Gold price developments last week

According to Kitco, world gold prices continued to decline this week. The precious metal was pressured by a strong combination of euphoria after the US presidential election, new tough moves by the US Federal Reserve (FED), a strong USD and a relatively quiet geopolitical environment.

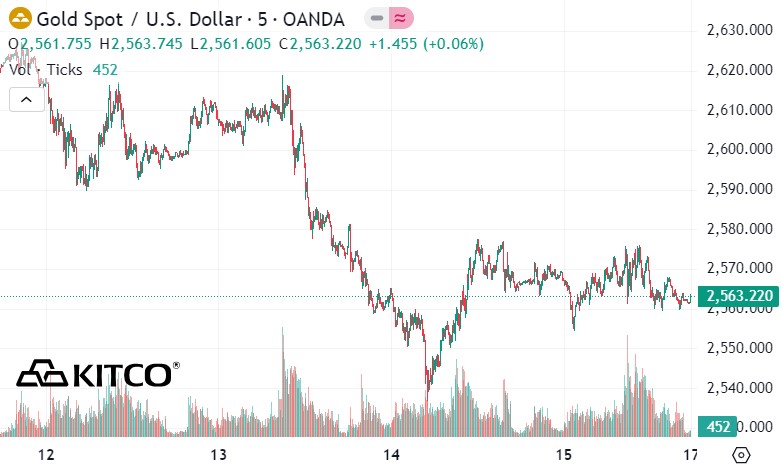

Gold prices started the week at $2,683.02 an ounce and remained above $2,660 an ounce overnight. By Monday afternoon, the price was pushed down to $2,610 an ounce.

Gold later recovered slightly to $2,625 an ounce, before falling further to a weekly low of $2,592 an ounce on Tuesday morning.

After rising to $2,615 an ounce, the precious metal quickly fell back below $2,600 an ounce. By Thursday morning, gold prices had plummeted to a weekly low of nearly $2,540 an ounce.

After a slight increase, gold prices leveled off and tended to move sideways at $2,560 an ounce. The gold market was a bit volatile on Friday morning, but traded between $2,560 and $2,573 an ounce.

Expert predicts surprise

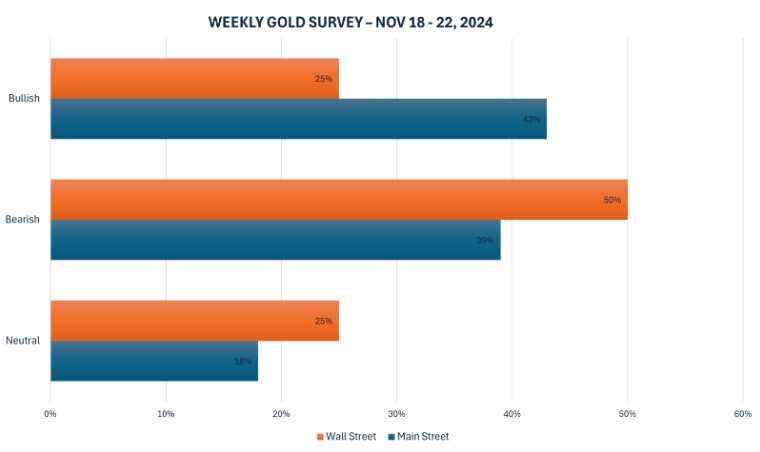

The latest Kitco News weekly gold survey shows strong bearish sentiment among industry experts, while traders are also increasingly concerned about the precious metal’s near-term outlook.

This week, 12 analysts participated in the Kitco News gold survey. Once again, only a handful of experts see gold’s near-term potential. Only three experts see gold prices rising next week. Six analysts predict further declines in the precious metal. The remaining three analysts see gold prices remaining flat.

Meanwhile, 181 votes were cast in Kitco’s online poll. While the number of investors who forecast positive prices remains high, the percentage is down significantly from previous weeks.

Seventy-eight retail traders expect gold prices to rise next week, while 71 expect the precious metal to fall. The remaining 32 investors see gold moving sideways in the coming week.

The economic calendar next week focuses on the US housing sector. The market will receive data on US housing starts and building permits for October on Tuesday, MBA mortgage applications on Wednesday and existing home sales for October on Thursday.

Other highlights include the Philly Federal Reserve manufacturing index on Thursday, with market participants watching to see if the Philadelphia region sees a strong increase in manufacturing activity like nearby New York state. Finally, the University of Michigan consumer sentiment for November.

See more news related to gold prices HERE...