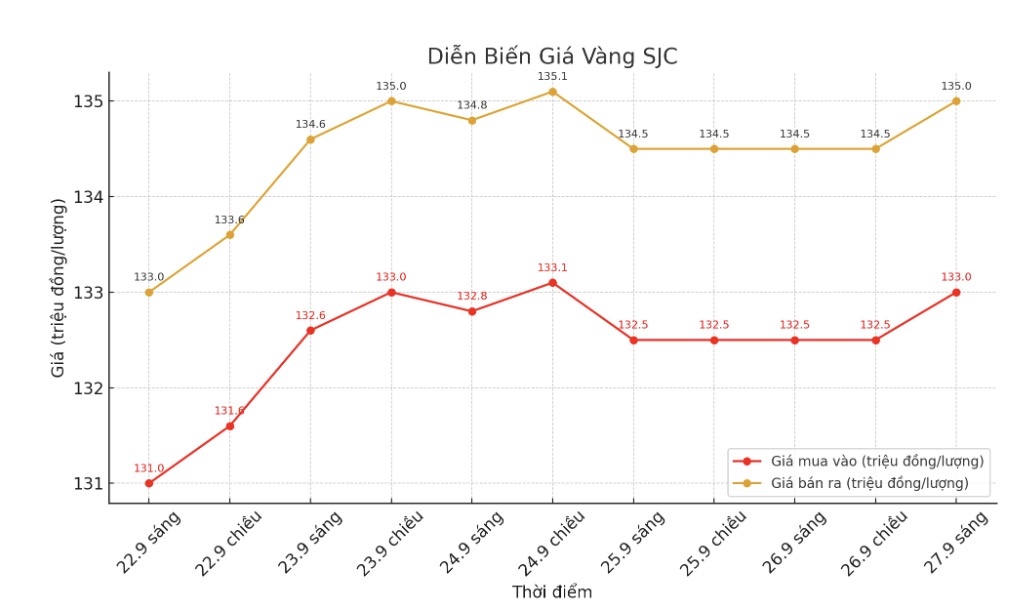

Updated SJC gold price

As of 9:20 a.m., DOJI Group listed the price of SJC gold bars at VND133-135 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133-135 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 132.5-135 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

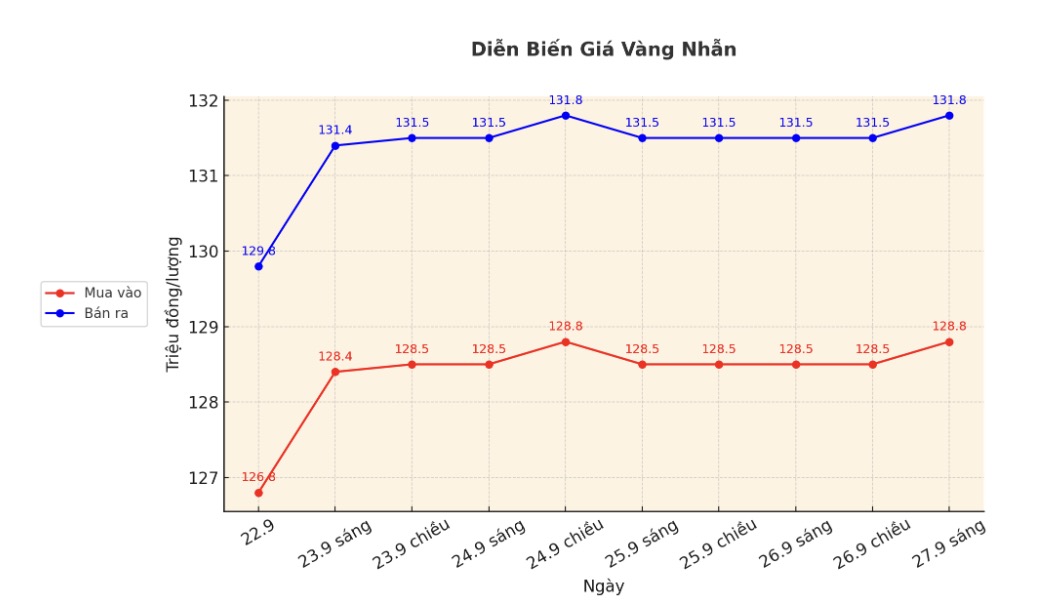

9999 round gold ring price

As of 9:20 a.m., DOJI Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.1-132.1 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.8-131.8 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

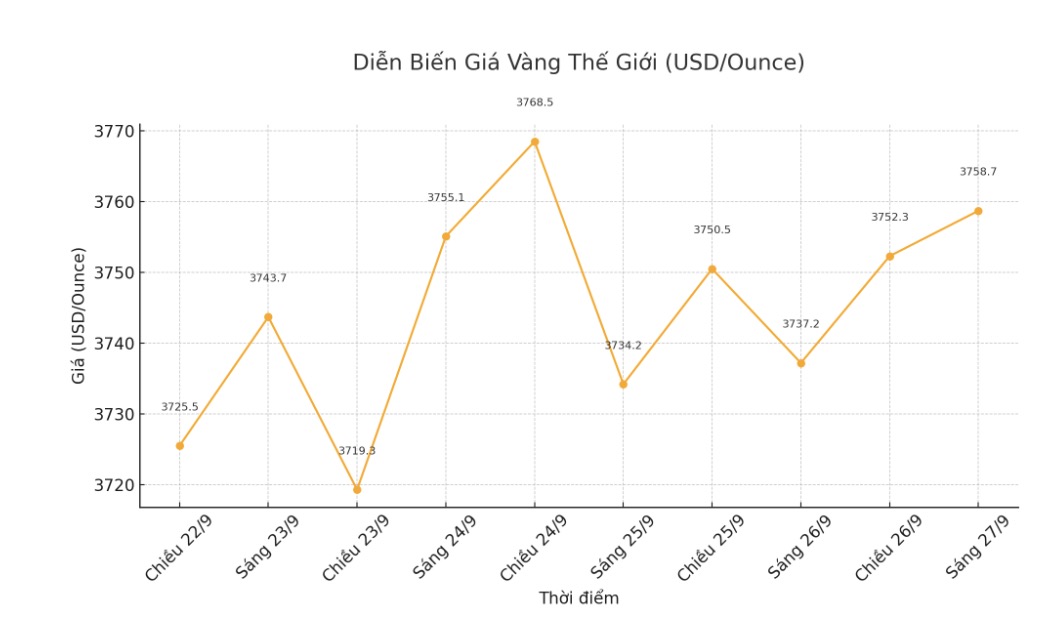

World gold price

At 9:20 a.m., the world gold price was listed around 3,758.7 USD/ounce, up 21.5 USD compared to a day ago.

Gold price forecast

World gold prices increased sharply after the important US inflation report was just released, as the market predicted.

The US personal consumption expenditure (PCE) price index just announced for August increased by 0.3% compared to the previous month, after an increase of 0.2% in July, as expected. Core PCE (excluding food and energy) increased by 0.2%, also in line with the forecast and lower than the 0.3% increase of the two previous months.

Compared to the same period, PCE inflation increased overall to 2.7% - in line with forecasts but highest in 6 months, from 2.6% in the July report. core PCE inflation was at 2.9%, also in line with expectations. PCE data is considered an inflation index closely monitored by the FED.

Aaron Hill - head of analysis at FP Markets (Australia) - said that the FED has enough room to cut interest rates by at least 0.5 percentage points by the end of the year.

Gold has enough strength to break through $3,800 thanks to central bank purchases (expected to exceed 900 tons in 2025) and capital flows into ETFs.

UBS and ANZ also target gold prices at the end of 2025 at this level in the context of many geopolitical fluctuations. It could be a quick breakthrough, not a long accumulation period, he said.

According to the CME FedWatch tool, the market predicts an 87% chance of the Fed cutting interest rates next month and a 65% chance of continuing to cut in December.

Fawad Razaqzada - an analyst at City Index and FOREX.com, said that only when expectations of interest rates change significantly can the increase of gold.

If next weeks data sharply reduce December rate cut expectations, the US dollar could strengthen and hold back gold. Conversely, if data is weak, gold will be supported. In general, unless there are major fluctuations, the current factors will still help gold soon surpass the $3,800/ounce mark, he said.

Experts say gold and the US dollar will be particularly sensitive to upcoming US jobs data. Any further signs of weakness in the US labor market will strengthen expectations of a rate cut, thereby supporting gold prices.

Barbara Lambrecht - commodity analyst at Commerzbank - commented that the market may need a new "fire" to push prices above $3,800, for example, a US jobs report disappointed for the third consecutive time. However, she predicted that the US labor market may improve slightly.

Although optimism is dominant, some experts advise investors to be cautious at the current price.

Technically, December gold futures are still in a short-term strong uptrend. The next upside target for buyers is to close above the strong resistance zone of $3,900/ounce. The latest downside target for the bears is to push prices below the strong support zone of $3,650/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...