Updated SJC gold price

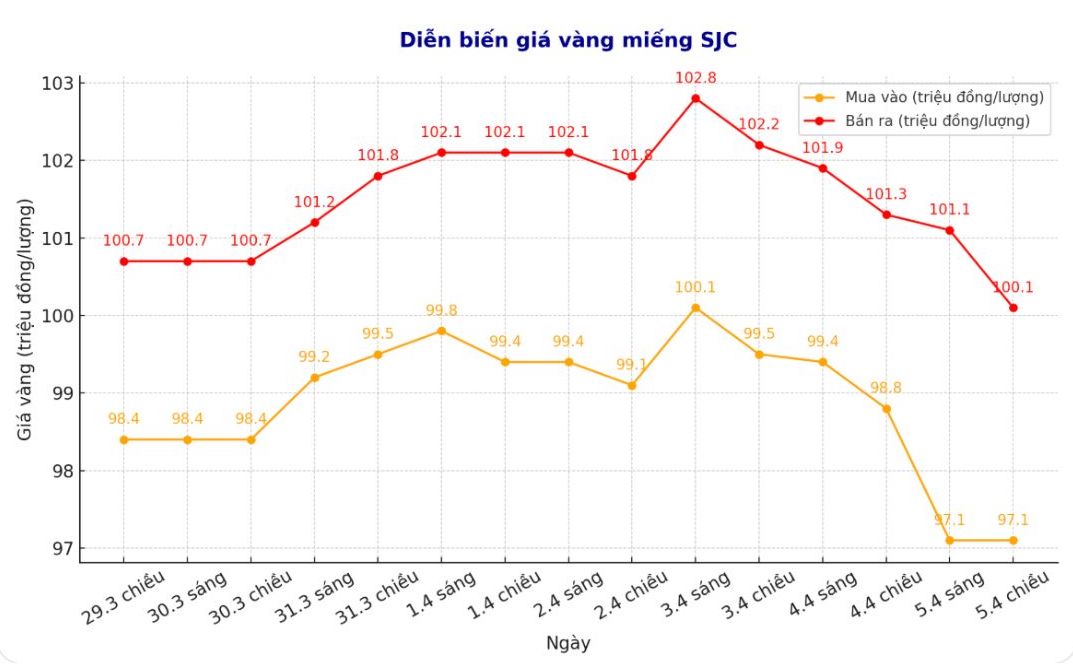

As of 5:50 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 97.1-100.1 million VND/tael (buy - sell); down 1.7 million VND/tael for buying and down 1.2 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 97.1-100.1 million VND/tael (buy - sell); down 1.7 million VND/tael for buying and down 1.2 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 97.2-100.1 million VND/tael (buy - sell); down 1.6 million VND/tael for buying and down 1.2 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 2.9 million VND/tael.

9999 round gold ring price

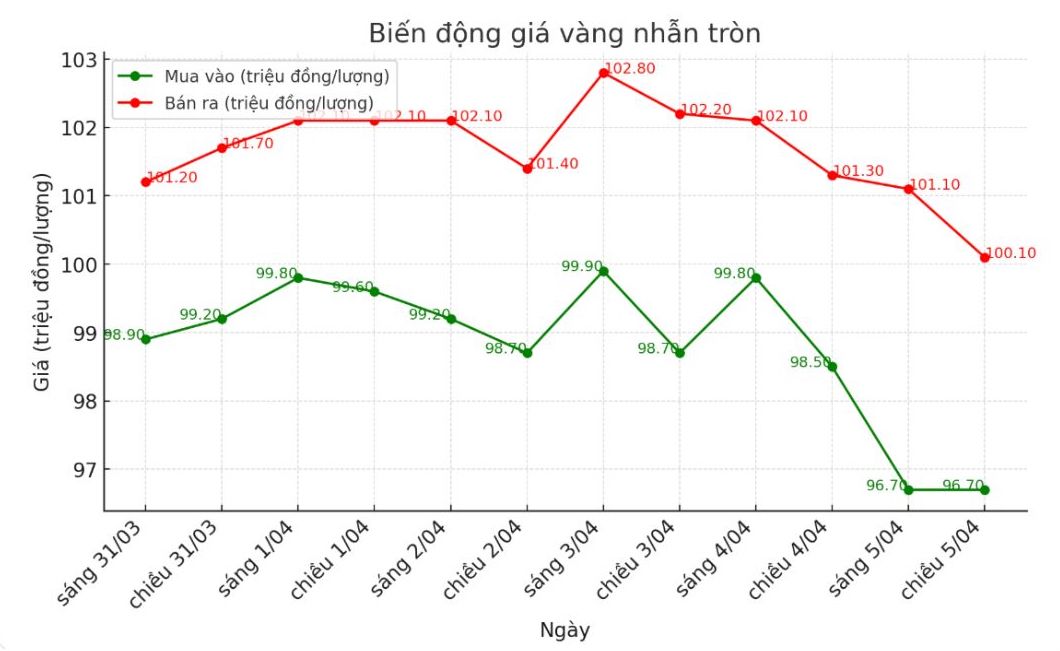

As of 5:50 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 96.7,100.000 VND/tael (buy - sell); down 1.8 million VND/tael for buying and down 1.2 million VND/tael for selling compared to early in the morning. The difference between buying and selling is at 3.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.5-100.5 million VND/tael (buy - sell); down 1.3 million VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

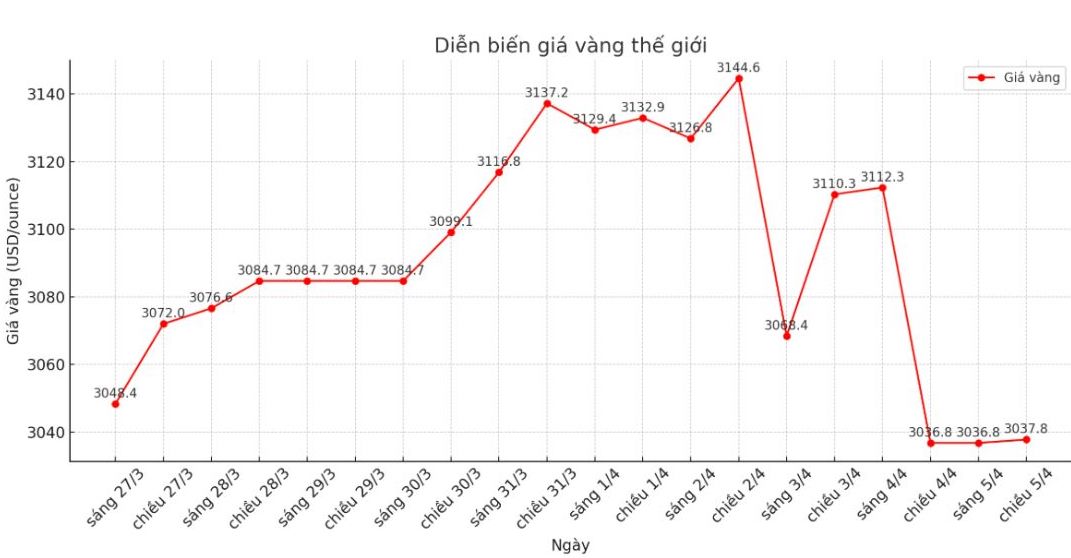

As of 6:10 p.m., the world gold price was listed at 3,037.885 USD/ounce.

Gold price forecast

Risk-off sentiment will continue to dominate the market over the weekend and gold prices will fall sharply due to profit-taking pressure. Many short-term futures traders have sold out for profit, causing buying pressure to weaken and gold prices to fall. Metals considered safe-haven assets are also suffering the same impact.

Ilya Spivak - Head of Global Macro Strategy at Tastylive commented: "Gold often increases strongly during periods of uncertainty such as when war first broke out - but will gradually lose momentum as the market gradually evaluates related risks".

He added: The Trump administration has now chosen a direction. Although the market may not like it, at least the road ahead is clearer and more predictable, leaving gold no longer benefiting from market uncertainty."

President Trump has said he will impose a basic 10% tax on all imports into the US, along with higher rates for some major trading partners.

In response, US trading partners threaten to push up trade tensions, as new tariffs could spike commodity prices in the world's largest consumer market.

Meanwhile, the US Federal Reserve's interest rate futures market currently shows the possibility of the US reducing interest rates 5 times this year. Each time decreased by 0.25%, a total of 1.25% this year. Analysts said this reflects the possibility of a recession in the US economy.

Currently, the market is waiting for the US non-farm payrolls report to assess the possibility of changing the Fed's interest rate policy.

See more news related to gold prices HERE...