Domestic silver price

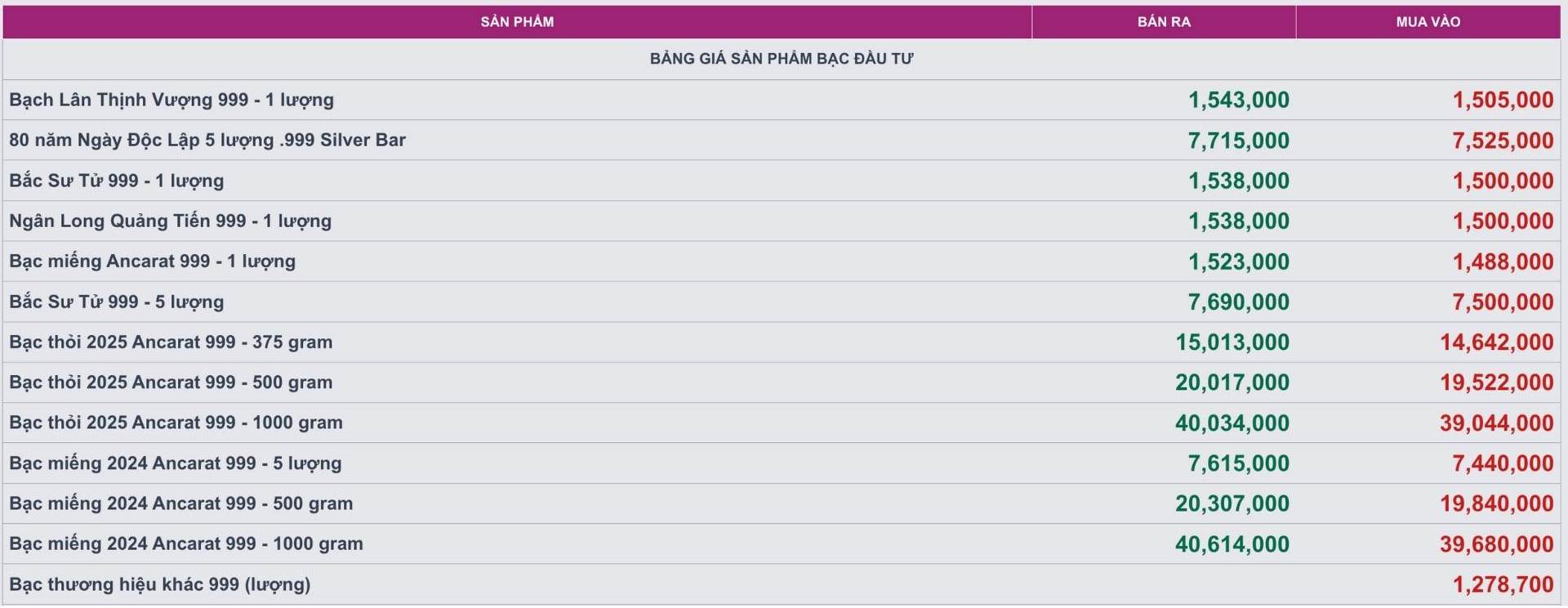

As of 11:20 on August 24, the price of 999 silver bars at Ancarat Metallurgy Company was listed at VND1.488 - 1.523 million/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 39.044 - 40.034 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 39,680 - 40.614 million VND/kg (buy - sell).

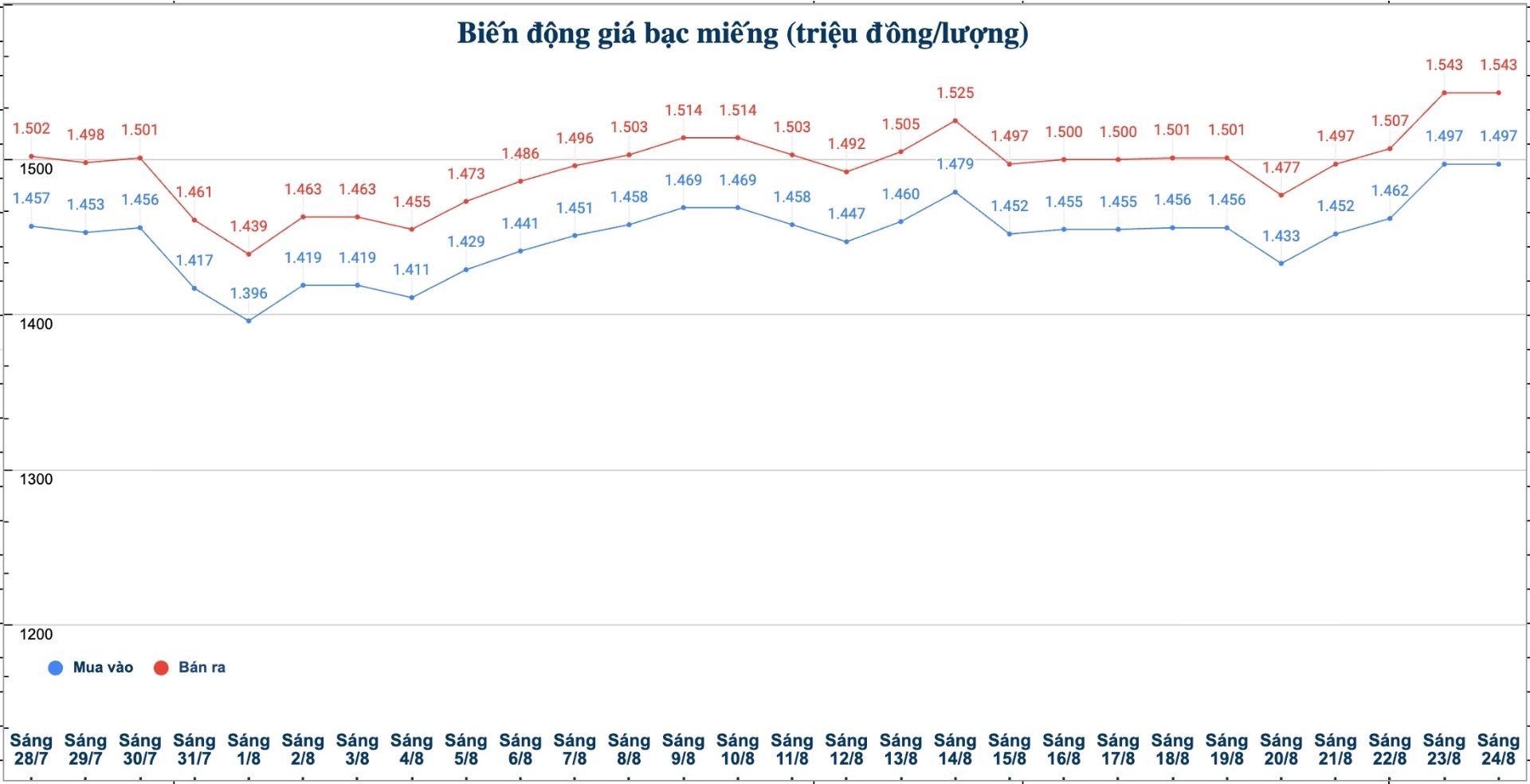

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.497 - 1.543 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.497 - 1.543 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 39.919 - 41.146 million VND/kg (buy - sell); unchanged in both directions compared to yesterday morning.

World silver price

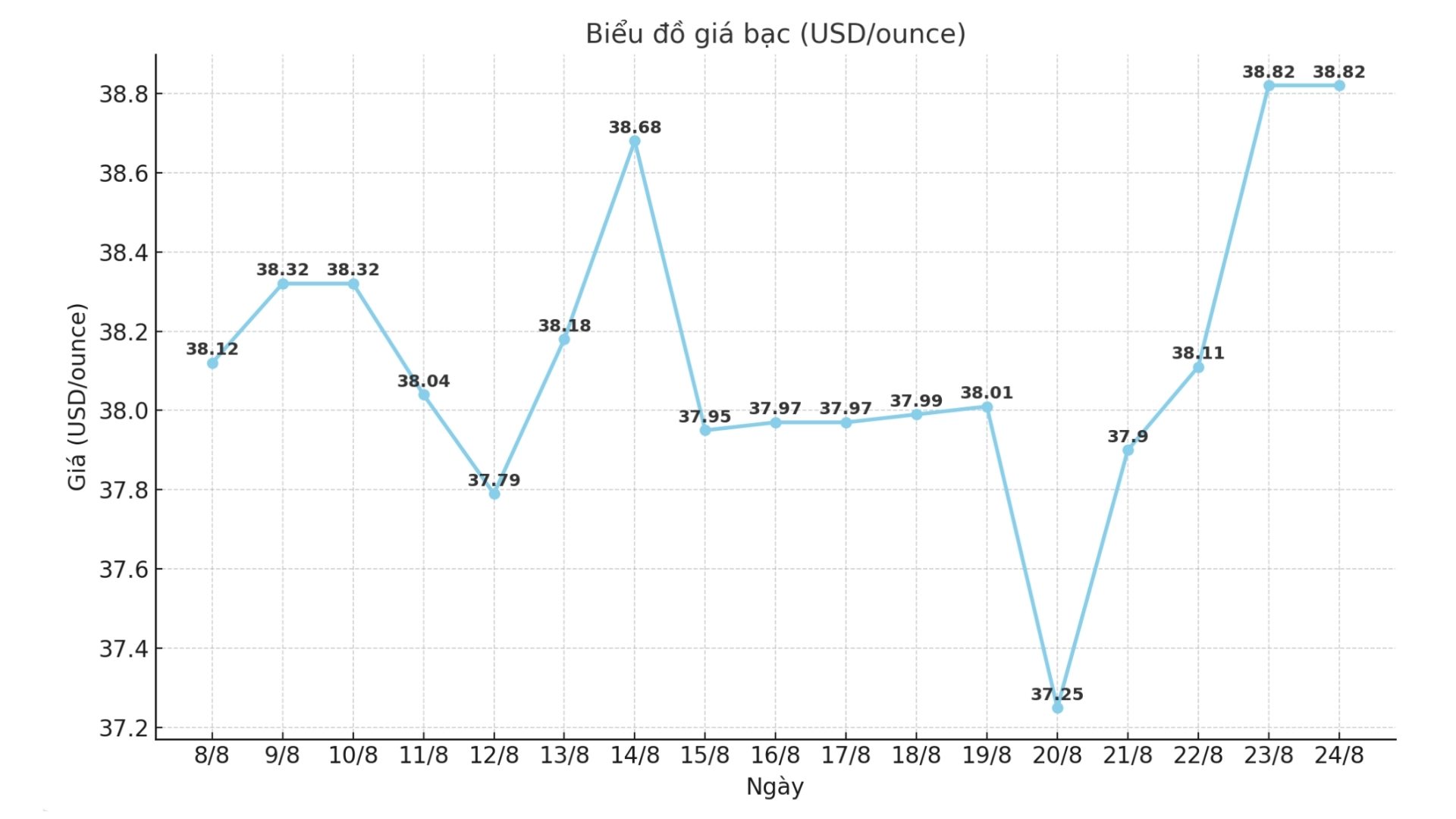

On the world market, as of 11:25 on August 24 (Vietnam time), the world silver price was listed at 38.82 USD/ounce.

Causes and predictions

Silver prices maintained their upward momentum after Federal Reserve Chairman Jerome Powell gave a dovish speech at Jackson Hole, causing the US dollar (USD) and bond yields to fall sharply.

Technically, according to analyst James Hyerczyk, the support level is currently approaching two levels of 37.50 USD/ounce and 37.40 USD/ounce.

"This is considered a key threshold for short-term traders; if prices remain stable in this zone, buying will increase as the market corrects," James Hyerczyk emphasized.

According to James Hyerczyk, silver is not currently facing any significant obstacles before the 39.53 USD/ounce mark. However, whether prices maintain their upward momentum or not depends on trading volume. The market is leaning towards a risk-off mentality, thereby adding strength to the increase in silver prices.

The expert added that the uptrend remains strong with a target of 39.53 USD/ounce. If the employment or inflation data does not reverse the Fed's dovish expectations, silver is still an attractive choice for long-term buying positions.

"If it breaks above 39.53 USD/ounce, silver could move to 40.30 USD/ounce. On the contrary, the price should be above 37.50 - 37.40 USD/ounce; if it breaks through this area, silver may temporarily decrease" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...