Gold price developments last week

Last week, the precious metal and the global financial market fluctuated strongly like a super-fast moon rover. Initially, prices increased on expectations that US President Donald Trump's tariffs would be low and only target certain subjects. However, after the announcement on Wednesday afternoon, the market realized that a real global trade war had begun, causing psychology to reverse and prices to plummet.

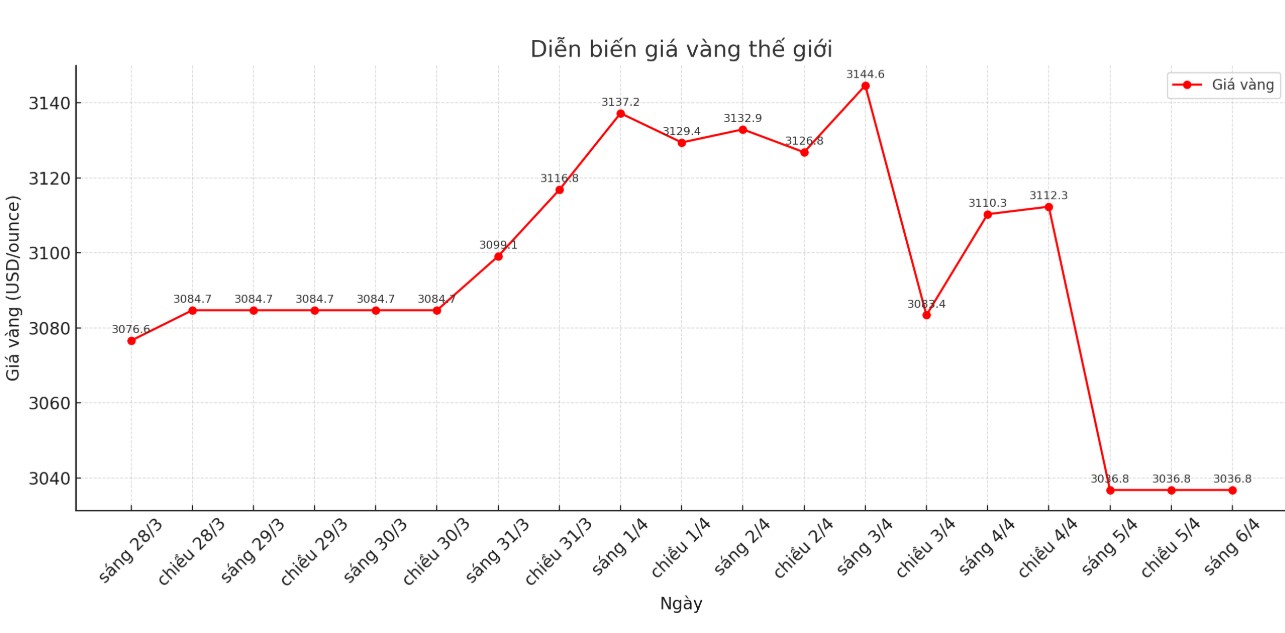

At the beginning of the week, spot gold prices were below $3,100/ounce, then quickly fell to the support zone around $3,077, then bounced strongly in the Asian trading session, peaking at $3,128/ounce.

In Europe, gold prices are kept stable in the range of 3,112 - 3,127 USD/ounce. At the beginning of the North American session, prices fell sharply to $3,100 and then returned to fluctuate in the same area throughout Monday.

By evening, optimism from Asia helped gold increase sharply, peaking at 3,149 USD/ounce at nearly 2 am (east time of the US). After that, prices returned to check the support level of 3,126 USD and remained stable until they were suddenly sold off at around noon, pushing prices back to 3,100 USD.

As the world anxiously awaits Donald Trump's announcement on Wednesday afternoon, gold prices fluctuate between $3,100 - $3,135.

When details of the major tax rate were released, US stock futures fell freely, while gold prices set a new record at 3,168 USD/ounce at 7:55 (US time in the East). However, after the market knew that gold and silver would not be taxed, buying pressure decreased, prices quickly returned to the 3,120 USD/ounce mark as before the announcement time.

However, the Western stock market at that time had not reacted strongly. And as European investors began selling off stocks, gold prices were pulled down, hitting a weekly low of $3,054 an ounce just 15 minutes before North American markets opened.

This time, it is US investors who have pushed gold prices up again, to $3,135/ounce. Many re-examinations of the $3,100 mark throughout the US and Asian sessions showed that this level was quite stable.

However, another stock sell-off in Europe pulled gold down to $3,080 an ounce early Friday morning.

Gold then bounced up to test the resistance level of $3,135 at 7:15 a.m., but then began a final decline. Prices plummeted to the bottom of the week at 3,015.65 USD/ounce at 11:45, because Chairman of the US Federal Reserve (FED) Jerome Powell disappointed investors when giving signals that the FED will not intervene to support the market.

After re-checking the $3,015 mark at around 1:30 p.m., gold moved sideways in the low of $20 through the end of Friday's trading session.

Experts predict gold prices next week

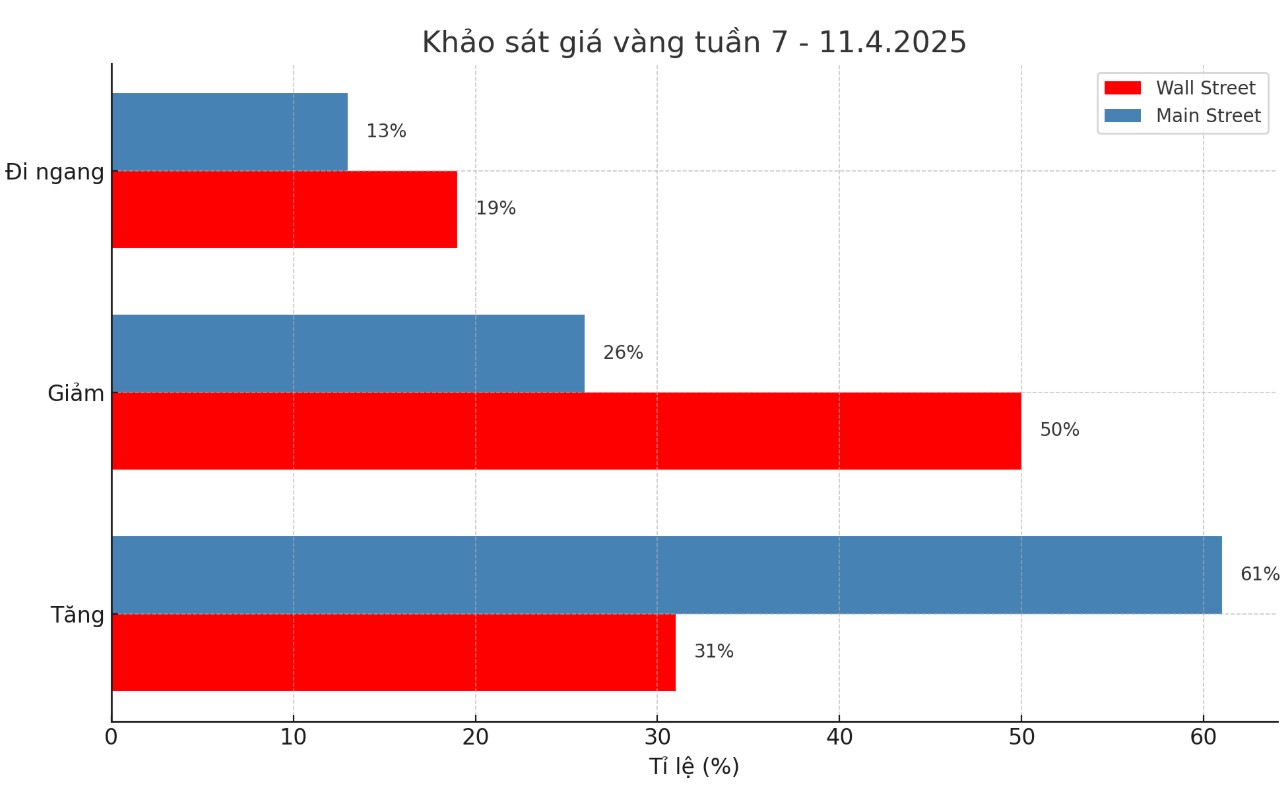

The latest weekly gold price survey from Kitco News shows that industry experts have given up the strong optimism like last week. Meanwhile, individual investors have only become slightly more optimistic about short-term gold prices, despite a strong sell-off this week.

This week, 16 experts participated in the Kitco News Gold Survey. Wall Street reverses from last week's extremely optimistic view. Five experts (31%) predict gold prices will rise again next week, while eight (50%) see prices continue to fall. The remaining three (19%) see gold prices moving sideways around current lows.

Meanwhile, Kitco's online survey attracted 273 individual investors to participate. The sentiment of retail investors has only decreased slightly compared to last week. 167 people (61%) expect gold prices to rise next week; 70 people (26%) expect prices to fall; the remaining 36 people (13%) expect prices to fluctuate sideways.

Economic calendar affecting gold prices next week

Next week, inflation and the Fed will return to the spotlight, as the minutes of the Federal Open Market Committee (FOMC)'s March monetary policy meeting are released on Wednesday. Next is the US consumer price index (CPI) report for March on Thursday, and the producer price index (PPI) on Friday.

Friday morning will also see the results of the latest preliminary survey on consumer sentiment conducted by the University of Michigan - an important indicator of Americans' feelings about the economic outlook.

See more news related to gold prices HERE...