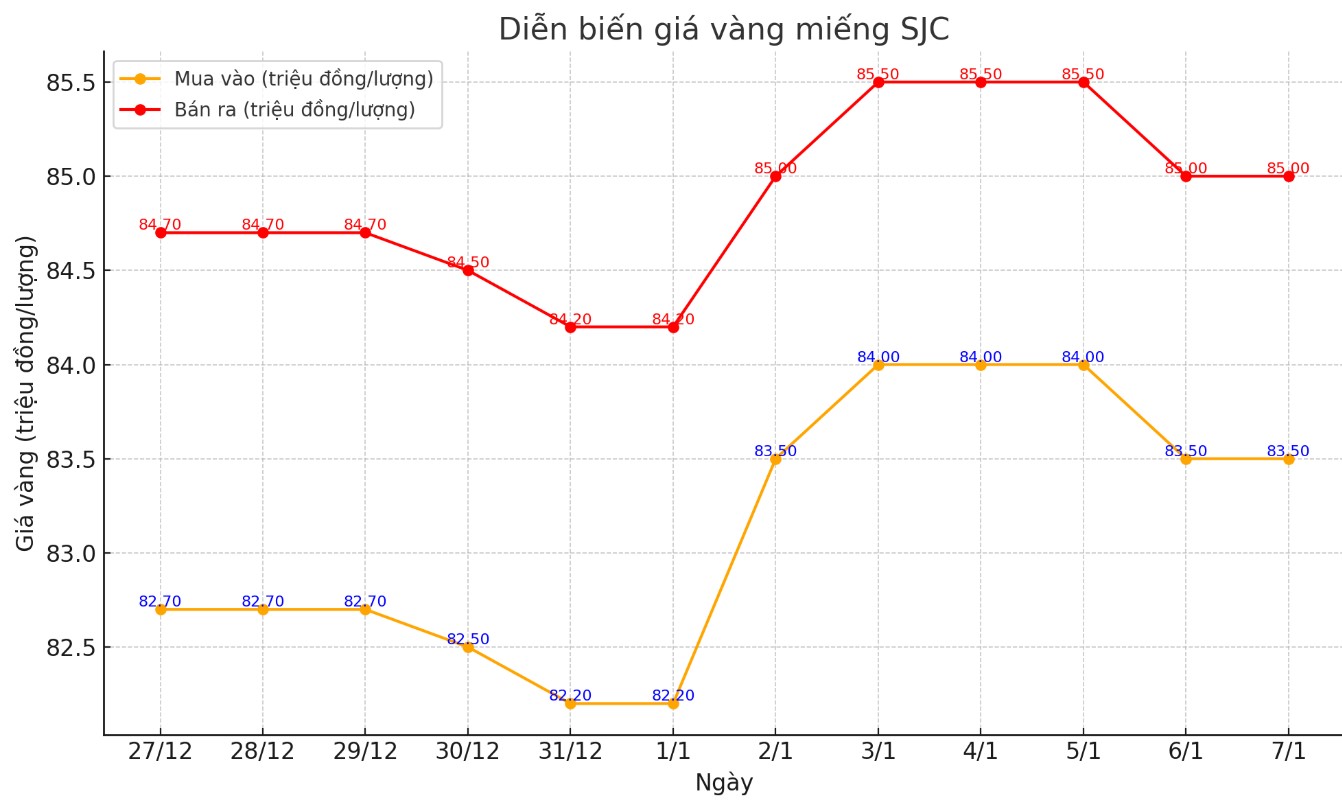

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.5-85 million/tael (buy - sell); down VND500,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 83.5-85 million VND/tael (buy - sell); down 500,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.7-85 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

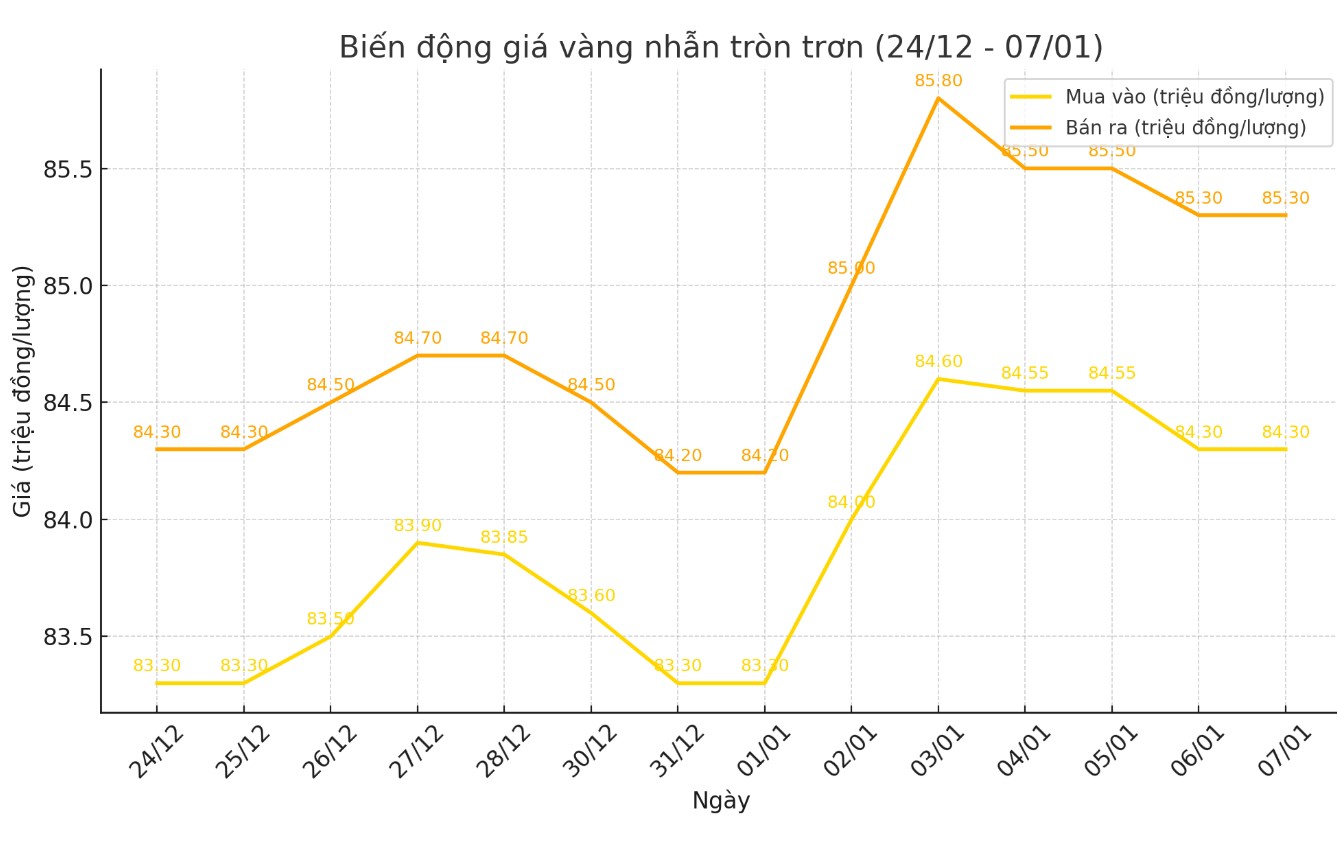

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.3-85.3 million VND/tael (buy - sell); down 150,000 VND/tael for buying and down 250,000 VND/tael for selling compared to the beginning of the trading session yesterday afternoon.

Bao Tin Minh Chau listed the price of gold rings at 84.4-85.5 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday afternoon.

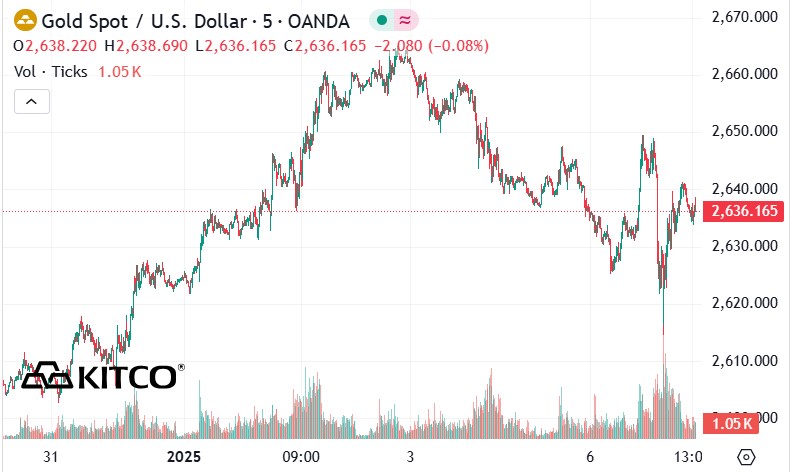

World gold price

As of 1:30 a.m. on January 7 (Vietnam time), the world gold price listed on Kitco was at 2,636.1 USD/ounce, down 3.6 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices have not increased despite the sharp decline of the USD. Recorded at 1:30 a.m. on January 7, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.120 points (down 0.62%).

Gold prices edged down slightly, but recovered significantly from sharp losses in early trading on Monday afternoon in the US. US government bond yields rose to their highest levels since May last year, a negative factor that put pressure on gold prices.

Meanwhile, the USD index fell sharply today due to concerns about the growing debt burden of the US government. Bloomberg reported that rising bond yields only added to the pressure on the US debt. There are concerns that the policies of the incoming US President-elect Donald Trump's administration could increase inflation.

The U.S. government will issue $119 billion in bonds this week, as the Republican-controlled Congress is expected to ramp up spending and increase the budget deficit. The USDX index rose briefly but only briefly after President-elect Donald Trump denied he would ease up on new trade tariffs. Trump dismissed a Washington Post article citing his aides as saying the incoming president could be more selective in imposing new tariffs.

In another development, Bloomberg reported that Goldman Sachs no longer predicted gold prices to reach $3,000 an ounce by the end of 2025, pushing the forecast to mid-2026 due to expectations that the Fed will ease interest rate cuts. In 2024, gold prices increased by 27%.

The key US economic data this week is the US December jobs report, due on Friday. The report is expected to show non-farm payrolls rose by 160,000, compared to the 227,000 increase in November's report.

Today’s key external factors saw Nymex crude oil futures edge up slightly, trading around $74 a barrel. The yield on the 10-year US Treasury note continued to rise, currently at around 4.6% - its highest level since 2023.

Technically, gold futures bulls still have the short-term technical advantage. The next target for bulls is a close above the strong resistance at $2,700/oz. Meanwhile, the next target for bears is pushing prices below the key technical support at the November low of $2,565/oz.

See more news related to gold prices HERE...