Gold price developments last week

Precious metals investors endured a volatile week as dismal US economic data combined with the threat of escalating trade tariffs pushed gold prices to all-time highs.

Spot gold started the week at $2,770 an ounce, but quickly fell to $2,740 an ounce shortly after North American markets opened. By noon ET, spot gold was trading at $2,731 an ounce.

This was the lowest level of the week, gold price quickly recovered to the area of 2,740 USD/ounce and held this level despite many retests on Monday.

Gold prices rose to $2,760 an ounce on Tuesday morning, with the market largely awaiting Wednesday afternoon's meeting to see what action the US Federal Reserve (FED) will take.

The central bank kept interest rates unchanged as expected and signaled that further rate cuts were unlikely due to persistent inflation and strong labor data, sending gold briefly lower to $2,745 an ounce.

However, prices recovered quickly and by 3:30 a.m. Thursday, spot gold had set a weekly high of over $2,772 an ounce.

The release of much weaker-than-expected GDP data for December was the next catalyst, pushing gold prices to $2,800 an ounce in Thursday trading, finally reaching that level at 2:15 a.m. ET.

Friday morning saw rising trade tensions, with mixed reports sending gold prices to a new all-time high of $2,817.21 an ounce just after 10:00 a.m.

After establishing a double top pattern at this level just before 1:00 p.m., gold prices eased slightly and hovered around $2,800 an ounce for the rest of Friday's trading session.

What do experts predict about gold prices next week?

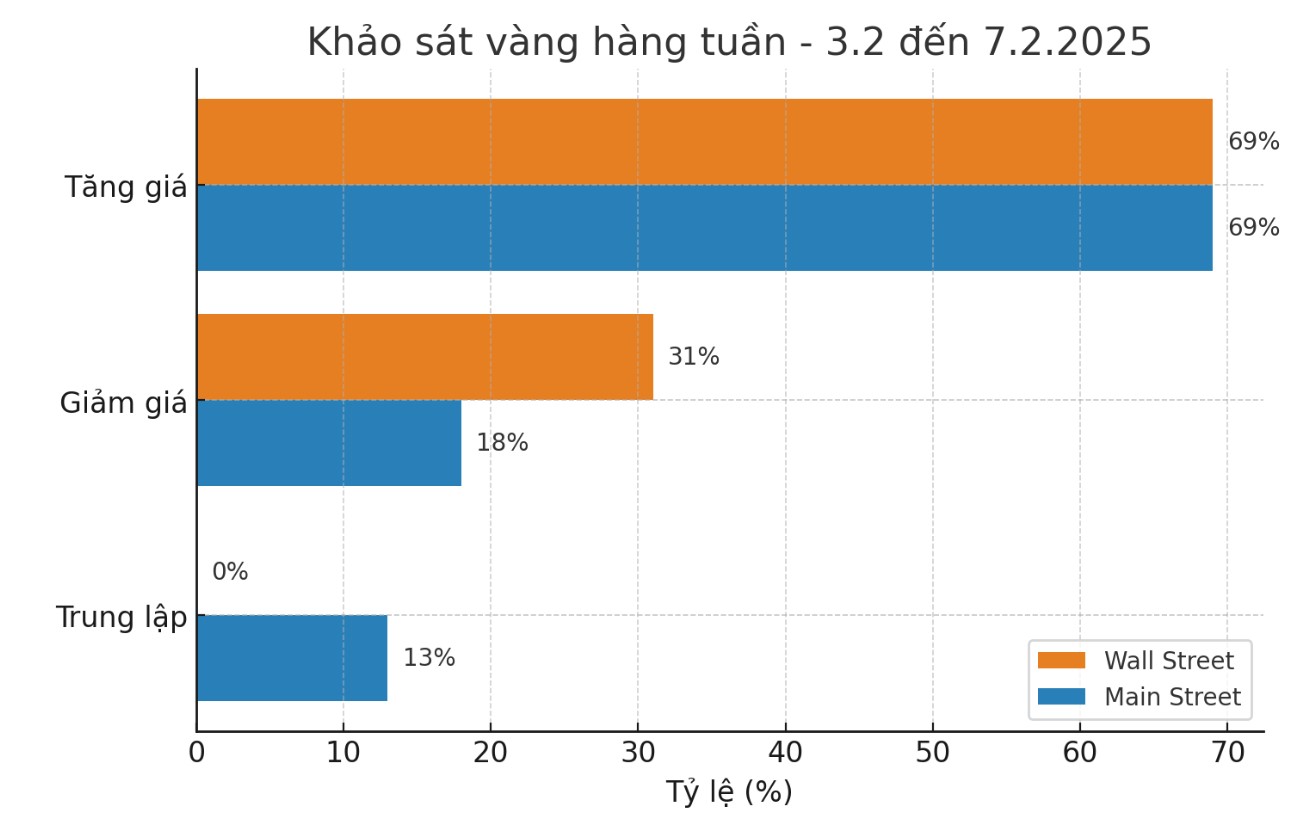

The latest Kitco News weekly gold survey shows that industry experts remain bullish on the precious metal, while retail investors also see higher prices in the near future.

Nine experts, or 69%, expect gold prices to surpass this week’s record next week. Four experts, or 31%, predict gold prices will fall. None expect gold to trade sideways or consolidate next week.

Meanwhile, 147 investors participated in Kitco's online poll, with retail investors as bullish as the professionals.

101 traders, or 69%, forecast gold prices to rise next week, while 27, or 18%, expect gold to fall. The remaining 19 investors, or 13% of the total, believe gold will move sideways in the short term.

Economic calendar affects gold prices next week

After a week in which the economic calendar was dominated by central bank interest rate decisions and inflation data, next week the market will turn its focus to the labor market with the December nonfarm payrolls report due on Friday.

Gold traders will also be watching a host of other key US economic data, including the ISM Manufacturing PMI on Monday, the JOLTS job vacancy report, the ISM Services PMI and the ADP jobs report on Tuesday and Wednesday.

Additionally, the Bank of England's monetary policy decision and the US weekly jobless claims numbers on Thursday, along with the University of Michigan's preliminary Consumer Confidence Index for January on Friday, will also be market-moving factors.

See more news related to gold prices HERE...