Investors call for tightening supply

Recently, silver has begun to attract attention as more and more users on X ( social media) called for a "tense silver supply" (SilverSqueeze2.0) on Monday, March 31.

This trend comes from the belief that silver prices are being manipulated in the futures market, causing prices to hold back even though factors such as rising inflation, high physical demand, shortage of supply and strong gold prices are all supporting a higher silver price.

Proponents of the movement believe that if they buy and not sell simultaneously even with the backlash from the market, silver prices could break out of resistance and trigger a new price increase cycle.

Trade factors and favorable times

Peter Krauth, author of The Great Silver Bull and founder of SilverStockInvestor, said that trade tariffs are a new factor disrupting supply and pushing demand for silver higher. This could give SilverSqueeze 2.0 an advantage.

There is a large amount of silver flowing from London to New York. If tariffs are imposed, they could affect both gold and silver. Interestingly, this amount of silver is pouring into New York but ends up in private warehouses. This raises questions about whether silver prices are being manipulated to keep low, Krauth said in an interview with Kitco News on March 27.

The participation of investment funds

Jesse Colombo - an independent analyst of precious metals is one of the earliest supporters of SilverSqueeze2.0. He believes that this movement is not simply individuals retailing a few coins at local stores, but also a large-scale strategy to attract investment funds.

This is about raising awareness and attracting the participation of both individual and institutional investors. I don't believe that small traders are the main force of this movement. Defendants can also participate by buying Sprott physical silver futures or ETFs, and even receive physical silver from futures, Colombo told Kitco News.

Colombo does not see March 31 as the decisive moment but wants to see the momentum continue to maintain. I hope there will be positive developments, he said. On Thursday, silver prices soared, surpassing an important technical level. I want to see the continuation today, although Friday is often not favorable, we still have many trading hours ahead."

Control of the futures contract market and the possibility of a breakthrough

The futures market is holding a net selling position of about 223 million ounces of silver, equivalent to 25% of total annual output. According to Krauth, the ratio of paper money to physical silver is at 378:1 - much higher than any other futures contract market for metals or commodities.

Colombo believes that silver prices may be pushed down in the morning, but there is still a chance to recover in the afternoon in the US market, and may even continue to increase when the Asian trading session begins.

When silver prices can maintain their upward momentum through Asian, European and US trading sessions, it is a signal of a strong technical breakthrough, Colombo said.

Can silver reach $50/ounce?

Despite being optimistic about the outlook for silver, Krauth still advised investors to be cautious when participating in this movement, because prices cannot increase far beyond the fundamentals.

In 2021, we saw a similar tightening of silver. At that time, silver prices and the trading volume of silver mining stocks increased sharply. But I have advised investors that if they have big profits, they should consider taking profits because I don't see this momentum as long-term, Krauth shared.

If another silver tightening happens this time, he predicts it could be stronger than 2021, but it still needs a real change in industrial demand to keep prices high sustainably.

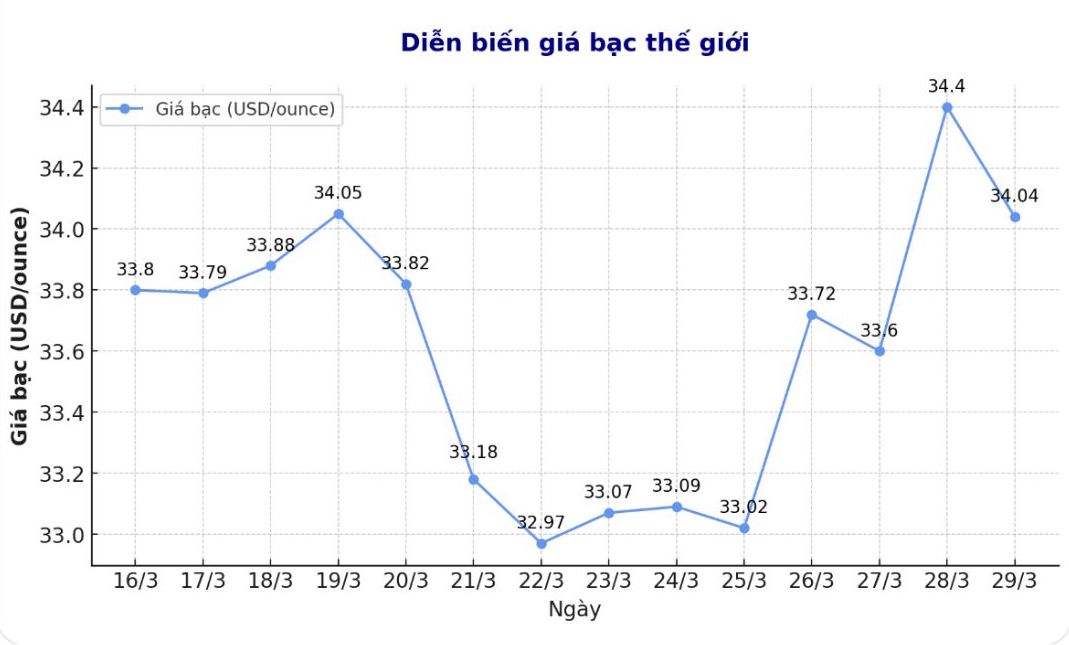

Colombo has a focus on technical analysis. He believes that if silver breaks above $33/ounce, the market will enter a price increase cycle like gold has done when it breaks above $2,000/ounce.

Krauth concluded: The all-time high for silver is $50 an ounce. I believe we will reach that level next year. It is not a question of if, but of when.