According to Silver Institute (an association that gathers large enterprises in the global silver industry, from mining, refining, processing, jewelry production companies, to precious metals trading and distribution corporations), investing in physical silver is an important part of the global silver demand, and is also the most volatile segment".

Over the past 15 years, physical silver investment has ranged from a low of 157.2 million ounces (Moz) in 2017 to a record of 337.6 Moz in 2022.

The US is the largest physical silver investor market, with a total of 1.5 billion ounces purchased by individual investors in the period 2010-2024. The average value of silver investment in the US is equivalent to 70% of gold, while this rate in other countries is only about 6%. Silver is also integrated into IRA retirement accounts, and there is still a lot of room to expand.

Although Americans have held them for a long time, their sales have increased since the end of 2023. Due to over-large reserves over the years, demand for newly minted silver and coins in the US is forecast to fall to a seven-year low in 2025.

India often ranks second, sometimes surpassing the US (2018, 2019). In 2024, silver will account for 70% of retail demand. A total of 840 million ounces of silver and coins were purchased in the period 2010-2024.

indians rarely sell, even when the price of silver calculated in rupees reaches a record. Domestic silver exchange-traded funds (ETPs) launched in 2022 were initially sluggish, but after 18 months they have increased sharply, holding more than 58 Moz as of the end of June 2025.

Germany ranked third, mainly buying coins (accounting for about 80%). In the period of 2012-2018, the average demand was only 24.6 Moz/year. However, the COVID-19 pandemic and the Russia-Ukraine war have caused explosive demand, reaching an average of 48.5 Moz/year in 2020-2022.

As tax incentives for non-EU coins end in late 2022, demand plummeted, down to 39 Moz. In 2025, the market will show signs of recovery thanks to economic and political instability, forecast to increase by 25% compared to 2024, but still much lower than the peak.

Australia has recently emerged as the fourth largest market. From 3.5 Moz in 2019, demand skyrocketed to a record 20.7 Moz in 2022.

The main reason is the popularity of investing in retirement accounts and tax advantages: investment money is not subject to sales tax, and if kept until retirement, it is exempt from capital interest tax.

After the 2023-2024 profit-taking period, demand is still much higher than before 2020. In 2025, it is expected to increase by 11% as the pressure on living expenses decreases. The psychology of silver being priced lower than gold has also prompted new interest.

Domestic silver price

At the time of writing (10:35 on August 28), the price of 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND1.476 - 1.511 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 38.724 - 39.714 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 39.360 - 40.294 million VND/kg (buy - sell).

The price of 999 999 pieces (1 tael) at Phu Quy Jewelry Group was listed at 1.488 - 1.534 million VND/tael (buy - sell).

The price of 999 taels of silver (1 tael) at Phu Quy Jewelry Group was listed at 1.488 - 1.534 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 39.679 - 40.906 million VND/kg (buy - sell).

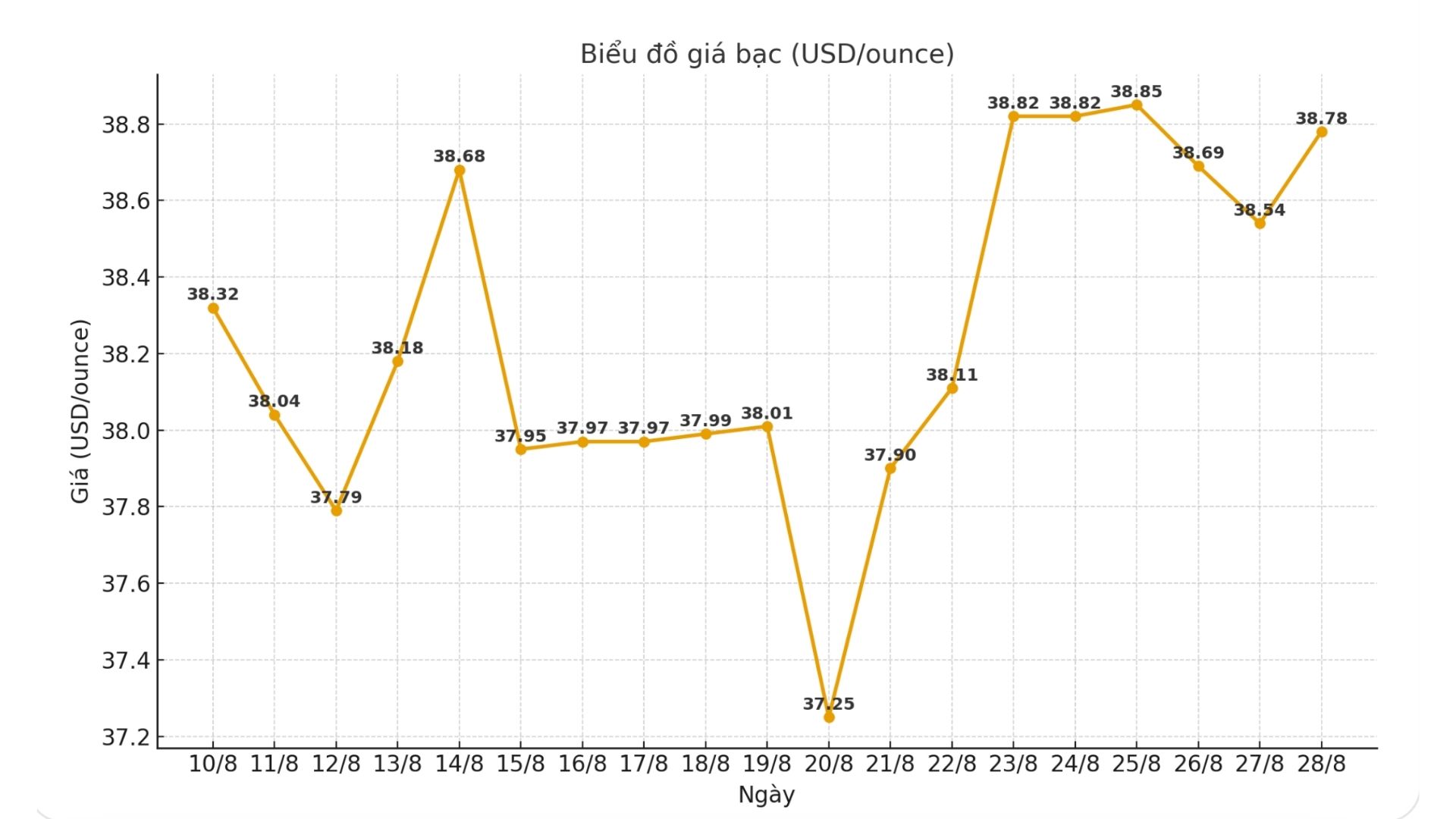

World silver price

At the same time, the world silver price was listed at 38.78 USD/ounce; up 0.24 USD compared to yesterday morning.