The gold market experienced historic moments in 2024, with prices breaking records on multiple occasions. Some of the highlights of 2024 included unprecedented demand from Asian consumers, which helped push gold prices to record highs early in the year. Central banks also bought gold at a record pace in the first half of the year.

Another milestone this year was the price of a 14 kg LBMA gold bar passing the $1 million mark.

According to one market strategist, 2025 could be equally exciting as the world faces major geopolitical and economic uncertainties.

In an interview with Kitco, George Milling-Stanley - chief gold strategist at State Street Global Advisors - said that he expects 2025 to be an interesting year and could set a new record for gold.

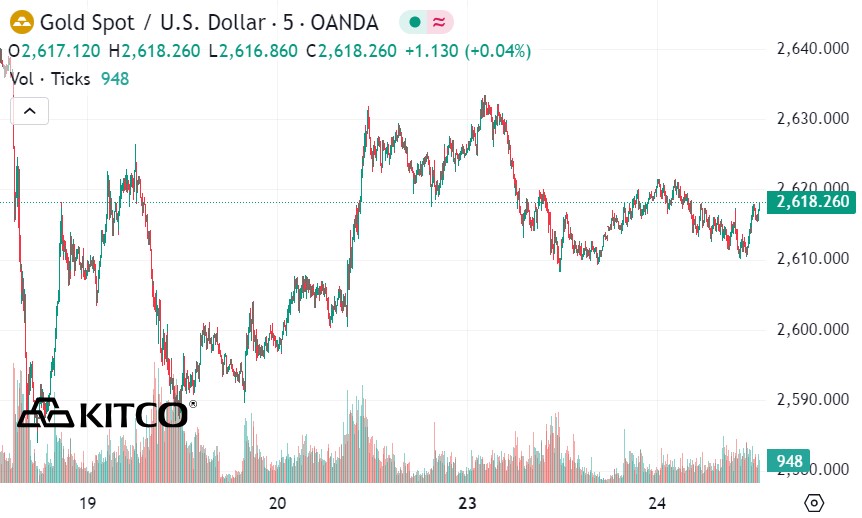

With the gold market holding firm support above $2,600 an ounce, gold prices have risen more than 25% for the year. At its peak in late November, gold prices were up more than 30%, marking their best performance since 1979.

Milling-Stanley, who has been involved in the gold market for more than 50 years, recalls the moment he witnessed the 37th US President - Richard Nixon decided to suspend the convertibility of the US dollar into gold under the Bretton Woods system, taking the US dollar off the gold standard. He also witnessed the birth of the first gold exchange-traded fund, SPDR Gold Shares, 20 years ago.

“In the past 50 years, I have never felt bored watching the gold market and I don't expect to feel that way this year,” he said.

Milling-Stanley's team at State Street has released its official gold price forecast for 2025. The investment firm sees a 50% chance of gold trading between $2,600 and $2,900 an ounce, and a 30% chance of gold trading between $2,900 and $3,100 an ounce.

On the downside, State Street estimates a 20% chance of gold prices falling to $2,200 - $2,600/ounce.

“That means we are 80% confident that gold prices will stay the same or move higher in 2025,” he said.

One notable aspect of State Street's forecast is the wider range of price swings. Milling-Stanley explained that this range reflects increased volatility in financial markets.

He noted that while gold prices are expected to rise in 2025, investors need to prepare for strong volatility.

While many analysts believe that the US Federal Reserve's (FED) monetary policy is the biggest risk to the gold market, Milling-Stanley said that it is only a secondary factor in the overall picture.

Gold prices have been on a correction over the past two months as investor expectations for the Fed’s monetary policy have changed. At its final monetary policy meeting of the year, Fed members said they planned to cut interest rates only twice in 2025, instead of four as forecast in September.

While a slower easing cycle could support the dollar, gold has proven to be a stronger global financial asset over the past year, Milling-Stanley said. He noted that the Fed’s hawkish stance in early 2024 did not prevent gold from hitting record highs, and he does not expect that to hamper gains in 2025.

“I don’t think the Fed’s monetary policy will create any sustained weakness for gold in 2025,” he said.

He added that if the Fed is forced to take a more “hawkish” stance next year, it could be due to rising inflation – which would be positive for gold.

“No matter what the Fed does next year, there is still a sound economic basis for holding gold in your portfolio,” he said.

As for the biggest driver of gold, Milling-Stanley predicts that central bank demand will continue to be the dominant force in the market. “Central banks, primarily in emerging markets, have absorbed more than 15% of total end-user demand and this trend is likely to continue for the next 14 years,” he said.

At the same time, he predicts strong gold demand from Asia in 2025 as consumers look to protect themselves against economic and geopolitical uncertainties.