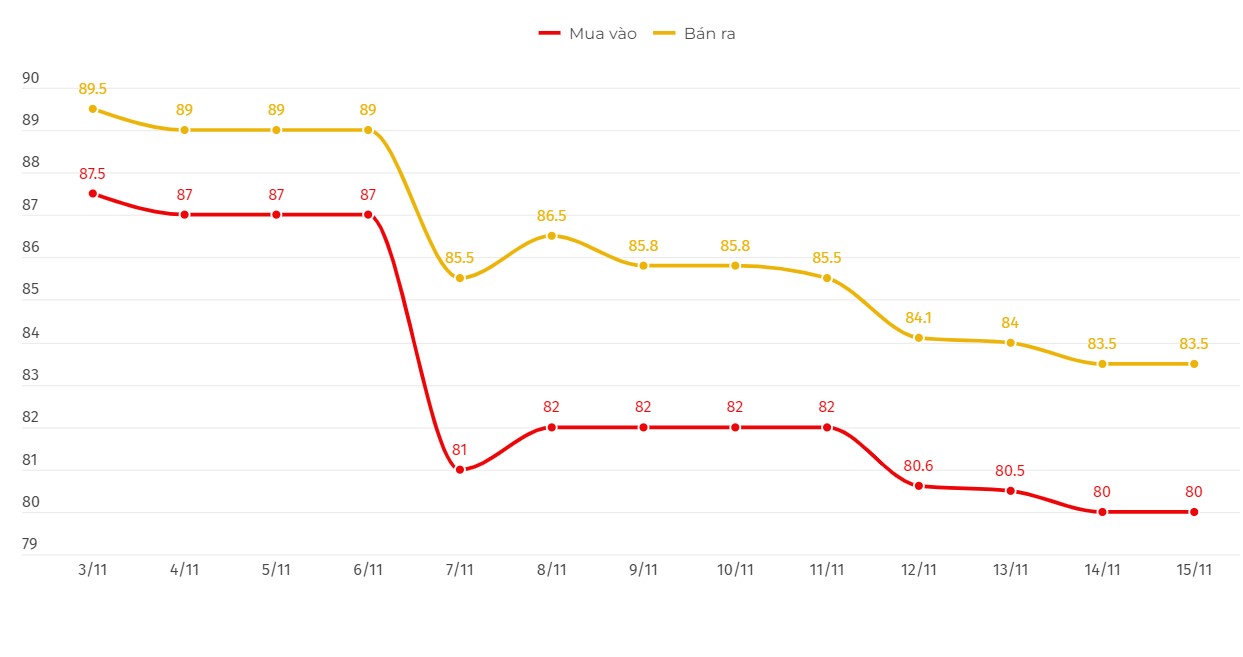

Update SJC gold price

As of 5:45 p.m., the price of SJC gold bars listed by DOJI Group was at 80-83.5 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80.3-83.5 million VND/tael (buy - sell).

Compared to the previous trading session, gold price at Bao Tin Minh Chau increased by 300,000 VND/tael for buying and remained unchanged for selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3.2 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 3.5 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

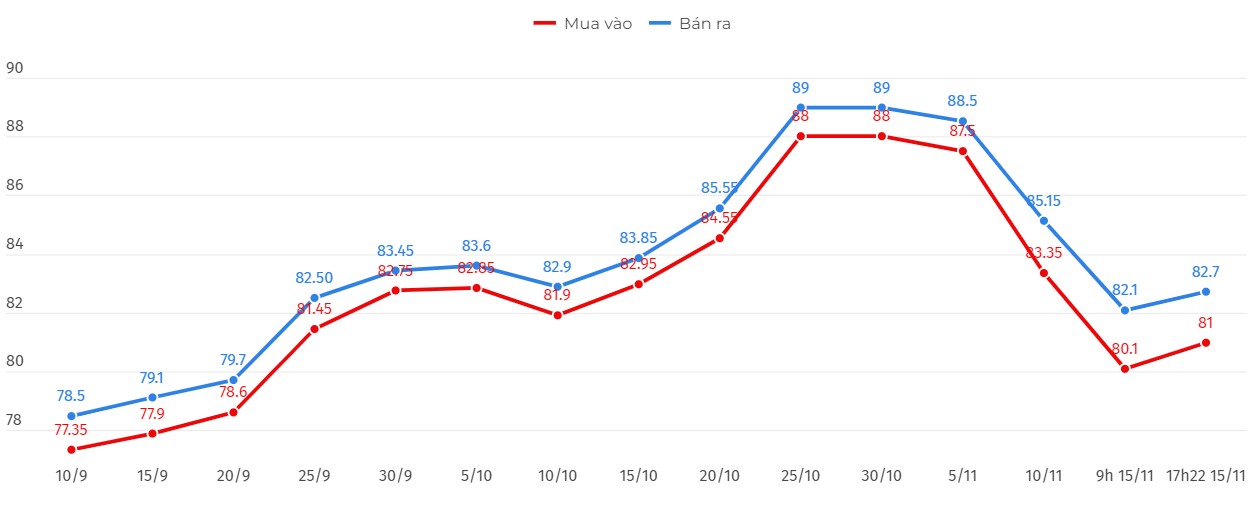

Price of round gold ring 9999

As of 5:22 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 81-82.7 million VND/tael (buy - sell), an increase of 1.2 million VND/tael for buying and an increase of 600,000 VND/tael for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 80.78-82.68 million VND/tael (buy - sell); increased by 660,000 VND/tael for buying and increased by 460,000 VND/tael for selling.

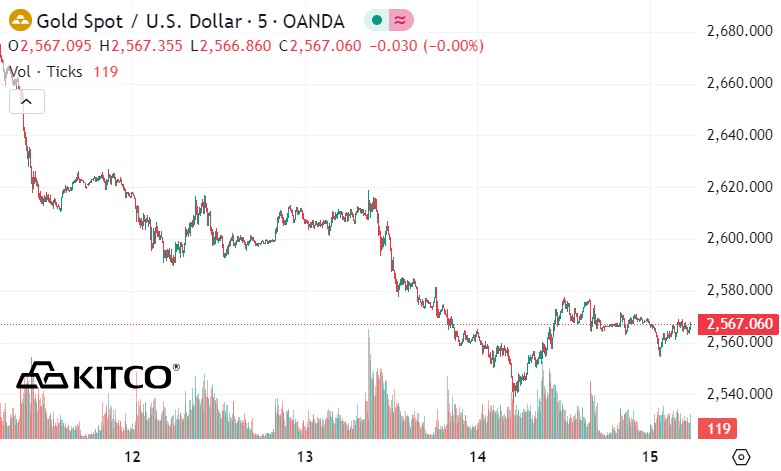

World gold price

As of 5:25 p.m., the world gold price listed on Kitco was at 2,567 USD/ounce, up 24.6 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices recovered amid a decline in the USD index. Recorded at 5:25 p.m. on November 15, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106.450 points (down 0.14%).

World gold recovered slightly in the context of the US announcing unemployment benefit applications of 217,000 applications, lower than the previous expectation of 223,000 applications. This should have been beneficial for gold prices because it affected the possibility that the US Federal Reserve (FED) would cut interest rates once again in December 2024.

In the long term, interest rates remain one of the factors affecting gold prices. Higher interest rates increase the opportunity cost of holding the precious metal.

FED Chairman Jerome Powell said on November 14 that stable economic growth, a strong labor market and persistent inflation are reasons for the FED to be cautious in cutting interest rates quickly.

According to the CME FedWatch tool, the market is now betting that there is a 59% chance that the Fed will cut interest rates by 0.25 percentage points at its December meeting, down from 83% the day before.

“Powell’s comments could limit gold’s upside as we head into the new year, but a volatile Trump presidency could also boost safe-haven flows into gold,” said Matt Simpson, senior analyst at City Index.

Fawad Razaqzada, a market analyst at Forex.com, said the drop in gold prices reflects expectations that US monetary policy will be tighter in 2025 under President-elect Donald Trump.

See more news related to gold prices HERE...