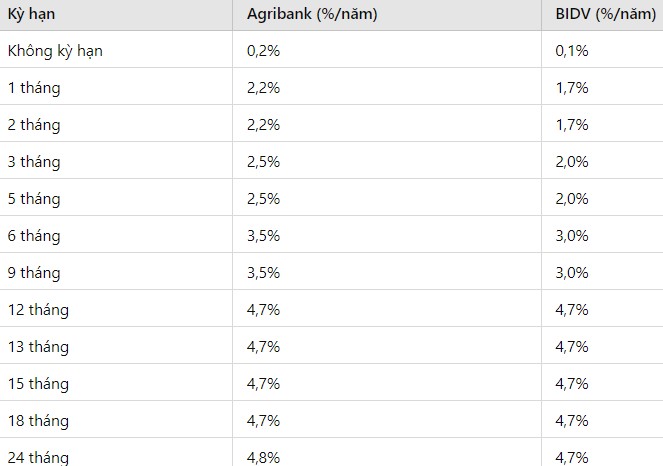

Update Agribank and BIDV interest rates

According to Lao Dong reporter on November 28, deposit interest rates at Agribank are listed around 2.2 - 4.8%, depending on the term.

The 24-month term interest rate is listed at the highest level, up to 4.8%.

Slightly lower, the interest rate for 12-month, 13-month, 15-month, and 18-month savings terms is 4.7%.

Next are the terms of 6 months, 7 months, 8 months, 9 months, 10 months and 11 months, Agribank interest rate is 3.5%.

Interest rates for 4-month and 5-month terms are lower at 2.5%. For 1-month and 2-month terms, Agribank's interest rates are at 2.2%.

For non-term savings interest rates, Agribank is applying a threshold of 0.2%.

On the same day, BIDV listed interest rates around 1.7-4.7%, depending on the term.

The interest rate for 12-24 month terms is listed at 4.7%. The interest rate for 6-month and 9-month savings terms is 3%. Next is the 3-month and 5-month terms at 2%. The interest rate for 1-month and 2-month terms is 1.7%.

Note: The above interest rates apply to individual customers and may vary depending on the location. For specific interest rates, readers can contact Agribank and BIDV branches/transaction offices nationwide.

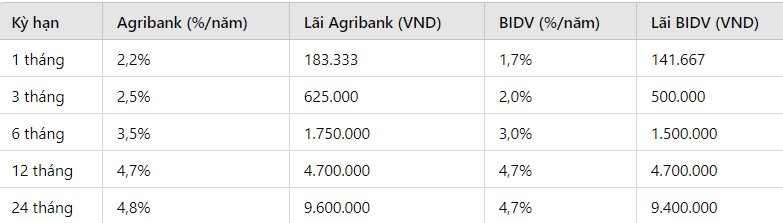

Calculate interest when depositing 100 million VND

Suppose a customer deposits 100 million VND at Agribank and BIDV with different terms, the interest received will be as follows:

In November 2024, Agribank has higher deposit interest rates than BIDV for many terms. Customers should consider their deposit term and financial needs to choose the right bank.

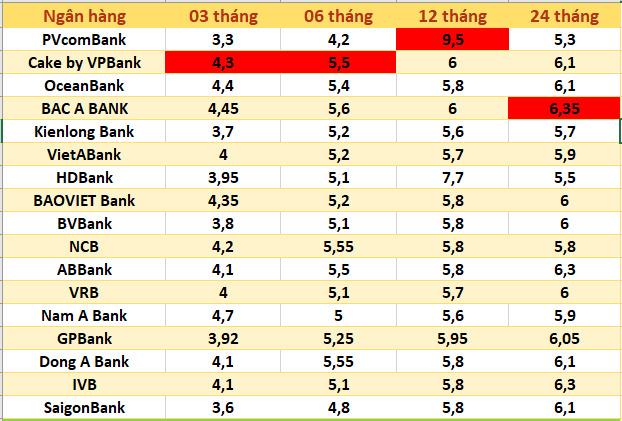

In addition, readers can refer to interest rates of some other banks.

Many banks list interest rates at high levels, up to 7-9.5%. However, to receive this interest rate, special conditions must be met.

PVcomBank is currently leading in special interest rates when customers deposit money at the counter, with 9.5% for a term of 12-13 months. However, the condition to receive this interest rate is that customers must have a minimum deposit balance of VND 2,000 billion.

Next is HDBank with a particularly high interest rate, up to 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB applies interest rates for deposits at the counter up to 8%/year for a 13-month term and 7% for a 12-month term. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has a deposit interest rate of 13 months or more, with the final interest rate applied to deposits of 200 billion VND or more at 7.5%/year. This bank also applies an interest rate of 6.1% for a 24-month term.

Bac A Bank applies an interest rate of 6.35% for a 24-month term, applicable to deposits over 1 billion VND. In addition, an interest rate of over 6%/year is also being listed by some banks for long-term deposits but without a minimum deposit requirement.