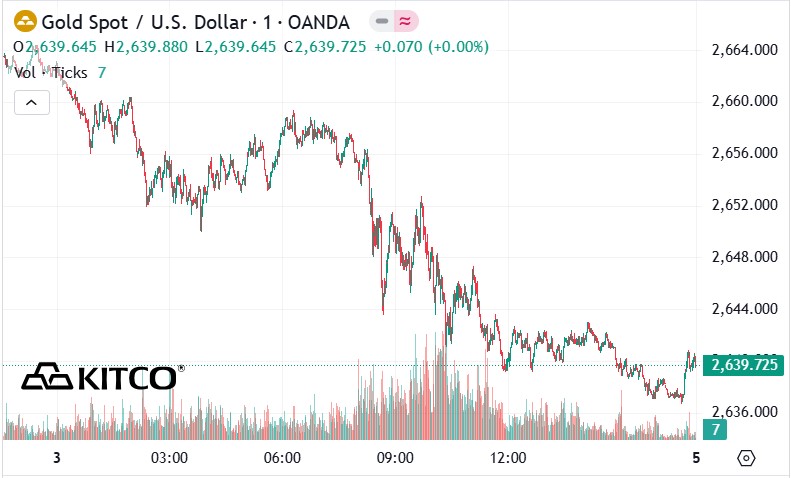

After posting its best annual growth in 14 years, gold prices started 2025 on a more stable note, holding above $2,600 an ounce.

Gold prices traded in a narrow range during the two-week holiday period. However, when the market fully reopened on Monday, analysts said the precious metal still faced some significant pressure.

Solid economic data is supporting the dollar, which is trading at a 25-month high against a basket of currencies.

In a note Friday, David Morrison, senior market analyst at Trade Nation, said bullish momentum is starting to build in gold and silver, but he is still watching the impact of the U.S. dollar on gold prices next week.

“It will be interesting to see if gold and silver can continue to rally from here, even as the US dollar hits two-year highs,” he said.

While the US dollar has been weighing on gold, Alex Kuptsikevich, chief market analyst at FxPro, noted that gold and the US dollar can sometimes move in tandem.

“The pressure on risk assets on December 31 and January 2, including a 1.5% rise in the US dollar during this period, did not prevent gold from strengthening. While the market range remained modest, the rise in the US dollar and gold when stocks fell is typical of periods of market flight to safe havens,” Kuptsikevich said in a note on Friday.

However, Kuptsikevich also stressed that gold's price action is sending out technical bearish warning signals.

“Gold tested the 50-day moving average in the first trading session of the new year. The drop below this level in November broke the uptrend and put gold into a consolidation phase after a 12-month rally of more than 50%.

The failure to hold above this line in November, December and early January seemed to be a bearish signal: Too many investors were looking to take profits,” he said.

Some analysts and economists note that next week could set the trend for the US dollar and gold in the first quarter of the year, when the market will receive important employment data.

While strong economic data should strengthen the US dollar, analysts continue to stress that any weakness in gold should be seen as a buying opportunity.

David Miller - Chief Investment Officer and Senior Portfolio Manager at Catalyst Funds - said he remains bullish on gold in the new year.

“Gold is trading above $2,600 an ounce, and there is good reason to believe that gold’s strength in 2024 will continue into 2025,” he said in a comment to Kitco News.

“BRICS countries are losing trust in the USD after the US and Europe used the SWIFT system as a tool to sanction Russia. They are shifting their USD reserves to gold, which they can hold physically and cannot be seized. This trend is likely to continue in 2025.

The US Congressional Budget Office (CBO) forecasts that the government budget deficit will reach $1.9 trillion by 2025, which fundamentally weakens the dollar as the government continues to increase its debt every year," he added.

Economic data to watch next week:

Tuesday: ISM services PMI, JOLTS job vacancies

Wednesday: ADP jobs report, FOMC meeting minutes

Thursday: Weekly Unemployment Report

Friday: Nonfarm payrolls, University of Michigan preliminary consumer sentiment index