Gold price developments last week

Gold prices have overcome all market fluctuations this week, maintaining their upward momentum and making investors question whether there is anything left to stop the precious metal's current breakthrough.

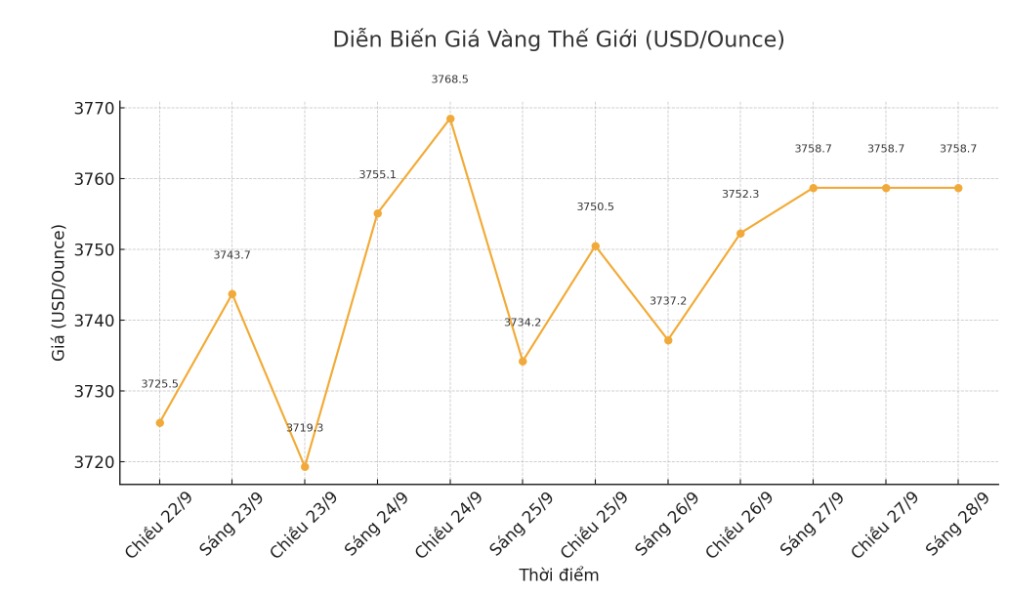

At the beginning of the week, spot gold prices were at $3,687.74/ounce and fluctuated within a range of $10, before breaking above $3,700 just after 2:00 a.m. (eastern time).

Gold prices maintained strong upward momentum in Asia and Europe, then advanced to $3,717/ounce when the North American market opened. By the end of the US stock market session on Monday, gold prices stood at 3,745 USD/ounce.

The increase continued to approach 3,760 USD/ounce but slowed down at the beginning of the Asian session. However, just after 4 hours on Tuesday, gold broke this threshold, jumping to nearly 3,790 USD/ounce - the highest level of the week. After that, prices created a "triple top" model in this resistance zone and gradually decreased, reaching 3,756 USD/ounce at 15:00 and down to 3,752 USD/ounce at the beginning of the Asian session the following day.

A failed failed challenge of $3,780 an ounce before 4:00 a.m. on Wednesday sent prices down sharply to a midweek low of $3,718 an ounce at 15,15 a.m. on the same day.

However, this is an important turning point. Gold bounced back to $3,750 an ounce when Asia opened but was held to around $3,757/ounce, then fell before the US session on Thursday.

Unlike previous sessions, US investors took a strong buy, bringing the price back to 3,755 USD/ounce at 15:00 on Thursday. The sale then pulled the price down to around $3,735 an ounce at 9pm.

On Friday morning, the PCE inflation report released at 8:30 a.m. added momentum, pushing prices from $3,751/ounce to $3,784/ounce just before 2 p.m. After a moderate profit-taking, gold stabilized around $3,765/ounce and closed the trading week.

Gold price forecast for next week

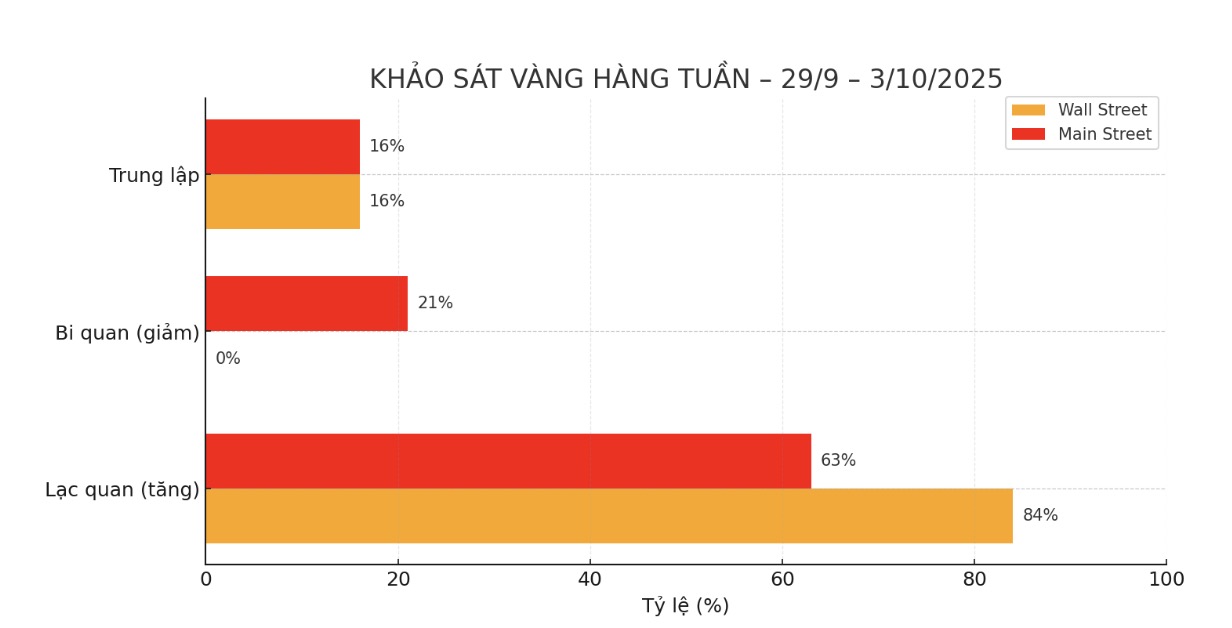

The gold survey with Wall Street experts shows unprecedented optimism, after gold prices continued to increase despite many obstacles. While retail investors are also slightly optimistic about the short-term outlook for the precious metal.

This week, 19 experts participated in the survey. Wall Street is particularly confident: 16 experts, equivalent to 84%, predict gold prices will continue to increase next week, no one predicts prices to decrease. The remaining three, or 16%, see prices moving sideways.

Meanwhile, the online poll received 265 votes from individual investors. Although optimism has also increased, the level is still far from the professional level: 166 people, equivalent to 63%, predict that gold prices will continue to increase next week; 56 people (21%) predict prices will decrease; and 43 people (16%) believe that prices will stabilize around the current level.

Economic data to watch next week

After a week of worsening inflation figures but not enough to deter market interest rate cuts, as well as gold's increase. The focus of the market next week will shift to the labor market.

There will be a report on Pending Home Sales in August on Monday, followed by JOLTS job recruitment data and the consumer confidence index (consumer Confidence) on Tuesday.

On Wednesday morning, the market waited for the ADP (ADP Nonfarm Payrolls) private employment report, along with the manufacturing manufacturing manufacturing PMI (ISM) to be released later. Thursday will see data on the number of weekly jobless claims.

All of this information is seen as a stepping stone for the September non-farm payrolls report released on Friday morning, as investors want to know if the weakening trend of previous months will continue and whether the Fed can continue to cut interest rates in October. The ISM Services PMI will close the week's data series.

See more news related to gold prices HERE...