Update SJC gold price

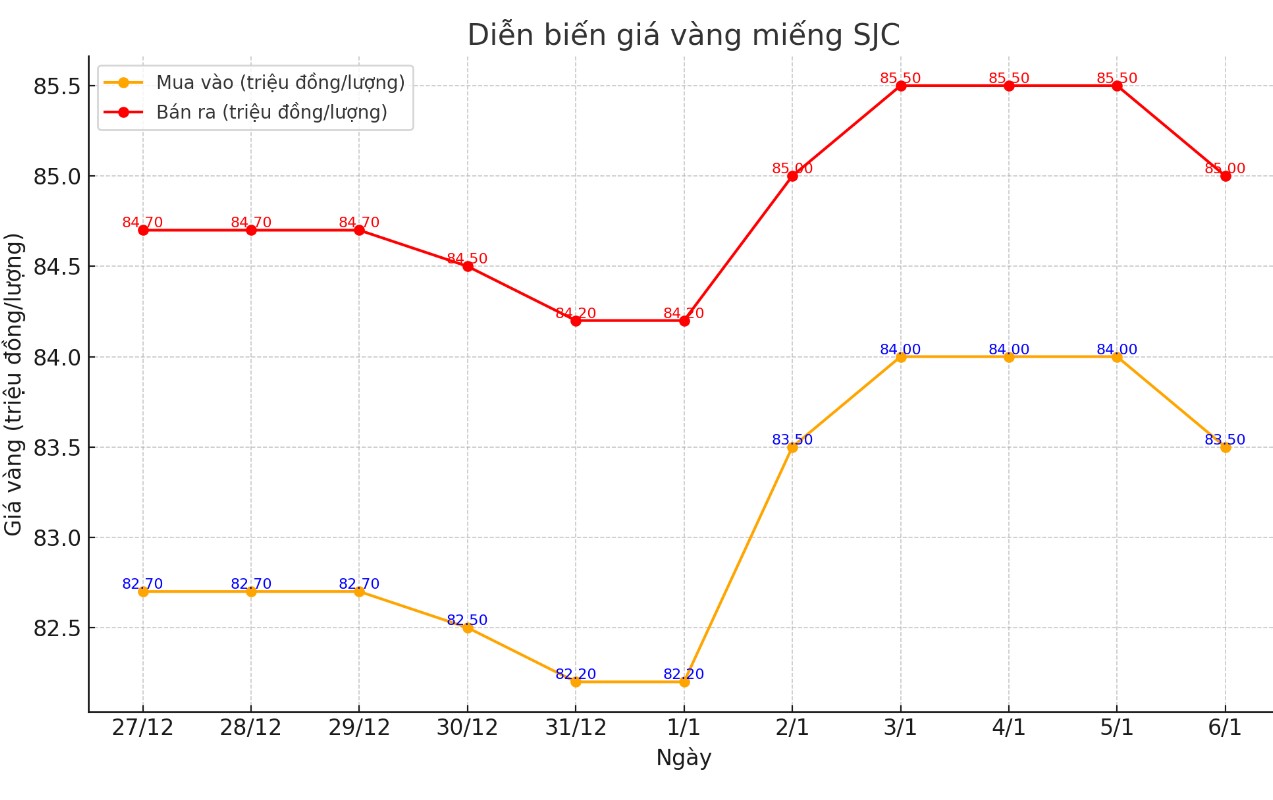

As of 5 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.5-85 million/tael (buy - sell); down VND500,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 83.5-85 million VND/tael (buy - sell); down 500,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83.7-85 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 500,000 VND/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

Price of round gold ring 9999

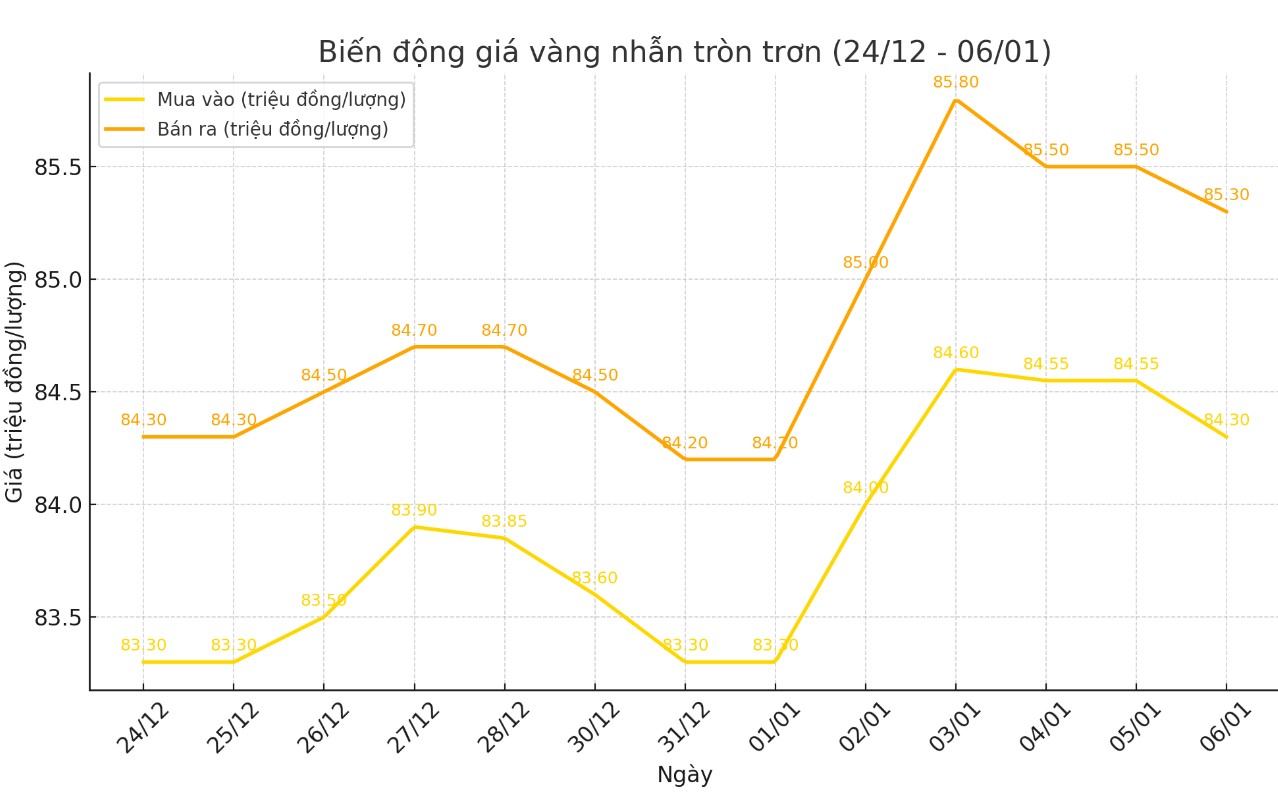

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.3-85.3 million VND/tael (buy - sell); down 150,000 VND/tael for buying and down 250,000 VND/tael for selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.4-85.5 million VND/tael (buy - sell), down 200,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 6:34 p.m., the world gold price listed on Kitco was at $2,638.8/ounce, down $0.9/ounce compared to the same time in the previous session.

Gold Price Forecast

World gold prices slightly decreased, the USD index decreased. Recorded at 6:36 p.m. on January 6, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.790 points (down 0.93%).

Goldman Sachs has revised its gold price forecast, no longer expecting it to reach $3,000 an ounce by the end of 2025. Instead, the date has been pushed back to mid-2026, reflecting expectations that the US Federal Reserve will cut interest rates at a slower pace than expected.

In a January 6 report, Goldman Sachs said the Fed’s slowing of monetary policy easing in 2025 could weaken demand for gold ETFs. Analysts estimate gold prices will be $2,910 an ounce by the end of 2025. In addition, weaker-than-expected inflows into ETFs in December 2024, after the uncertainties from the US presidential election subside, also contributed to the decline in gold’s starting valuation in 2025.

Goldman Sachs said that the conflicting factors of reduced speculative demand and increased central bank purchases have balanced each other, keeping gold prices within a narrow range in recent times. They predict that central bank demand will continue to be the main driver of gold prices in the long term. According to forecasts, about 38 tons of gold will be bought each month between now and mid-2026.

Chantelle Schieven, Head of Research at Capitalight Research, told Kitco News that the current accumulation phase in gold is necessary for the market to maintain a sustainable upward momentum.

“I’m not at all concerned about the volatility we’re seeing. I think this lull is healthy for the market,” she said.

After gold surpassed $2,400 an ounce in 2024 — far exceeding initial forecasts — the precious metal still has plenty of room to rise in 2025, according to Schieven. She expects gold prices to fluctuate between $2,500 and $2,700 an ounce in the first half of the year before surpassing $3,000 an ounce in the second half.

“I remain as bullish on gold in 2025 as I was on 2024,” she said, acknowledging that the current accumulation phase could last for several months.

See more news related to gold prices HERE...