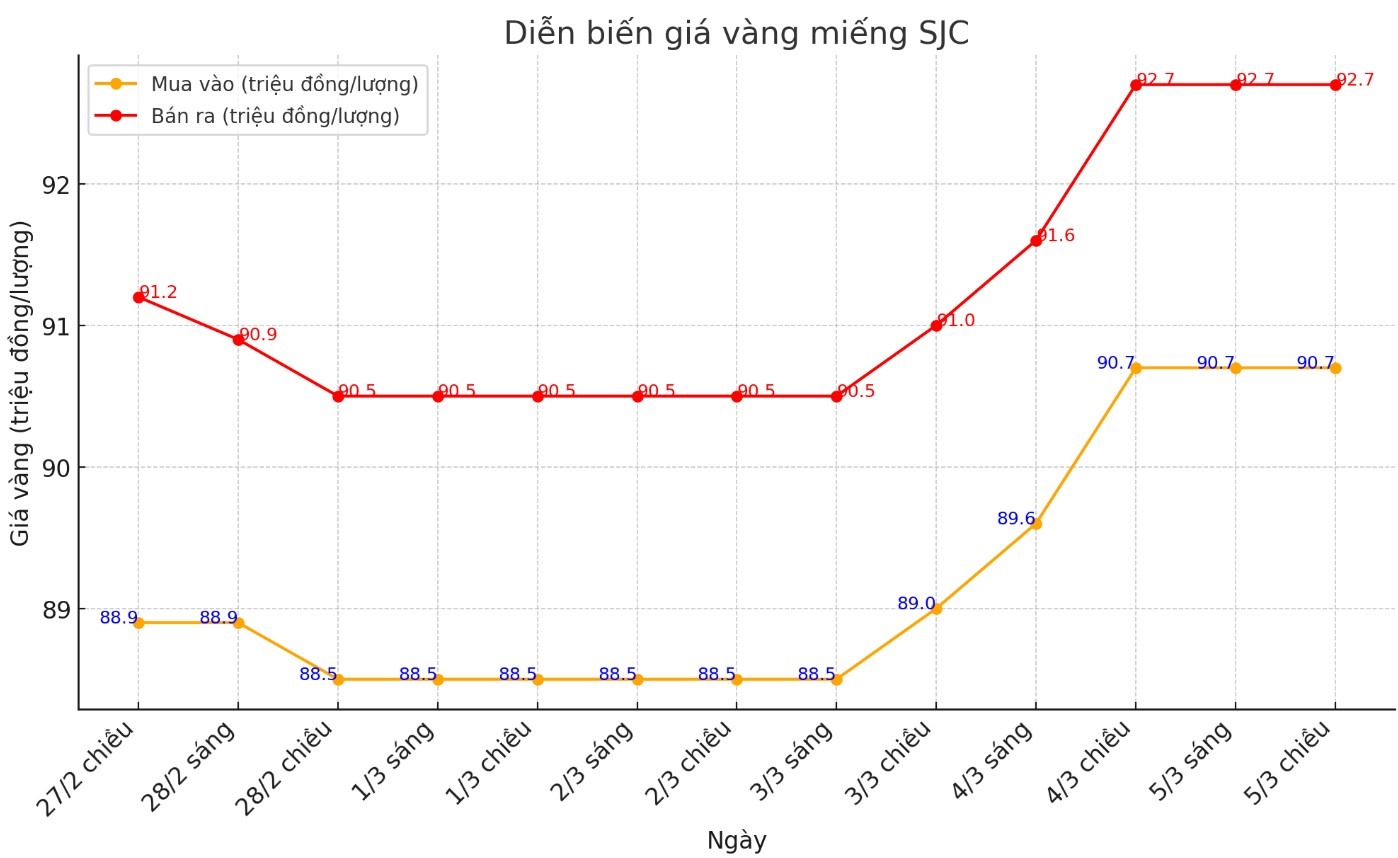

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at 90.7-92.7 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at 90.7-92.7 million VND/tael (buy in - sell out), unchanged in both buying and selling directions. The difference between the buying and selling prices of SJC gold was listed by Saigon Jewelry Company at VND2 million/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 90.9-92.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and kept the same for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 1.8 million VND/tael.

9999 round gold ring price

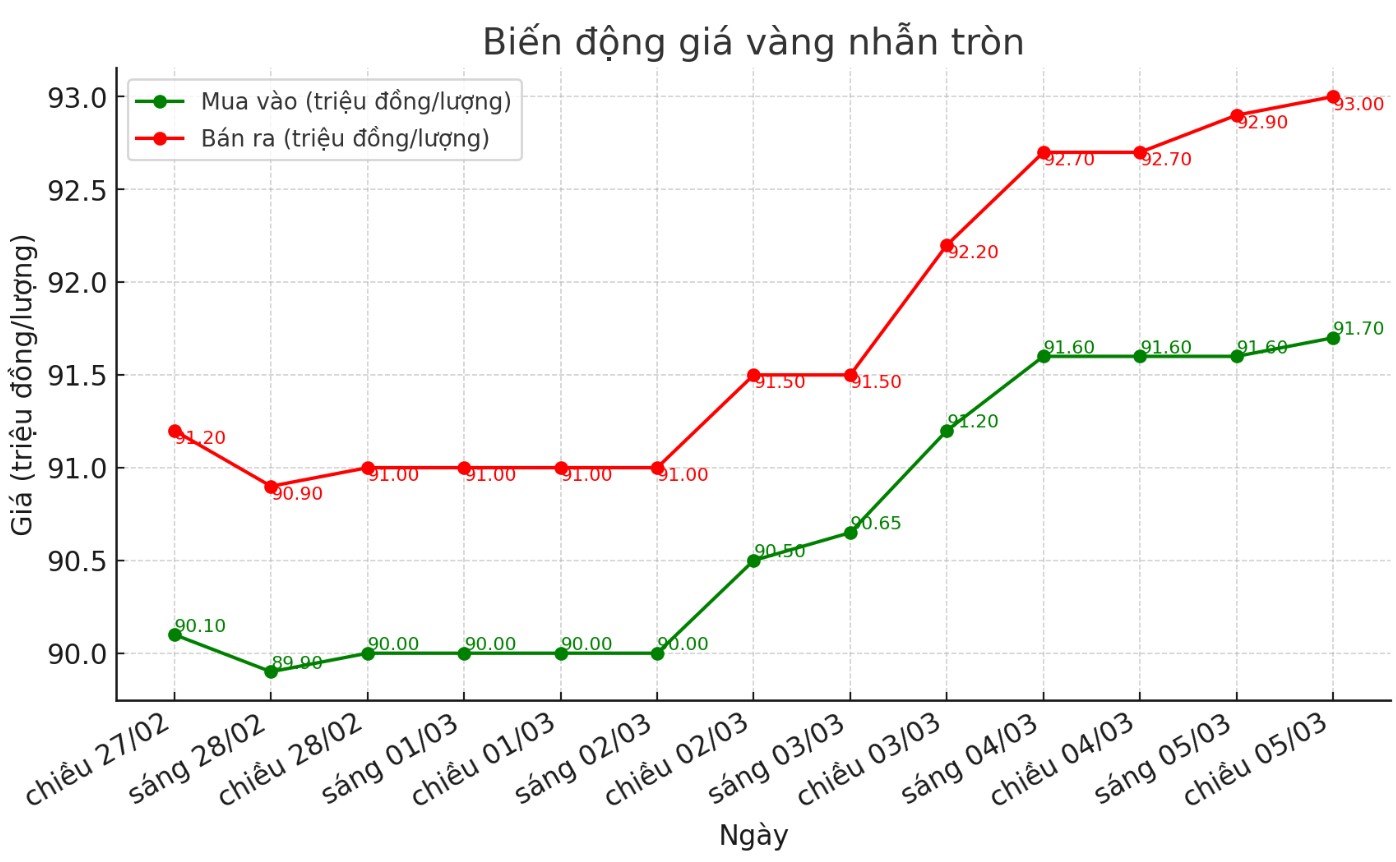

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND91.7-93 million/tael (buy - sell); increased by VND100,000/tael for buying and increased by VND300,000/tael for selling. The difference between buying and selling is listed at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92-93.2 million VND/tael (buy - sell); increased by 400,000 VND/tael for both buying and selling. The difference between buying and selling is 1.2 million VND/tael.

World gold price

As of 5:30 p.m., the world gold price listed on Kitco was at 2,917.4 USD/ounce, up 5 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 5:30 p.m. on March 5, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 105 points (down 0.64%).

Last week's gold price adjustment quickly ended as the US stock market plummeted, boosting safe-haven demand for precious metals.

Ole Hansen - Head of Commodity Strategy at Saxo Bank - commented that gold still has room to increase after the recent slight correction. According to him, the target of $3,000/ounce is returning to the target.

The outlook for gold remains positive, especially as the recent correction only took place in a short time, showing strong demand even with selling pressure from traders according to technical analysis.

In addition to the need for diversification and safe havens, gold will continue to be supported by central bank purchases amid concerns about rising public debt, Hansen wrote in the latest report on the precious metal.

Central banks continue to net buy gold in January 2025. The trend of gold hoarding raises many expectations for gold price developments in the coming time.

According to the latest report from the World Gold Council (WGC), strong purchases in January continued the buying momentum of 1,045 tons of gold by central banks in 2024. This is the third consecutive year that official reserves have increased by more than 1,000 tons, much higher than the long-term average.

Constant buying shows that gold plays an important role in official reserves, especially as central banks face increasing geopolitical risks, wrote Marissa Salim/Senior Research Lead, APAC at WGC.

According to the report, central banks in emerging markets are still the main net buyers. Uzbekistan was the top gold buyer in January, increasing its official reserves by 8 tons.

The People's Bank of China also continues to buy with 5 tons of gold. This is the third consecutive month that the People's Bank of China has increased its gold reserves after suspending purchases for six months last year.

The National Bank of Kazakhstan was the third largest gold buyer in January. Kazakhstan's National Bank President Timur Suleimenov said the bank is discussing a "transition to monetary neutrality in gold purchases" to increase international reserves and protect the economy from external shocks.

Kazakhstan has also started selling USD as part of a "greening of gold purchases".

In addition, the National Bank of Poland and the Reserve Bank of India each bought 3 tons of gold, the Czech National Bank increased its reserves by 2 tons, and the Central Bank of Qatar bought 1 ton of gold.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...