SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 114.9-117.2 million/tael (buy - sell); down VND 1.1 million/tael for buying and down VND 800,000/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 114.9-117.2 million VND/tael (buy - sell); down 1.1 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.9-117.2 million VND/tael (buy - sell); down 1.1 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 114.5-117.2 million/tael (buy - sell); down VND 500,000/tael for buying and down VND 800,000/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111-114 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

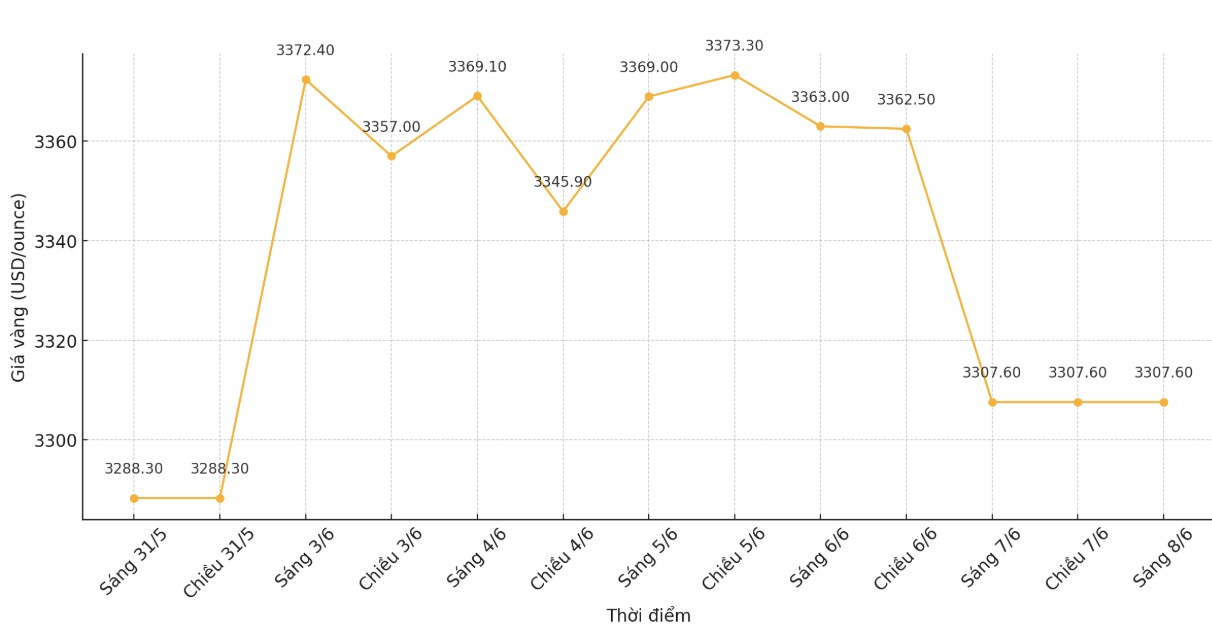

World gold price

At 6:15 a.m., the world gold price was listed at 3,307.6 USD/ounce, down 14.3 USD.

Gold price forecast

Investors took profits in the weekend trading sessions as gold prices tested resistance at $3,400/ounce. Selling pressure increased on Friday after economic data showed that the US economy created 139,000 jobs in May, exceeding consensus forecasts. At the same time, the unemployment rate remained unchanged at 4.2%, and the salary increase was higher than expected.

Lukman Otunuga - Senior market analyst at FXTM said: "Gold is still dominating below 3,400 USD/ounce. Purchasers may counterattack, but prices need to push above $3,360/ounce and above $3,400/ounce."

Although the labor market is slowing, economists believe that the latest non-farm payrolls report will not force the US Federal Reserve (FED) to cut interest rates.

"The slowdown in the labor market has been quite smooth so far, without many surprises. If job growth continues like this, the Fed could still be in waiting and watching mode," Jeffrey Roach, chief economist at LPL Financial, said in a note.

As the employment data was released, attention turned to the inflationary side of the economic plan, with the release of the consumer price index (CPI) for May next week. However, the data is still not expected to support pre-school interest rate cuts.

A hotter CPI is expected to strengthen the US dollar and cut expectations of a Fed rate cut, leaving gold vulnerable, while a weak CPI could push gold prices higher, Otunuga said.

Meanwhile, Michael Brown - Senior Research Expert at Pepperstone said that although the Fed will maintain a neutral stance until at least the end of the year, gold is still an attractive asset.

In another development, Metals Focus' annual gold report, Gold Focus 2025, shows that gold prices still have strong momentum to continue to increase in 2026.

Philip Newman, CEO of Metals Focus, said it is difficult to imagine a scenario that could disrupt the market. He also said that, although not an official forecast, he expects this growth momentum to last until 2026.

Looking at whats happening in the global economy, there are many active factors. We have all the necessary factors to create a sustainable growth market," he said.

Economic data to watch next week

Wednesday: US Consumer Price Index (CPI)

Thursday: US producer price index, weekly jobless claims

Friday: University of Michigan Consumer Psychology Index

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...